- Fine wine prices are influenced by a range of factors – from age to critical acclaim and storage conditions.

- Certain wine regions carry inherent prestige that elevates their value.

- Bordeaux First Growths, Burgundy Grand Crus, and Napa cult wines typically hold the highest average prices due to global demand and scarcity.

Fine wine prices are shaped by a mix of tangible and intangible factors, each playing a crucial role in determining a wine’s market value. For collectors or investors treating wine as an alternative asset, understanding how these prices are established is essential. The fine wine market behaves differently from stocks or traditional commodities, yet follows clear principles around scarcity, quality, provenance, and demand.

In this guide, we break down the key influences behind price performance, from production realities to global market trends and the behaviour of auction houses and collectors.

The value of fine wine is influenced by a combination of tangible and intangible factors. For anyone interested in wine investment, understanding these factors is essential to making informed decisions. This guide explores the key elements that determine it, from production to market dynamics.

Producer and brand reputation

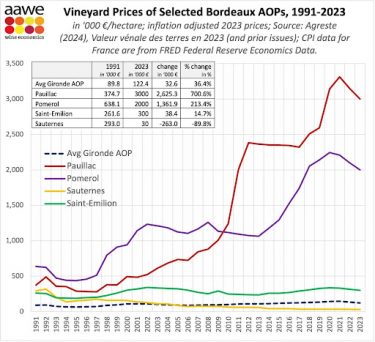

One of the most powerful drivers of fine wine prices is producer reputation. In renowned regions such as Bordeaux, Burgundy, Tuscany, and Napa Valley, a small number of elite estates have built global prestige over centuries.

Producers such as Domaine de la Romanée-Conti, Château Latour, Masseto, and Screaming Eagle consistently command premium prices because:

-

their wines have a long track record of excellence

-

collectors trust their craftsmanship

-

demand outstrips supply year after year

Even wines from emerging or lesser-known estates within these regions benefit from the halo effect of high-prestige appellations.

Reputation is a form of currency in the fine wine markets – one that contributes significantly to long-term appreciation and stability.

Vintage quality

The quality of a vintage year is a foundational element in determining value. Weather conditions during the growing season impact grape ripeness, concentration, acidity, and overall structure.

Exceptional vintages often receive strong critical acclaim, accelerating early demand and pushing up prices in both primary and secondary markets. Examples include:

-

Bordeaux 1982, 2000, 2009, 2010

-

Burgundy 2005, 2010, 2015

-

Champagne 2008, 2012

-

Napa Valley 2013, 2016

These highly rated vintages often see long-term appreciation as collector interest endures.

On the other hand, weaker vintages may grow in value more slowly but can still appreciate over time if produced by top estates with strong brand equity.

Scarcity and production volume

Scarcity is one of the strongest long-term drivers of demand and appreciation. Wines produced in limited quantities or from small vineyard sites can become highly collectible, especially when combined with rising global popularity.

Key scarcity factors include:

-

small vineyard size (e.g., Burgundy Grand Cru parcels)

-

tiny production quantities (e.g., cult wines like Screaming Eagle)

-

ageing windows that encourage consumption, shrinking supply globally

-

strict allocations, limiting the volume released to each market

As bottles are opened worldwide, the remaining supply becomes increasingly rare. This dynamic is central to why fine wine is considered a reliable long-term luxury asset for investors looking to diversify their portfolios.

Critical scores and reviews

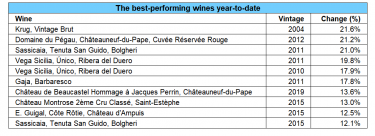

The influence of major critics – such as Robert Parker, Jancis Robinson, Neal Martin, and Antonio Galloni – extends across the wine market. High scores can increase a wine’s value almost overnight.

A wine that receives 100 points from a leading critic often experiences:

-

an immediate spike in demand

-

rapid price appreciation

-

greater visibility at wine auctions

-

a strong long-term reputation

Wines with consistently strong critical track records tend to demonstrate more resilient pricing across market cycles.

Conversely, wines with poor or average reviews may struggle to outperform, even if produced by respected estates.

Provenance and storage conditions

Provenance – the verified history of a wine’s ownership and storage conditions – is vital in determining its market value. Buyers pay a premium for wines with impeccable provenance, often stored in:

-

bonded warehouses

-

producer cellars

-

trusted merchant facilities

Perfect provenance assures collectors that the wine has been stored correctly, preserving quality and value. Auction houses frequently highlight provenance as a core selling point, and wines sourced directly from estates often achieve superior prices.

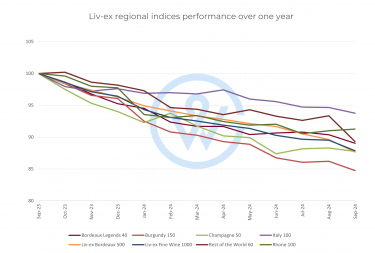

Market trends and global demand

Fine wine prices do not exist in isolation. Global market trends, economic conditions, and consumer behaviour all shape demand.

Factors influencing the broader wine market include:

-

widening wealth in emerging markets

-

shifting preferences toward Burgundy, Champagne, and Tuscany

-

currency fluctuations

-

macroeconomic stability

-

rising interest in biodynamic and organic wines

-

growth of digital trading and globalised auctions

For example, surging demand from Asia over the last decade has contributed to extraordinary appreciation in Burgundy prices. Similarly, Champagne’s increasing popularity as both a collectible and a safe-haven luxury asset has pushed demand for prestige cuvées like Dom Pérignon, Cristal, and Krug.

Tracking global demand helps investors anticipate future price movements and identify opportunities across regions.

Age and maturity

A wine’s age is closely tied to its market value. As fine wines mature, they often enter their optimal drinking window, increasing desirability.

Collectors will pay more for wines that are:

-

perfectly stored

-

approaching or at peak maturity

-

ready to drink immediately

For example, a young First Growth Bordeaux might sell for £400 on release, but reach £800–£1,000 once its drinking window opens. Much older wines can appreciate even more dramatically due to extreme scarcity.

This age-driven evolution is one reason many investors treat wine as a multi-year, low-volatility strategy rather than a short-term investment.

Regional prestige and classification systems

Certain wine regions carry inherent prestige that elevates their pricing. Fine wines from the regions below regularly outperform less renowned regions in terms of long-term appreciation.

-

Bordeaux

-

Burgundy

-

Champagne

-

Tuscany & Piedmont

-

Napa Valley

Formal classification systems – like the Bordeaux 1855 Classification or Burgundy’s Grand Cru hierarchy – further reinforce value by signalling quality and exclusivity.

Wines from higher classifications consistently command premium pricing and often show superior secondary-market performance.

FAQ: Fine Wine Prices

Why do wines of similar quality often differ so much in cost?

Producer reputation, track record, and regional prestige significantly influence pricing. Top estates with limited production naturally command higher values.

Does fine wine always appreciate in value over time?

Not always. While many investment-grade wines appreciate, price performance varies by vintage, producer, storage, and global market trends.

How do wine auctions affect fine wine prices?

Auction houses help establish benchmark pricing. Rare bottles with great provenance often achieve record prices, influencing global perceptions of value.

Is fine wine a safe alternative investment?

Fine wine is considered a low-volatility luxury asset with strong long-term performance, making it a popular portfolio diversifier.

What role does provenance play in price performance?

Perfect provenance can dramatically increase a wine’s value.

Which regions tend to cost the most?

Bordeaux First Growths, Burgundy Grand Crus, and Napa cult wines typically hold the highest average prices due to global demand and scarcity.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.