- Bordeaux 2022 is a vintage of ‘potential greatness’ but also ‘heterogeneity’, according to the Wine Advocate’s En Primeur report.

- The reviewers, William Kelley and Yohan Castaing, found potential for perfection in eight wines, and included a list of En Primeur recommendations.

- Kelley noted that the second wines ‘merit more serious consideration than usual this year’.

Potential greatness and heterogeneity

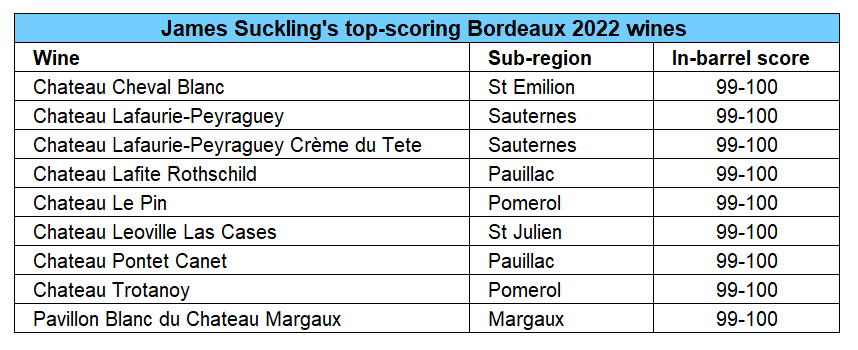

During the En Primeur trade tastings last week, and following James Suckling’s report, another major publication released its assessment of the 2022 Bordeaux vintage – Robert Parker’s Wine Advocate. William Kelley and Yohan Castaing reviewed 459 wines ‘after several weeks of intensive tasting and hundreds of visits to wineries’.

The critics found ‘potential greatness’ in this vintage that has surprised many, but also ‘heterogeneity’.

Kelley explained that ‘Bordeaux has produced some monumental wines in 2022, but unlike many of the great vintages of the 20th century, the year was not a rising tide that raised all boats’.

He added that ‘at its best, this is a vintage of remarkable concentration, energy and harmony’. According to him, ‘the accumulated experience of 2015, 2018, 2019 and 2020 meant that intelligent winemakers were ready to harvest at the right time, a choice of decisive importance’. However, he noted that ‘the less-successful wines are jammy, astringent and rustic’.

The vintage heterogeneity means that buyers will have to be selective; 2022 ‘is not a year to buy blind,’ the critic argued.

Top-scoring wines

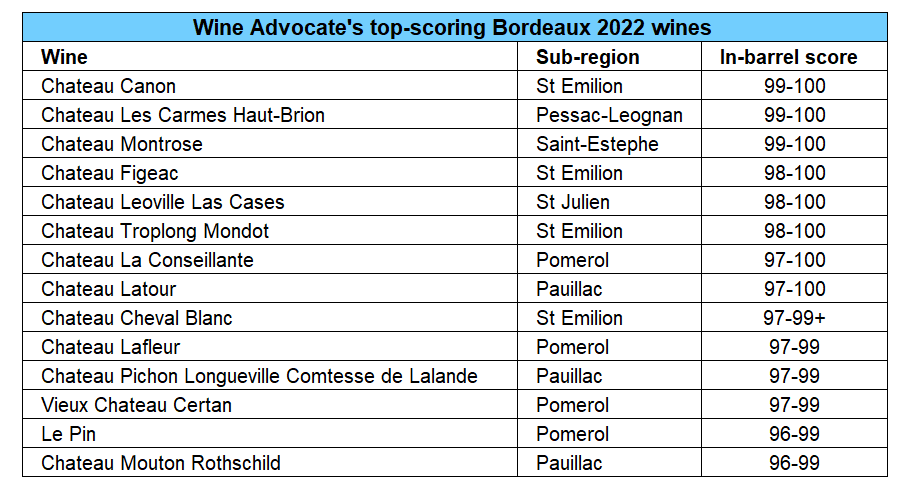

The critics found potential for perfection in eight wines, with Canon, Les Carmes Haut-Brion and Montrose coming on top (99-100 points).

Among the three, Les Carmes Haut-Brion has been the best performing investment wine over the last five years, up 56%, while also having the lowest average case price. Castaing singled it out as ‘a strong candidate for the title of wine of the vintage’.

One First Growth, Château Latour, was also among contenders for perfection, although the wine is not released En Primeur. Meanwhile, Château Mouton Rothschild, received 96-99 points. Kelley called it ‘a brilliant wine that likely sits somewhere between the 2019 and 2020 in quality’.

Kelley also noted that second wines ‘merit more serious consideration than usual this year’. In 2022, they ‘often exhibit similar structure and texture to their grand vin counterparts’.

Apart from their top-scoring wines, the critics made a list of En Primeur recommendations to buy, which included Branaire-Ducru and Langoa Barton.

En Primeur pricing

A great vintage usually translates to expensive releases.

However, Kelley suggested that there were grounds ‘for optimism with regard to pricing this year,’ if the chateaux take into account the global economic uncertainty and the state of the secondary market.

He remarked that ‘it is not always necessary to purchase great Bordeaux as futures,’ as sometimes older vintages might represent better value today.

To spot the best value opportunities and explore the historic performance of any fine wine brand, visit Wine Track. Our tool provides a clear overview of a fine wine’s track record, including critic scores, average price and investment returns.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.