- Stability, sustainability and increased market liquidity are the key drivers of investment interest in fine wine.

- UK investors are also attracted by the tax advantages of fine wine, which is classed as a ‘wasting asset’.

- Meanwhile, passion investing is on the rise in the US, seeing an 8% uptick since last year.

Our recent survey among UK and US wealth managers revealed the top reasons why investors are choosing fine wine in 2024.

While there are differences in their motivations based on demographic, sustainability, stability through different economic environments, and increased liquidity came at the forefront in both markets.

Fine wine’s stability during market volatility

In uncertain times, investors often seek tangible assets that offer stability. As WineCap’s CEO, Alexander Westgarth puts it, ‘In times of hardship, people want something solid. Literally. Tangible assets like property, gold or fine wine tend to feel more precious during market downfalls’.

With US market sentiment being one of fear, according to the Fear & Greed index, 74% of US wealth managers chose stability as their top reason to include fine wine in client portfolios, marking a 6% increase from last year.

In the UK, stability came as the second most important factor driving demand for fine wine. It was cited by 56% of our survey respondents, up 16% since 2023. High inflation, slow economic growth and various macroeconomic headwinds have solidified fine wine’s position as a ‘safe haven’ asset, preferred by UK investors.

Sustainable investing on the rise

Sustainability was the number one reason to invest in fine wine for UK wealth managers, and the second most important factor in the US.

As we recently explored (‘The growing importance of sustainability in fine wine investment’), there has been a broader global trend where environmental, social, and governance (ESG) factors are increasingly shaping investment strategies across various asset classes, including fine wine.

Research from Morgan Stanley shows that more than half of individual UK investors plan to increase their allocations to sustainable investments in 2024, making fine wine a great investment option.

According to our survey, 68% of UK investors invest in fine wine because of its low-carbon benefits, with many fine wine producers leading the charge in sustainable viticulture.

Improved liquidity

Investors in both the UK and US recognise that the fine wine market is becoming more liquid. Advances in technology have opened up new avenues for investors, simplifying buying and selling processes, improving price transparency, and shifting perceptions of fine wine as an “illiquid liquid.”

As a result, UK investor confidence in the market’s liquidity has increased by 32% in 2024. As for the US, there has been a 14% increase from 2023.

UK tax benefits

UK investors benefit from fine wine’s status as a ‘wasting asset’ making it a more tax-efficient investment. As of April 2024, UK investors pay up to 28% tax on profits over £3,000. Pre-2022, investors paid tax on anything above £12,300, but the past few years have seen the threshold slashed in a bid to plug the ‘fiscal black hole’.

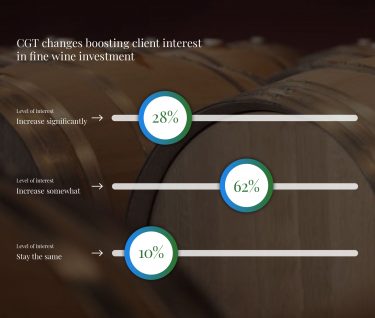

As a ‘wasting asset’, the HMRC does not consider fine wine an investment where the profit should be taxed. Investors recognise this benefit, with 90% of our survey respondents noting that the CGT changes will increase the attractiveness of fine wine.

Tax efficiency was the fourth most important reason for UK investors, cited by 38% of the respondents.

The overlap between collecting and investing in the US

Fine wine, long seen simply as a passion asset, has managed to rebrand itself as a sound alternative investment choice. UK investors today focus less on ‘passion’, a motivation that has seen a 16% dip since last year.

Still, in the US, many investors start out as collectors. ‘Passion investing’ has been on the rise across the pond, with 24% of the survey respondents being motivated by earning a profit and enjoying the experience that comes with owning a fine wine collection.

For the full breakdown of the reasons why investors choose fine wine in 2024, read our UK and US Wealth reports.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.