We have conducted our wealth management survey again in 2025. Here is what UK wealth managers expect to happen with investment demand under Trump’s policies.

- 94% of UK wealth managers favour US equities under Trump’s pro-business policies, and 90% predict growth in emerging markets.

- 82% see UK property as a strong hedge against inflation, signalling a shift toward stability-focused investment strategies.

- 58% of respondents highlight fine wine, art, and classic cars as attractive investments, reinforcing the trend toward tangible, wealth-preserving assets amid economic uncertainty.

With the return of Donald Trump to the White House in 2025, the global investment landscape is experiencing heightened volatility. Events could unfold in any direction given President Trump’s inherent unpredictability – making it more crucial than ever for investors to prepare for the unexpected.

His administration’s tax and trade policies – historically pro-business, protectionist, and favouring domestic production – are already creating ripple effects far beyond US borders. For UK investors, this means a reassessment of how political developments shape financial decisions.

While Trump’s policies could drive stock market rallies, lower corporate taxes, and encourage capital repatriation, they also pose potential risks – such as renewed tariff wars, increased market fragmentation, and a more aggressive stance on trade negotiations.

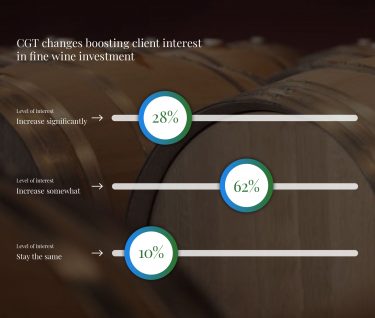

The last time Trump held office, his administration imposed tariffs on European wines, disrupting trade and affecting fine wine markets in both the US and UK. In 2025, the geopolitical and economic landscape is vastly different, and while tariffs remain a possibility, the bigger picture suggests that alternative assets – including fine wine – may play an increasingly important role in UK investment strategies.

Investment trends forecast

The expected increase in demand for assets under Trump’s tax and trade policies underscores a broader flight toward stability, alternative assets, and tangible wealth preservation. The following results are based on a 2025 survey among UK wealth managers and independent financial advisors.

Strongest performing asset classes

US stocks

US equities are projected to see the biggest increase in demand, favoured by 94% of investors. This is a continuation of the 2024 trend, fuelled by expectations of corporate tax cuts, deregulation, and a more business-friendly environment. Historically, Trump’s economic policies have supported stock market growth, and investors appear confident in a similar outcome this time around.

Emerging market stocks

Emerging markets follow closely, with 90% of respondents anticipating increased demand. During Trump’s first term, emerging markets posted positive results, achieving 13.6% annualised growth. However, with Trump’s history of trade wars and potential geopolitical tensions, investors are likely to tread cautiously, focusing on regions that align with US trade interests.

Property

UK property is also enjoying rising demand, according to 82% of wealth managers. At the start of 2025, buyer activity rose 13% year-over-year, with new sales agreed up 12% over 2024. More properties are reaching sale-agreed status, and a 10% increase in listings suggests previously hesitant buyers are re-entering the market. As real estate remains a hedge against inflation, demand for prime and luxury properties is expected to strengthen further.

Cash

The old adage ‘cash is king’ rings true for 80% of investors, reflecting a preference for liquidity amid economic and geopolitical uncertainty. With interest rates still elevated and market volatility expected, investors appear to be holding significant cash reserves, waiting for the right moment to deploy capital.

Alternative and safe-haven assets

Bonds

As fiscal policy and interest rate expectations evolve, 72% of investors see bonds as an attractive asset class. With central banks adapting to economic shifts, fixed-income investments may serve as a stabilising force in portfolios.

Non-US developed market stocks

While US stocks dominate, 72% of investors also foresee demand for non-US developed markets, particularly in regions that may benefit from a changing trade landscape.

Startups & venture capital

With Trump’s pro-business policies likely to fuel entrepreneurial activity, 70% of respondents see an uptick in demand for venture capital and angel investing. Lower corporate tax rates and deregulation could further incentivise innovation and high-growth sectors.

Luxury collectibles

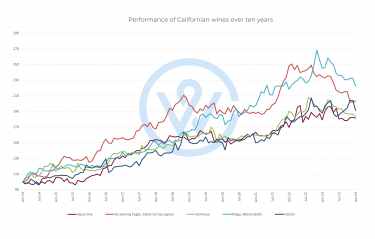

The category that includes fine wine, art, and classic cars is expected to see greater demand, with 58% of respondents highlighting it as an attractive asset class. Given fine wine’s historical resilience during economic downturns and inflationary periods, investors may see it as a store of value amid uncertainty.

Moderate to low confidence assets

Digital currency

Despite Trump’s previous scepticism toward cryptocurrency, his recent endorsement of digital assets may explain why exactly half of respondents see further growth in this sector. While regulatory uncertainty persists, crypto remains a potential high-risk, high-reward investment.

Precious metals

Traditionally a go-to safe haven during market turmoil, precious metals received the lowest investor confidence in our survey. With only 48% forecasting increased demand, this suggests investors may be looking toward more dynamic, yield-generating alternatives rather than passive gold holdings.

Stay tuned for the 2025 edition of the WineCap Wealth Report – published next week.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.