- Top Bordeaux labels are now approximately 20% below their peaks achieved during the last decade.

- Lafite Rothschild has been the hardest hit, driven lower by classic vintages such as 2018, 2009 and 2000.

- The recent fall in prices has brought many labels back to levels not seen in years.

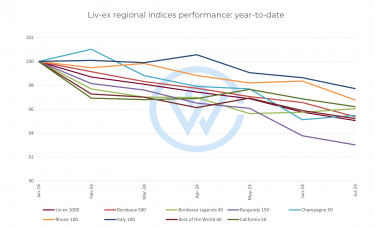

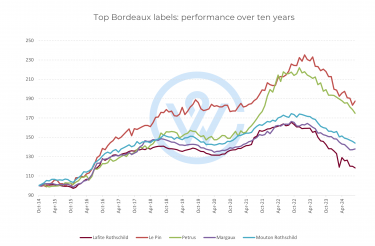

As recently explored, the fine wine market has been on a downward trend, but what does this mean for individual labels? Today, we turn to Bordeaux’s top names, examining the recent performance of some of the most investable wines in the world.

Bordeaux after the peak

Top Bordeaux labels are now approximately 20% below their peaks, achieved during the last decade.

The First Growths, which often serve as the barometers of the fine wine market, had been riding high, with September 2022 marking a peak in pricing for Lafite Rothschild, Mouton Rothschild and Margaux.

However, since then, the landscape has changed dramatically. Lafite Rothschild, once the shining star, has fallen by 28.6%, the most severe decline among the top names. Margaux and Mouton Rothschild have also taken significant hits, falling by 17.1% and 17.5%, respectively.

On the Right Bank, the situation is no different. Petrus, which peaked in December 2022, has since dropped by 21.4%, while Le Pin, which reached its high in February 2023, has declined by 20.3%. These losses have brought prices to levels last seen several years ago.

First Growths peaked in September 2022, since then:

- Lafite is down 28.6%

- Mouton is down 17.5%

- Margaux is down 17.1%

On the Right Bank:

- Petrus is down 21.4% since its December 2022 peak

- Le Pin is down 20.3% since its February 2023 peak

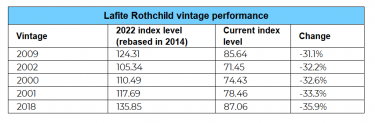

The Lafite fall: a deep dive

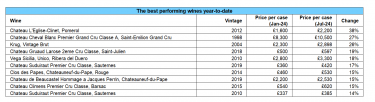

Lafite Rothschild – the second most-searched-for wine on Wine-Searcher – has seen the steepest decline since its peak, with prices plummeting 28.6% on average.

Which vintages have contributed to its fall over the last two years? The 2018 (WA 100 points) has been the hardest hit, down 35.9%. The wine was originally released at levels akin to the brand’s bull years, due to high critic scores, but failed to offer the best investment value. The recent price adjustment has made it a more attractive proposition.

Older vintages that have had more time to grow have similarly fallen in value by over 30%. The classic 2009 Lafite, which boasts 99+ points from Robert Parker himself, is down 31.1% over the last two years.

The millenial vintage, with a drinking window that extends well into the 2050s, is currently 32.6% below its peak.

Buying levels: back to the square one

The recent fall in prices has brought many labels back to levels not seen in years. Lafite, for example, has returned to its 2016 pricing levels, while Margaux and Mouton are back to 2020. On the Right Bank, Petrus and Le Pin have both returned to their 2021 levels.

While this might raise concerns on the surface, it presents a compelling opportunity. The scale of the correction suggests that Bordeaux wines, while still highly valued, may have been oversold in the last 18 months.

For those looking to enter or expand their portfolios, this could represent a chance to acquire top-tier wines at a significant discount before prices start to rise again.

As with previous corrections, price declines are often followed by periods of recovery. For wealth managers and clients with a long-term investment horizon, the current situation may be seen as a momentary blip in an otherwise upward trajectory.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.