- The fine wine market is not correlated with mainstream markets yet there are some notable similarities and differences between them.

- Global events and the law of supply and demand affect both the fine wine and financial markets.

- Some of the main differences are tangibility, liquidity, the impact of time and factors influencing their performance.

The world of fine wine and the broader financial market might seem like distinct universes at first glance. However, there are intriguing similarities and differences between the two, which we examine below.

Similarities between fine wine and financial markets

Both fine wine and financial markets provide lucrative opportunities for investors. While the latter showcases a plethora of options like stocks, commodities, and currencies, the former provides an alternative avenue for diversification, offering tangible assets, valued not just for their financial potential but also their historical and cultural significance. In stark contrast to the complexity and varied strategic approaches inherent in the financial markets, the wine market is more straightforward, predominantly guided by a ‘buy and hold’ strategy. Moreover, the universe of investable wines is notably narrower, typically centering around a select group of regions and producers.

Driven by demand

The laws of supply and demand are central to price determination in both markets. A rare vintage from a renowned vineyard or a wine produced in small quantities can fetch astronomical prices due to limited supply, mirroring the price surge of a high-demand stock or asset. For instance, Hubert Lamy Saint-Aubin Premier Cru Derriere Chez Edouard Saint Aubin has risen 189% in value over the last year due to low supply. The singular wine comes from a tiny plot of 0.7 hectares in Derrière chez Edouard, which was planted 20 years ago at 30,000 vines per hectare. At such a density, the entire plot only yields enough juice to fill the contents of a single barrel. In the world of stocks, demand has played a key role too. Nvidia – the company of the AI-fueled market rally – has been the best-performer in 2023, up 198%.

Impact of global events

Economic downturns, political events, and global crises can influence both the fine wine and financial markets. However, fine wine is less susceptible to global crisis. In fact, events that induce uncertainty usually drive investors towards more stable, tangible assets, which can include fine wines.

For instance, the fine wine market hit new heights during the Covid-19 pandemic, which saw a shift away from risk assets. Prices rose due to heightened demand for fine wine, which demonstrated remarkable resilience during the pandemic.

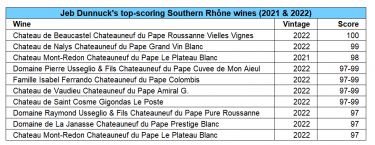

Expert valuations

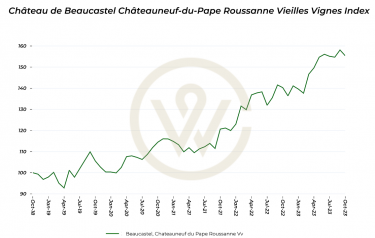

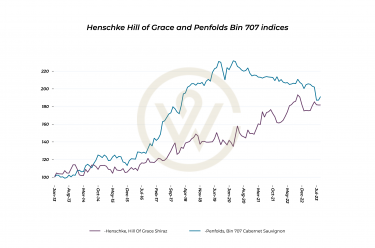

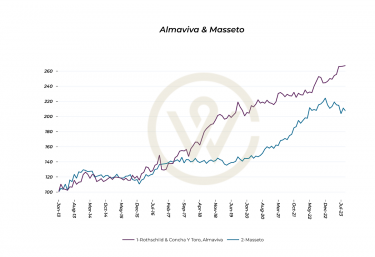

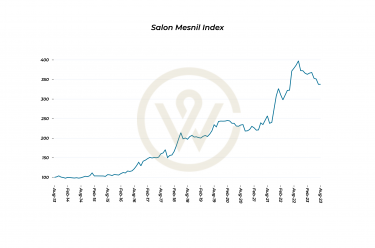

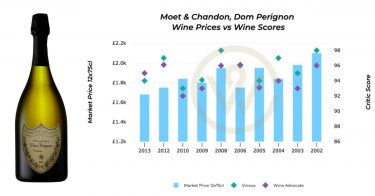

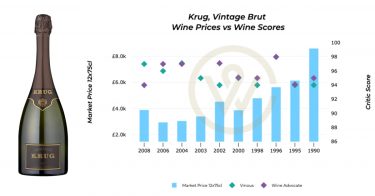

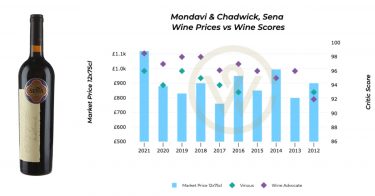

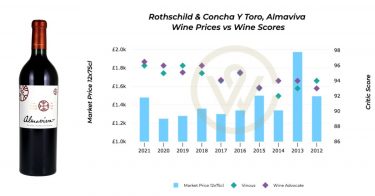

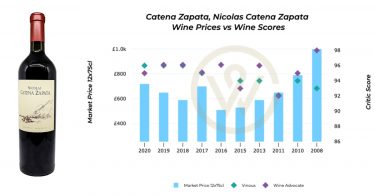

Just as financial analysts predict stock performances, wine experts gauge the potential value of wines, guiding investors’ decisions. Investors can also follow the historical performance of their wines of interest with tools like Wine Track, which shows the performance of different brands over various time periods, as well as average prices and scores.

Differences between the fine wine and financial markets

Tangibility

Investing in fine wine is an investment in tangible assets. The very bottle that appreciates in value over the years can be held, showcased, and ultimately consumed. Contrarily, financial investments, such as stocks or bonds, epitomise intangible assets, wherein the investment is in a concept or a digital representation.

Liquidity

The fine wine and financial markets have different levels of liquidity, which are rooted in their inherent trading characteristics. Fine wine tends to be less liquid, due to its tangibility, with transactions often slowed by factors such as the necessity for physical transport, authentication of products, and a comparatively limited buyer market. Additionally, investment-grade wines often necessitate longer holding periods to realise their gains, further reducing their liquidity. Meanwhile, the financial market is commonly cherished for its high liquidity, with assets like stocks and bonds that can be rapidly traded on large-scale platforms, accommodating a broad, active base of buyers and sellers.

The impact of time

The relationship between wine and time also sets these markets apart. While fine wine can age (which impacts its quality and value), financial assets do not inherently bear such physical transformations. However, their value may be just as susceptible to the passage of time and shifts in market dynamics.

Storage and maintenance

Fine wines require specific conditions for storage to retain or enhance their value, incurring additional costs. In contrast, stocks or digital assets don’t require such maintenance.

Factors influencing performance

In the wine investment landscape, several factors, including vintage quality, expert reviews, provenance, and global demand, play pivotal roles in determining a wine’s value and investment potential. Often burgeoning markets exert a profound influence, dynamically shaping global demand and investment flows, like China’s love affair with Bordeaux.

On the other hand, the financial market is steered by economic indicators and central bank policies, technological advances and corporate actions, such as mergers and acquisitions. Each factor, be it micro or macro in scale, casts its influence over the market’s performance, underscoring the multifaceted nature of financial investments.

Investor profiles

Fine wine appeals to a myriad of audiences, including collectors, connoisseurs, and institutional investors seeking diversified, alternative investment portfolios. The allure of tangible, appreciative assets, coupled with a penchant for oenology, makes this market a vibrant tapestry of participants.

Conversely, the financial market is frequented by a diverse mix of retail and institutional investors, brokers, and analysts. The widespread availability of resources, platforms, and instruments in the financial domain makes it accessible to an extensive demographic.

While the fine wine market and the financial market operate in distinct realms, the parallels and contrasts between them offer valuable insights. As with any investment, potential investors in either market should conduct thorough research and seek expert advice.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.