- Both bonds and fine wine can help to mitigate short-term risk in a portfolio.

- After ten years the average bond delivers a 15% return, while fine wine – 78%.

- Fine wine is an inflation-resistant asset, unlike bonds.

- Bonds are generally much more liquid than fine wine.

Bonds are one of the most popular ways to invest. For decades, investment managers would opt for a strategy known as “60/40”, where 60% of the portfolio was allocated to equity and 40% to debt instruments. The idea was that the riskier equity (stocks and shares) would shield against inflation while helping to generate returns. By contrast, the more stable debt instruments (bonds and credit) would ground the portfolio and prevent it from plummeting during market downturns.

However, a lot has changed since then. Today, many experts comment that the 60/40 rule no longer applies. Instead, investors need to diversify much more to achieve more market stability. And they need to go further afield – into alternative assets – to find true inflation resistance.

In this article, we’ll compare the risk, value drivers, return, liquidity, and inflation characteristics between bonds and fine wine.

Both wine and bonds can mitigate short-term risk

Bonds come with many different risk levels. Some borrowers – like fledgling start-ups – are extremely likely to default. While there are others – like the governments of developed nations or blue-chip companies – that are almost definitely going to meet the repayments.

Occasionally investment managers will opt for extremely risky debt – known as a High Yield Bond strategy. But generally, most will allocate a greater portion of the portfolio to low-risk bonds, which tend to be rated AAA or Aaa by specialist agencies. This is usually to anchor the portfolio and help bring in stable fixed income.

Like bonds, fine wine is also generally a low-risk investment. Because the value is intrinsic, it is unlikely to plummet overnight. After all, fine wine will always be valuable. No matter what’s going on in the stock market, somebody will almost always want to buy it.

Investment managers will often add a small allocation to fine wine to help preserve wealth and mitigate risk. We have noticed that the wealthier the client, the higher the proportion tends to be. So, ultra-high net worth (UHNW) individuals and family offices generally have more fine wine in their portfolios.

The sources of value are different

While AAA bonds and fine wine may have similar risk levels, their revenue sources couldn’t be more different.

Investors make money from debt instruments like bonds by collecting the repayments from the initial sum, plus interest (the extra interest is known as “coupons”). With bonds, investors get regular revenue, which is why the asset falls under the category of “fixed income”. The repayments and coupons are usually paid quarterly.

By contrast, fine wine investors generally need to wait until they have sold the cask or bottle before they can access any returns. However, the returns are usually much more lucrative than bonds.

Wine has a stronger return profile

The average annual return of a bond is 1.6%. Usually, bonds will last for longer than a year though. Short-term bonds are around three years, mid-term is about five years and long-term is anything over a decade. Over ten years, investors gain an average of 15% returns. This means that if you invested £1,000, you could expect to get around £1,150 back.

One of the useful things about a bond is that investors should be able to clearly know how much they will get in advance. This is because the repayment terms and interest are already agreed upon, it does not depend on the ebbs and flows of market sentiment.

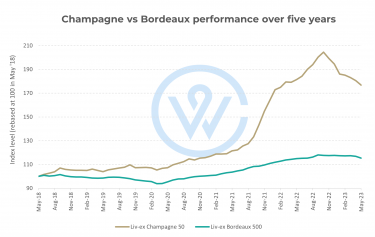

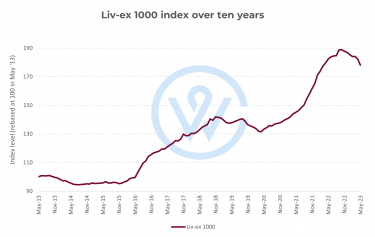

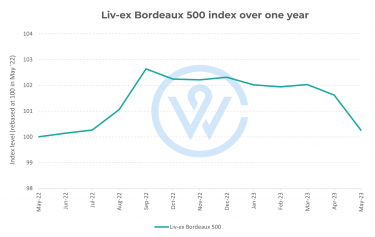

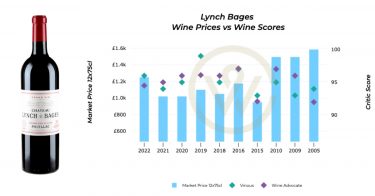

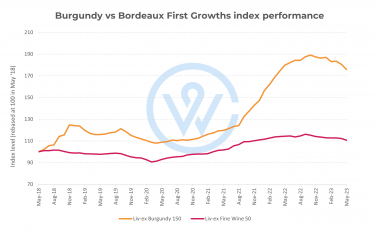

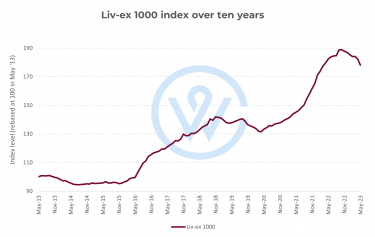

Like bonds, fine wine can also take some time to realise its return potential. But, on average, it’s much more profitable for investors than bonds. Figures from the Liv-ex 1000 index show that the average bottle of fine wine already brings returns of 23% after two years. After five years, that increases to 34%, and after ten to 78%. So, if you had invested £1,000, you could expect to get back £1,780%.

You can follow how specific bottles have performed over the past decade with Wine Track.

Bonds are more liquid than fine wine

There are two main ways to invest in bonds. You can buy them on the primary market and lend money directly to borrowers, or you can trade bonds on the secondary market. In the secondary market, the new buyer will then own the debt and pick up the repayments. This makes bonds quite liquid, meaning they are fairly easy to sell and turn into cash if you suddenly need the money. For publicly traded loans (rather than private debt) you should usually be able to sell a bond and expect the money in your bank account within a week.

Fine wine investors also have a primary and secondary market, but the process of trading is not usually so quick. For the best results, investors should wait until the wine matures before selling. But this can mean that the money is locked-up for months or years at a time. Some vintages, for example, can take upwards of twenty years to peak. If you sell early, you could miss out on valuable returns.

Before investing in wine, always consider your liquidity needs. It can be helpful to add-in some cash or cash-like investments into your portfolio in case you need to access funds quickly.

Fine wine is more inflation-resistant than bonds

Inflation occurs when the value of money decreases. Usually, this is because a central bank (like the Bank of England) prints more money to help the economy overcome a crisis, known as Quantitative Easing. While this measure may help to prevent a recession, sooner or later it usually needs to be reversed. When the economy is red hot, central banks normally need to hike up the interest rates to cool things down again. This can be painful for debt investors, and especially those holding long-term bonds.

Imagine that in 2019, you bought a ten-year bond to lend £1,000. At this time, the bank rate was set at 0.75%. Today (in 2023), you would still have six years left on your bond, but the bank rate has soared to 4.5%. The borrower will still be paying you the rate that was agreed in 2019. You could be paying more for your own mortgage or credit card than you’re getting back from your investment.

What’s more, the initial sum is becoming worth less by the day as high inflation of 8.7% grips the economy. If the inflation continues, by the time the bond is repaid, that £1,000 is the real value equivalent of just £740.55 today.

The downside of investing in bonds is that they don’t really protect you from inflation, especially over the long term.

Fine wine, on the other hand, is a good example of an inflation-resistant asset. Over the years, the value of precious bottles tends to keep up or even outpace Quantitative Easing.

There are many reasons for this. First and foremost, it is a physical asset like property and art, which acts like a wealth store. It is rare and depleting. Furthermore, the passionate and global market usually keeps prices at a healthy level.

The best approach is probably a mix of investments

As Nobel-prize laureate Harry Markowitz famously quipped, “Diversification is the only free lunch in finance”. This philosophy marks the cornerstone of modern portfolio theory. The idea is that you should invest in as many different revenue sources as possible to mitigate against risk. This means that for most portfolios there should be a blend of equity, debt (like bonds), alternative investments (like fine wine), real estate and some cash. Usually, the allocation to cash is about 5%.

Both bonds and fine wine have different investment characteristics. The trick is to use them in the most beneficial way to investors. For example, if you’re looking to grow your wealth over the long-term, fine wine is probably a better option. However, if you’re looking to generate regular income, investing in bonds could be a better bet.

There are interesting examples of bonds and fine wine working together within retirement portfolios. Fine wine is increasingly used as a growth generator to boost the investor’s wealth at the start of their pension journey. Meanwhile, bonds normally provide stable and regular income after the investor retires.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.