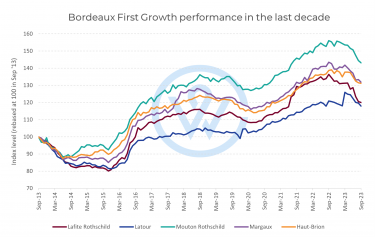

- Once the dominant force in the fine wine market, the Bordeaux First Growths have lost market share due to its broadening.

- In the last decade, Château Mouton Rothschild has been the best price performer, up 43.2%.

- Château Haut-Brion offers the best value, with the highest average critic score and the lowest average price per case.

The Bordeaux First Growths in a broadening market

The Bordeaux First Growths have long been the cornerstone of the fine wine investment market. Back in 2010, they made up close to 90% of all Bordeaux trade by value – at a time, when Bordeaux’s share of the total market stood at 96%.

With the broadening of the market, their share has decreased and they now regularly account for around 30% of all Bordeaux secondary market trade (which itself has fallen below 35% annual average).

This trend was also reflected in the 2022 Power 100 list, which offered a snapshot of the ever-changing landscape of the secondary market. For the first time ever, no Bordeaux wines featured among the top ten most powerful fine wine labels.

Even if trade for these brands remains consistent or increases, the First Growths are facing greater competition. Still, they are among the wines with the greatest liquidity, attracting regular demand and high praise from critics year after year.

First Growths’ price performance

In terms of price performance, the five First Growths have followed a similar trajectory (i.e. rising post-Covid and dipping in the last year in line with the current market reality). The relative outcast has been Château Latour, whose performance was impacted by the decision to leave the En Primeur system in 2012. The wine has been the worst-performing First Growth, up just 17.9% in the last decade.

The best performer has been Château Mouton Rothschild, with an increase of 43.2%. Recent releases have elevated the performance of the brand, like the 2020 vintage, which boasts 100-points from The Wine Advocate’s William Kelley, 99-100 from James Suckling, 98-100 from Jeff Leve and 99 from Antonio Galloni (Vinous). ‘Off’ vintages like 2011, 2013 and 2014, which have greater room to rise, have also fared well over the last five years.

The second-best performer has been Château Margaux, which is also the second most affordable First Growth. Similarly, its biggest price risers have been 2014, 2011 and 2013. Less classical years reveal the strength of these brands, as demand for the First Growths remains consistently high regardless of the vintage.

First Growths’ price and score comparison

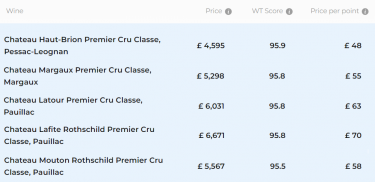

The table below shows the average price per case and critic score of the First Growths for vintages since 2000.

Château Haut-Brion tops the list with the highest average score (95.9) and the lowest average price per case (£4,595). With a price per point of £48, the wine seems to offer the best value among the First Growths. Vintages that have received 100-points from The Wine Advocate include 2018 (LPB), 2016 (LPB), 2015 (LPB), 2009 (LPB) and 2005 (RP).

Looking at the average prices, Château Lafite Rothschild stands out as the most expensive of the First Growths. The wine has achieved 100-points from The Wine Advocate for its 2019 (WK), 2018 (LPB), 2010 (LPB) and 2003 (RP) vintages.

In conclusion, the First Growths remain an important part of the changing secondary market, offering brand strength, consistently high quality and stable growth.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.