- On the outside, wine collecting and investment look similar, but they are different activities with unique objectives.

- Wine collectors and wine investors have different considerations and motivations.

- Most fine wine lovers are a mix of collector and investor and need professional guidance for optimal decision-making.

Many wine lovers curate an expanding cellar over time. However, while some earmark these special wines for future dinner parties and family events, others regard them as financial assets with growth and return potential. From the outside, wine collecting and wine investment often look similar – but the mindsets, motivations, and strategies that drive these activities are fundamentally different.

As the fine wine investment space continues to grow and garner interest as an alternative asset class (owing to its record of stability, low correlation to equities, and years of consistent wine investment returns), understanding these differences is crucial.

Are you a private wine collector or a global wine investor – or a combination of both? Read on to find out.

What is wine collecting?

What drives wine collecting is, above all, passion. Fine wine collectors buy items they admire because of their storytelling, ability to evoke memories, or simply because they align with their tastes. When making decisions about which wines to buy, financial goals are not a key factor.

Collectors of wine typically:

- Buy wines they intend to enjoy one day.

- Curate their collection around regions or producers they esteem.

- Purchase wines spanning a range of styles, including niche bottles.

- Build verticals for pleasure rather than profit.

- Store wines at home or in mixed-use cellars.

- Open rare bottles to celebrate important milestones.

For a collector, the ‘return on wine investment’ is the quality of the experience when a treasured bottle is finally opened and enjoyed.

What is wine investment?

In contrast, wine investment is a financial strategy, rather than purely an expression of taste. Investors regard fine wine as an asset – one that has shown strong returns over decades, enjoys low volatility, and displays reliable resilience in periods of economic turbulence. It is often regarded as a valuable addition to a wider investment portfolio, performing as an asset that can weather the volatility sometimes seen in equities.

Investors typically:

- Select wines which have strong capital appreciation.

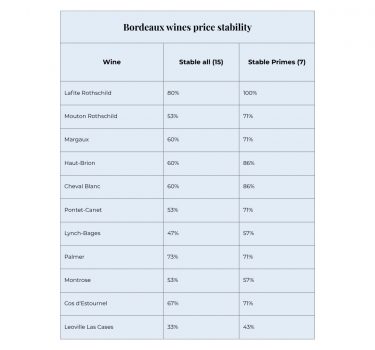

- Concentrate on blue-chip regions with deep and consistent demand globally such as Bordeaux, Burgundy, Champagne, Tuscany, Piedmont, Napa, and the Rhône.

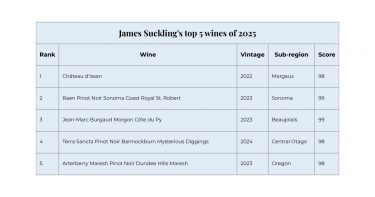

- Use wine investment market data: indicators of market liquidity, critic scores, scarcity, and historical performance to evaluate the best wines to invest in.

- Put provenance, condition, and professional storage first.

- Buy and store wine via trusted wine investment platforms.

- Are guided by data, analytics, and market signals over personal taste.

- Have a clear time horizon and exit strategy.

Investors measure success by risk-adjusted return, not just by how pleasurable a wine might be to enjoy at a future date.

See our Wine Investors Guide for more information.

Asset behaviour: drinkable luxury vs financial instrument

Investors and collectors are each interested in pricey wines because of their quality and historical significance. However, while the former values prestige wines mostly for their potential financial value, the latter appreciates their cultural capital.

Collectors value wine for its:

- Sensory experience.

- Connection to place and tradition.

- Work of craftsmanship.

- Reflection of personal identity and tastes.

Against this background, they may be comfortable purchasing wines with imperfect provenance or storage, as the drinking enjoyment overrides any financial return of wine investment.

Investors value wine as:

- An object with unique economic and structural features and potential.

- A reliable portfolio diversifier.

- Having a finite supply, which can work in favour of price performance.

- Possessing global demand and growth potential as established markets grow and new ones emerge.

- An asset with advantageous low correlation with stocks, currency, and commodities.

These characteristics are key influencers in wine investor decisions and can play a stabilising role in diversified portfolios during periods of market volatility.

Financial mechanics

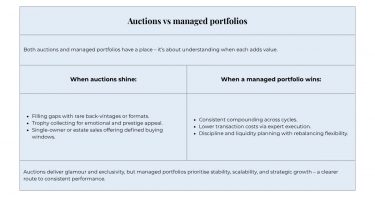

Both categories of wine lovers have to navigate factors that impact if and when they buy, sell, or enjoy their bottles. The most significant are costs, liquidity and wine investment growth.

Costs

Both collectors and investors may face costs associated with:

- Professional storage.

- Insurance.

- Shipping and logistics.

- Potential taxes depending on jurisdiction.

While costs are similar for both collecting and investing, how they are approached varies vastly. Collectors usually accommodate expenses as part of their hobby. Investors, however, have to take them into account when calculating net returns. For example, storage and fees can impact long-term profits.

Liquidity

Wine as an asset class is less liquid than equities. Due to its tangibility, selling can take days or weeks, meaning investors need:

- A platform or experienced broker.

- Impeccable provenance records.

- Timely demand for the particular wine and/ or vintage.

In contrast, collectors don’t necessarily factor selling into the equation. In fact, they often don’t sell at all, with most of their bottles eventually being opened and enjoyed.

Returns

Investment-grade wine has a long history of producing solid long-term returns, with many indices outperforming conventional markets during major downturns. However, fine wine performance is cyclical, like all assets.

Meanwhile, for collectors, the return is the pleasure they enjoy when they choose to open a bottle for private enjoyment or to mark a special occasion. It does not correlate to the rise and fall of the market.

Other considerations

Collectors and investors have different buying motivations but they still need to consider how to balance their cellars or portfolios.

Collectors buy based on emotion, which can mean that they:

- Overbuy wines they don’t drink.

- Don’t have proper or enough storage.

- Build imbalance cellars.

- Are too sentimental to sell or open valuable bottles when the time is right (in their peak drinking window).

Investors purchase wine for its returns potential, which means they need to consider the market and operations:

- Market cycles, shifts in regional demand, and the influence of critics.

- Optimal liquidity.

- Buying the right wine from a reputable supplier.

- Reliable storage and logistics.

Where are you on the spectrum?

Most wine enthusiasts do not fall 100% into either the collector or investor category; they are usually a hybrid of both. The key question you need to ask yourself is: Do you buy wine for emotional or financial return?

If you buy wine because you love what’s in the bottle, you’re a collector. If you purchase wine because of how it can enhance your portfolio, you’re an investor. If you are somewhere in between and are looking to fine-tune your objectives, WineCap can guide you with clarity, confidence, and data-driven precision as you take the next step.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.