- Neal Martin said Bordeaux 2021 shouldn’t be dismissed and identified an ‘overachiever’ among the wines in this challenging vintage.

- According to Antonio Galloni, the quality is higher on the Left Bank than on the Right Bank.

- A dry white wine and a Sauternes were the critics’ top-scoring wines from the vintage.

Vinous recently published two separate Bordeaux 2021 in-bottle reports by Neal Martin and Antonio Galloni. In this article, we summarise their views on this polarising vintage.

Why Bordeaux 2021 should not be ignored

In his report, titled ‘2+2=5: Bordeaux 2021 In Bottle’, Neal Martin explained why ‘irrationality tastes good’ and why Bordeaux 2021 shouldn’t be ignored. He said that ‘on paper, a cursory glance at the troubled growing season would make any rational person dismiss its wines’. But the critic argued that they would be wrong.

While Martin awarded few wines more than 95 points, he advised readers against ‘thinking that the 2021 vintage is incapable of giving sensory and intellectual pleasure’.

According to him, advanced technology and refined winemaking made a fundamental difference at the top end, and thus 2021 cannot be compared ‘with off-vintages like 1977, 1992 or arguably even 2013’.

Martin singled out Les Carmes Haut-Brion as an ‘overachiever’ that ‘halts you in your tracks’ and noted that ‘there is a cluster of very strong-performing wines on the Left Bank that merit attention and possess the substance to repay cellaring’. He added that ‘the Right Bank matches the Left Bank, particularly the usual names on the Pomerol plateau […] and likewise those in Saint-Émilion on free-draining limestone soils’.

Similarly, Galloni found ‘a wide range of compelling wines that merit attention’ within the context of a challenging growing season.

‘In many ways, 2021 can be summarized as a year in which classic Bordeaux weather of the past meets the technical know-how of today in both the vineyard and winery,’ the critic argued.

Overall, he said, ‘the quality is higher and more consistent on the Left Bank over the Right Bank, even though at the very top, the best Right Bank wines can only be described as stellar’.

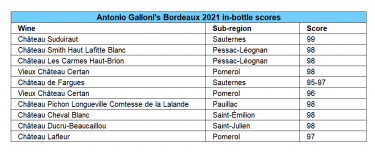

Galloni called Calon Ségur, Ducru-Beaucaillou, Lafite Rothschild, Pichon-Comtesse and Rauzan-Ségla ‘magnificent’, Les Carmes Haut-Brion – ‘majestic’, Vieux Château Certan, Cheval Blanc, Canon, and Lafleur – ‘compelling’. He also made a special mention of the dry white wines, namely Smith Haut Lafitte Blanc, Haut-Brion Blanc and Domaine de Chevalier Blanc.

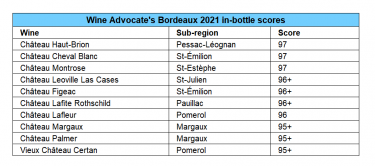

Top-scoring Bordeaux 2021 wines

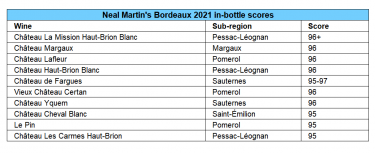

Neal Martin’s top-scoring Bordeaux 2021 was a dry white wine, La Mission Haut-Brion Blanc, while Galloni gave a near-perfect score to a wine from Sauternes – Suduiraut.

Wines that appeared in both critics’ top ten included Les Carmes Haut-Brion, Vieux Château Certan, Lafleur, and Cheval Blanc.

For Galloni, Vieux Château Certan ‘may very well be the wine of the vintage from the Right Bank’, while Martin commented that it ‘transcends the limitations of the growing season’, calling it ‘outstanding’.

Another wine that critics agreed on was Lafleur, which Galloni described as ‘incredibly fascinating’ in 2021, and Neal Martin noted as a ‘strong contender for the wine of the vintage’.

Full report and tasting notes are available on Vinous.

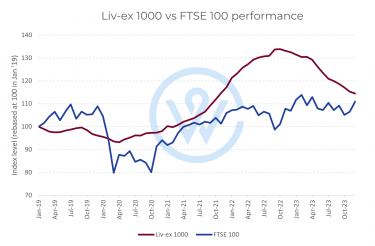

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.