Our Q2 2024 report has now been released. The report examines the macroeconomic factors affecting fine wine prices, the Bordeaux 2023 En Primeur campaign, the best-performing wines, industry news and an outlook for Q3.

Executive summary

- The second quarter built on the successes of the first, with risk assets delivering another set of positive returns to investors.

- Global equity markets were buoyed by resilient economic growth and rising investor confidence.

- UK investment sentiment also improved after a landslide election win for the new Labour government.

- The fine wine market remains a buyers’ market, with Burgundy and Champagne priced down the most in Q2.

- Bordeaux back vintages enjoyed rising demand and prices, following the 2023 En Primeur campaign.

- The best-performing wine in Q2 was the 100-point Château Léoville Las Cases 2016.

- This year’s En Primeur yielded mixed results with few great successes despite the general price cuts.

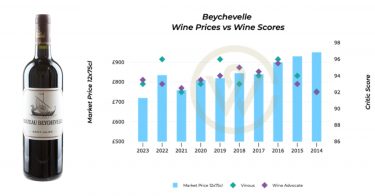

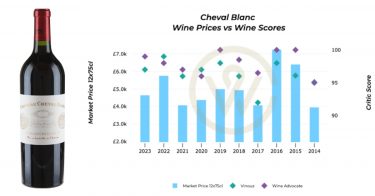

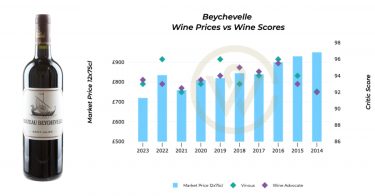

- Some of the best releases included the First Growths and their second wines, Beychevelle, and Cheval Blanc.

- In other news, Sotheby’s Burgundy sale smashed wine auction records and Marchesi Antinori took full ownership of the Washington State winery Col Solare.

- In buying opportunities, Latour 2009 offers perfect scores at the best possible price on the market.

- Looking ahead, we anticipate the autumn La Place de Bordeaux campaign following a short summer lull.

The trends that shaped the fine wine market

Economic resilience boasts global markets

The second quarter delivered positive results for global equity markets which were buoyed by resilient economic growth, and supportive earnings and sales expectations. This strong economic foundation has allowed equities to advance, even as stubborn inflation poses potential challenges. Bond markets also appeared attractive; however, the same economic resilience that benefitted equities introduced near-term risks for fixed-income investments.

UK investment sentiment also improved following a landslide election victory for the new Labour government. The British pound, which has been the strongest major currency against the dollar this year, nudged higher when the scale of Labour’s victory became clear. The UK-focused FTSE 250 share index, which has outperformed the more global FTSE 100 year-to-date, rose to its highest level since April 2022, reflecting renewed investor confidence in the country’s economic prospects.

Fine wine – a buyer’s market

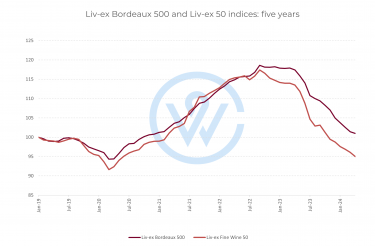

Meanwhile, fine wine prices continued to decline. The Liv-ex 1000 index, the broadest measure of the market, is currently at the level it was in August 2021 (388.28). Despite falling prices, trade volumes are higher than this time last year, suggesting that buyers are seizing opportunities to acquire wines at more favourable prices. Moreover, some of the best-performing wines this quarter rose as much as 20% in value. There are opportunities to be had if one follows closely.

En Primeur and Bordeaux’s falling prices

Some of these opportunities arose during the 2023 Bordeaux En Primeur campaign. The best new releases offered a compelling mix of quality and value, with a significant potential for future price appreciation. These included Beychevelle, Cheval Blanc, and the First Growths’ Grand vins and second wines – still, few and far between given the scale of the campaign. In the secondary market, Bordeaux prices fell 1.8% in the second quarter, making back vintages even more attractive. The only index that rose in value as the campaign concluded was the Bordeaux Legends 40 – exceptional older vintages that enjoyed rising demand.

Regional fine wine performance

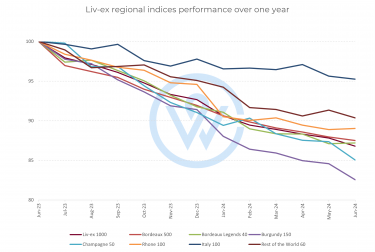

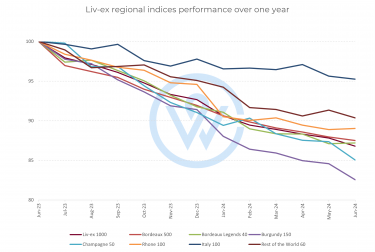

As the market’s focus shifted to new releases, prices in the secondary market fell in Q2. The broadest measure, the Liv-ex 1000 index, dipped 2.4%. It was led lower by the Burgundy 150 (-3.9%) and the Champagne 50 (-3.7%). The Rest of the World 60 and the Italy 100 indices experienced the smallest declines of 1.1% and 1.2% respectively.

As the chart above shows, Italy has shown relative resilience in the current bearish market. Despite broader market uncertainties, some Italian brands have even recorded positive movement in the last six months as high as 15%.

In June, the Bordeaux Legends 40 index recorded its first positive movement in almost a year, rising 0.3%. The index tracks the performance of a selection of 40 Bordeaux wines from exceptional older vintages (from 1989 onwards). As we have previously highlighted, older vintages can often be a lucrative investment prospect, offering a combination of quality, value and bottle age.

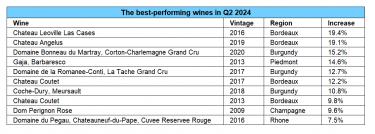

The best-performing wines in Q2

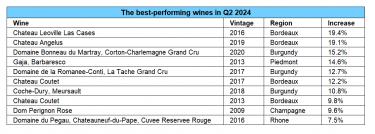

The best-performing wines this quarter were a diverse mix from Bordeaux, Burgundy, Piedmont, the Rhone and Champagne. Leading the charge was the 100-point (WA) Château Léoville Las Cases 2016, with an impressive 19.4% increase. William Kelley described it as ‘one of the high points of this great vintage’. Close behind was Château Angélus 2019, which saw a 19.1% rise.

From Burgundy, Domaine Bonneau du Martray Corton-Charlemagne Grand Cru 2020 came third, up 15.2%. Other wines from the region that rose in value included Domaine de la Romanée-Conti La Tache Grand Cru 2017 and Coche-Dury Meursault 2018.

Dom Pérignon Rosé 2009 also made the rankings, with a 9.6% rise this past quarter. On average, prices for the wine have risen 83% in the last decade.

Fine wine news

Sotheby’s Burgundy sale smashes records

On July 5, 2024, Sotheby’s conducted its first exclusive single-owner Burgundy sale, breaking eight world records and achieving €2 million ($2.1 million). Held in the historic Caves du Couvent des Cordeliers in Beaune, the auction featured over 175 lots from Taiwanese entrepreneur Pierre Chen’s cellar.

Top highlights included six bottles of Chevalier Montrachet d’Auvenay 2009, which fetched €106,250 (£89,915), and 12 bottles of Domaine Armand Rousseau Chambertin Clos de Bèze 1990, sold for €100,000 (£84,630). Among the record-setting sales were three bottles of 2005 DRC Échezeaux at €10,000 per bottle and a magnum of 2005 DRC La Tâche at €35,000.

Last month, Chen’s collection of fine and rare Champagne achieved €1.35 million (£1.14 million) at Sotheby’s in Paris, with notable sales including three magnums of Salon Le Mesnil Blanc de Blancs 1990 for €25,000 (£19,600) and a magnum of Dom Pérignon P3 1966 for €23,750 (£20,100), both setting new records.

Sotheby’s expects Chen’s collection to fetch a record $50 million (£39.2 million) by the series’ end, with upcoming auctions in New York and Hong Kong.

Antinori expands into Washington

Marchesi Antinori, one of Italy’s oldest family-owned fine wine producers, has taken full ownership of the Washington State winery Col Solare, which was established as a joint venture in 1995 with Ste. Michelle Wine Estate (SMWE). The acquisition includes the winery, the estate vineyard spanning 12 hectares planted primarily with Cabernet Sauvignon, and the brand, which produces around 5,000 bottles annually. Piero Antinori, president of Marchesi Antinori, expressed admiration for Red Mountain AVA’s unique terroir, emphasising the challenge and excitement of producing high-quality Washington red wines.

Juan Muñoz-Oca, COO of Antinori USA, highlighted the significance of this acquisition, reflecting Washington’s growing reputation for luxury wines. This move follows Antinori’s 2022 acquisition of Napa’s Stag’s Leap Wine Cellars, transitioning from a 15% to 100% stake after SMWE was sold to Sycamore Partners for $1.2 billion in 2021. Besides Stag’s Leap, Antinori owns Antica, a 200-hectare estate in Napa Valley, as part of their expansion in the states.

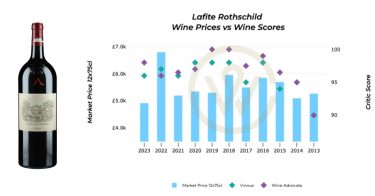

Buying opportunities: Latour 2009

Château Latour 2009 currently represents a combination of perfect scores and perfect timing. The highest-scoring wine ever at the annual Southwold tasting, Latour 2009 is now at the best price it has been in almost a decade.

The recipient of no less than five perfect scores from Robert Parker, Lisa Perrotti-Brown MW, Jeff Leve, James Suckling, and Falstaff, Latour 2009 is a stand-out wine among critics. Hailed by Robert Parker as the greatest vintage he’d ever tasted, more recently Neal Martin described it as ‘outstanding’ and a ‘Latour firing on all cylinders’.

Latour is also the highest-scoring 2009 Bordeaux on Cellar Tracker, where it’s also the second-highest-scoring wine of the entire decade, beaten only by Petrus 2000 at more than six times the price.

In terms of price performance, Latour has outperformed all the other First Growths over one, two and five years.

The 2009 vintage, which is currently available at one of the lowest price points ever, offers value among other prime vintages. Its scores match the 1982 and 1961, both of which come at a significant premium.

It is more affordable than the 2010 as well as the 2000 and 1990 vintages but with superior scores than all of them. The 2009 Latour is a hidden gem that seems particularly good to seek out now.

Outlook for Q3

With the onset of the summer lull, the market is expected to experience a temporary slowdown as usual. Despite this seasonal dip, numerous opportunities remain available. The market for collectibles, including fine wine, is gaining popularity among new investors looking for diversity and uncorrelated market returns.

Over the next two months, the fine wine market will shift its focus to wines from around the globe as the autumn La Place de Bordeaux campaign takes centre stage. Esteemed producers such as Almaviva, Opus One, Vérité, Seña, Catena Zapata, Masseto, and Solaia will unveil their latest vintages on the international stage, accompanied by numerous other exciting releases.

As the campaign expands to include New World wines, the category is expected to see a surge in secondary market demand, potentially driving up prices. We will continue to spotlight the best investment opportunities where exceptional quality and brand prestige meet attractive pricing.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.