Fine wine investment is rapidly gaining traction among beginners and novice investors looking to benefit from a reliable, alternative asset with real historical performance. As both a passion pursuit and a proven alternative investment, fine wine offers something few markets can: the ability to diversify an investment portfolio, strengthen long-term returns, and take part in a centuries-old tradition that continues to evolve.

Surging wine prices frequently make headlines, especially stories of collectors who bought extraordinary wines early, only to sell their wine years later through a wine auction or specialised platform for significant profit. But for newcomers, the key questions remain: How does investing in fine wine actually work? What returns can you expect? And how do you begin your journey in today’s fine wine markets?

This wine investment guide provides a complete introduction to the global wine market, how it operates, and what to look for as you start buying wine strategically.

How big is the wine investment market?

Investing in wine is not a new phenomenon. In fact, wine has functioned as a tradeable commodity since antiquity. Ancient Greeks, Egyptians, Phoenicians, and Romans circulated wine across renowned regions long before modern trade existed. One of the earliest recorded examples of wine prices appreciating appears in the writings of Thomas Jefferson. In 1787, he observed that the 1783 Bordeaux vintage commanded a premium over the younger 1786 vintage – a clear historical example of age and rarity influencing value.

Throughout the centuries, seasoned drinkers quietly practised what we now call wine investing, selling select bottles from their cellars as a way to subsidise consumption. The concept rested on a simple truth: as wine matures, scarcity increases – and so does its value.

Today, wine investment is more transparent, accessible, and data-driven than ever. The global wine market is forecast to reach US$525 billion by 2025, driven by growing international demand and a rising appreciation of luxury assets.

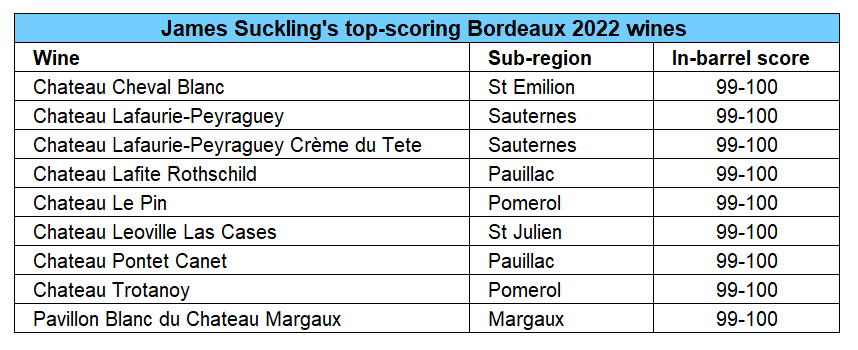

However, despite its size, only a small percentage of all wines produced worldwide are genuinely investment-worthy. Even in renowned regions like Bordeaux and Burgundy, most wines are made for drinking rather than appreciation. Only the rarest cult wines, top estates, and blue-chip producers have the characteristics required to deliver long-term returns.

This scarcity – of high-quality, investible wine – is the core driver of wine’s investment potential. Limited supply combined with global demand leads to price appreciation, particularly for wines with established reputations, critic recognition, and strong market trends.

More fine wine investment opportunities than ever before

Historically, Bordeaux’s classified growths dominated the fine wine investment landscape. In 2010, Bordeaux accounted for 96% of all global trade by value – a reflection of its scale, structure, and tradition.

Today, however, the market has expanded dramatically. Bordeaux now represents less than a third of trade as investors explore a broader set of regions offering compelling returns.

High-performing, investment-grade wines now come from:

Burgundy

Micro-production estates with global cult status and extraordinary long-term appreciation.

Champagne

Steady, consistent performers with strong brand equity—an ideal low-volatility segment.

The Rhône

Producers like Guigal’s La La wines (La Mouline, La Landonne, La Turque) provide both rarity and prestige.

Italy

Led by Tuscany and Piedmont, with wines like Sassicaia, Ornellaia, Masseto, Gaja, and Giacomo Conterno.

USA

Napa Valley’s cult wines – Screaming Eagle, Harlan, Opus One – offer exceptional long-term demand.

Germany, Spain, Australia

Smaller in volume but increasingly recognised for quality and collectability.

The growth of these renowned regions means that wine investment is no longer defined by one country or category. Investors can buy and sell wines across a far more diverse global landscape, tailoring their preferences to budget, style, risk appetite, and investment goals. The collectors’ market is booming, with record number of investible wines trading right now.

Greater fine wine investment returns

As global demand for investment-grade wines has expanded, so too have potential returns. Burgundy provides the clearest example: thanks to microscopic production levels and immense international demand, top estates have delivered some of the strongest returns in the entire luxury asset class.

-

Some Burgundy wines have risen 2,000% in 15 years.

-

The region’s major index is up ~200% over the last decade.

-

Trading volume, value, and liquidity have surged.

Champagne has also been a favourite for investors seeking steady gains. While it is not always the rarest category, its brand strength, vast global audience, and robust distribution networks deliver exceptionally consistent growth. It is often treated as a low-volatility safe-haven asset within a wine investment portfolio.

Different regions appreciate at different rates, influenced by:

Understanding these factors helps investors set realistic expectations for both short- and long-term returns.

How long do I need to invest in fine wines for?

Fine wine is generally classed as a medium to long-term investment. As a rule of thumb, WineCap recommends holding wines for at least three years, though many investors choose a horizon of five to fifteen years.

Most collectible wines improve over 10–50 years, depending on region and vintage. As bottles are opened worldwide, scarcity increases, and prices usually rise.

External factors can accelerate returns. For example:

-

When Wine Spectator named Sassicaia 2015 its Wine of the Year, the price rose 25% in a single day.

-

Those who bought upon release have seen gains exceeding 160% to date.

Fine wine’s resilience also contributes to its appeal. Unlike the stock market, which can swing dramatically in short periods, fine wine typically shows low volatility and stable year-on-year growth. This is why many investors consider fine wine a safe-haven asset, particularly in periods of economic stress.

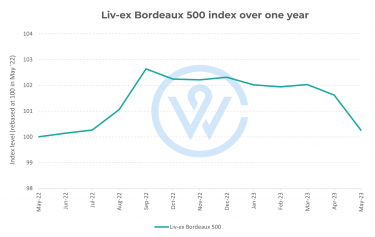

During Covid-19 disruptions and even after the geopolitical shocks following Russia’s invasion of Ukraine, fine wine indices outperformed the S&P 500, FTSE 100, and even gold.

How do I start investing in wine?

There are a lot of decisions you need to make when taking on wine investment. Wine investment experts like our team here at WineCap can help you make decisions relating to the following factors:

Set a wine investment strategy

The first step is to set your budget. Consider how long you would like to hold your wines for and your preferred investment strategy. Fine wines command a range of prices depending on the producer, how much of their wine is made and the wines’ age. Make sure to set your budget before embarking on building your portfolio so you can ensure you have exposure to all countries and regions.

Speak to a wine investment expert

There are different routes to accessing the wine investment market, such as through specialised retailers and auction houses. Expert wine investment brokers offer unbiased advice on strategic investment opportunities and can help you build your portfolio, based on your preferred length of investment and budget. While WineCap doesn’t charge any annual fees, most wine investment companies do, so be sure to do your research and be aware of any fees your portfolio might incur.

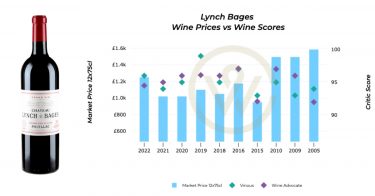

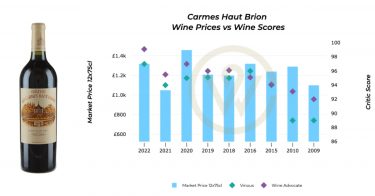

Select world-class wines for your portfolio

A wine investment expert will help you find the wines best suited for your investment portfolio. WineCap has formed long-lasting relationships over the past decade with négociants, wholesalers and private collectors. This means that we have access to some of the world’s most prized wines. What’s more, our unique proprietary technology analyses over 400,000 wine prices a day to identify the right, undervalued wines to buy and sell across the global market at the right time and price.

Store your wines professionally

Choose to keep your wines in government bonded warehouses as this will ensure they are professionally stored in temperature-controlled conditions best-suited for ageing wines. World-class care ensures that when you come to sell, your wines’ provenance will quickly secure maximum prices.

Final thoughts

Fine wine investment can feel daunting at first, but with the right strategy, guidance, and market insight, beginners can access one of the world’s best-performing luxury assets. With global demand growing, more fine wine investment opportunities emerging, and the market proving resilient through economic uncertainty, now is an excellent time to begin building an investment in wine.

Ready to get started now you know more about how to invest in wine? Speak to one of WineCap’s investment experts to discover the next steps on your wine journey.