- La Place de Bordeaux’s autumn campaign continues to expand, with new entries from Germany, France and the rest of the world.

- The network offers producers logistics expertise and knowledge of the world’s fine wine markets.

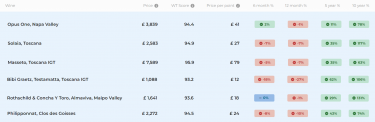

- Some of the top brands that enjoy sustained demand every year include Californian cult wines Opus One and Promontory, and the Super Tuscans Solaia and Masseto.

Following a mixed 2023 Bordeaux En Primeur campaign, which saw many châteaux lowering their prices compared to last year, this autumn will see the annual hors Bordeaux La Place campaign.

As the market for Bordeaux narrows, the system, originally designed purely to sell the wines from the region, continues to expand. However, it’s essential to recognise the challenges that lie ahead.

Current market sentiment

The fine wine market is currently navigating through a period of uncertainty. Economic downturns in key markets like China, where Bordeaux sales have plummeted by two-thirds since their peak in 2017, and the looming threat of a recession in the US, have created a cautious environment. This has significantly impacted confidence in the market, with many stakeholders bracing for a potentially attritional campaign this autumn.

Continued expansion of La Place de Bordeaux

For new producers, the benefits of joining the La Place distribution network are manifold. As Areni put it in a recent article, ‘La Place offers fine wine producers something remarkable: a depth and breadth of fine wine expertise, coupled with a fine-grained knowledge of the world’s fine wine markets and plenty of logistics expertise. La Place also offers prestige, making it highly attractive to many of the world’s fine wine producers’.

According to Mathieu Chadronnier, president of Bordeaux négociant CVBG, ‘We will see more wines from beyond Bordeaux come to La Place. That trend is not going anywhere because the fundamental rationale that fine wine is one single category that embraces regions and countries of origin remains.’

This shift is particularly significant in light of the current market conditions. As Bordeaux faces challenges, the inclusion of international wines has become more crucial, providing a broader range of offerings and catering to an increasingly global market.

New entries on La Place

Ernst Loosen, the renowned Mosel-based producer, is entering La Place for the first time this year with a limited-production wine, Weingut Dr. Loosen, Zach. Bergweiler-Prüm Erben.

Meanwhile, Rheingau Riesling producer Schloss Johannisberg is advancing its strategy to expand the global reach of its premium Rieslings. This autumn, they will introduce Schloss Johannisberg Riesling Goldlack and Schloss Johannisberg Riesling Orangelack Kabinett to a broader international audience using the network’s global reach.

Additionally, Maison Georges Vigouroux will release the first Malbec from Cahors – Château de Haute-Serre Grand Malbec 2022 – through La Place de Bordeaux. This marks the first global ‘icon’ wine from the appellation since phylloxera nearly eradicated the grape variety in France almost 200 years ago.

Top brands to watch

The coming weeks will see the release of the latest vintage from some of the hottest brands, including the Super Tuscans Solaia, Masseto and Bibi Graetz, Californian cult wine Opus One joined by estates such as Inglenook, Joseph Phelps and Promontory, the Chilean Almaviva, Viñedo Chadwick and Viña Seña.

From Australia, Wynns will release the 2021 John Riddoch, Cloudburst its Cabernet Sauvignon, Chardonnay and Malbec 2021, Jim Barry ‘The Armagh’ Shiraz 2021, and Penfolds Bin 169 2022.

France will also see the release of the 2022 vintage of Le Petit Cheval Blanc, Y de Yquem and Château de Beaucastel Hommage à Jacques Perrin, Philipponnat Clos des Goisses 2015, and Latour 2009.

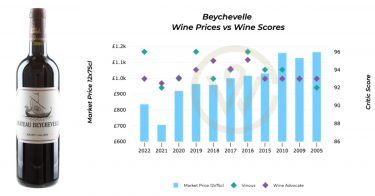

The table below shows the performance and price points of some of the top brands released via La Place de Bordeaux every autumn.

Long-term prospects

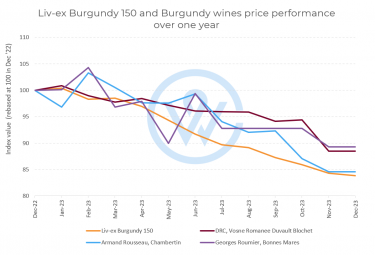

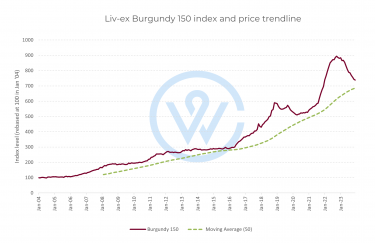

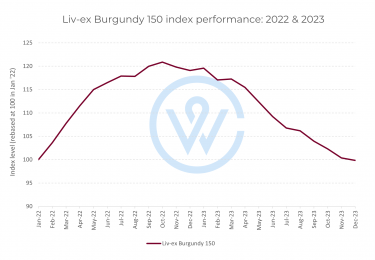

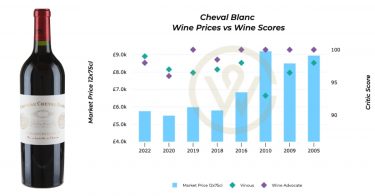

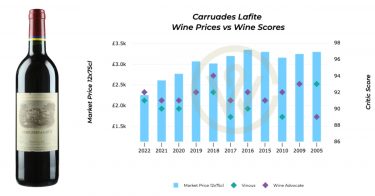

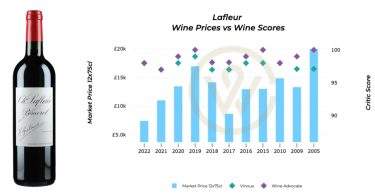

Although prices for all these brands have fallen in the last year – creating the so called ‘buyer’s market’ – they remain great long term investments. Moreover, the new releases enjoy sustained demand year after year.

The current downturn in the market presents an opportunity for change. This period of uncertainty has led to more informed decision-making, a focus on quality, and a more selective approach to the new releases.

The 2024 La Place de Bordeaux campaign is set to be a dynamic and expansive event, showcasing a diverse array of global wines alongside the region’s traditional offerings. Despite the current challenges, the long-term prospects for La Place are promising, with the potential for significant growth and continued evolution in the years to come.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.