- The first Bordeaux 2023 En Primeur releases are expected next week.

- According to early reports, 2023 is a heterogeneous vintage shaped by climate extremes.

- The market expects lower release prices that last year, given the broader economic context.

The trade is now in Bordeaux tasting the 2023 vintage En Primeur, and the first releases are expected already next week. The campaign is set to be fast-paced and shorter than usual, and the price forecasts suggest discounts of up to 30% year-on-year.

The vintage is shaping up to be one of measured optimism, tempered by both climate challenges and shifting market dynamics. In the following paragraphs, we delve into what we know so far in terms of quality, volumes and the broader context of Bordeaux 2023 in the global wine market.

A year of extremes

Weather patterns play a significant role in defining a vintage’s potential. According to Bordeaux correspondent Colin Hay for the Drinks Business, 2023 was marked by uneven climatic conditions, with a particularly challenging start due to persistent rain and mildew threats. However, a shift in the latter half of the season brought drier, warmer conditions, providing a much-needed respite, and aiding in the maturation process. This dual phase growing season has resulted in a heterogeneous vintage that, while not exceptional, holds the promise of producing some truly outstanding wines.

Gavin Quinney’s comprehensive harvest report further underscores the impact of the weather, noting that despite the high mildew pressure similar to 2018, the consistent warmth towards the end of the season slightly tipped the scale towards better quality. The blend of early challenges and a fortuitous Indian summer echoes the sentiments of resilience and cautious optimism.

Bordeaux 2023 – quality and quantity

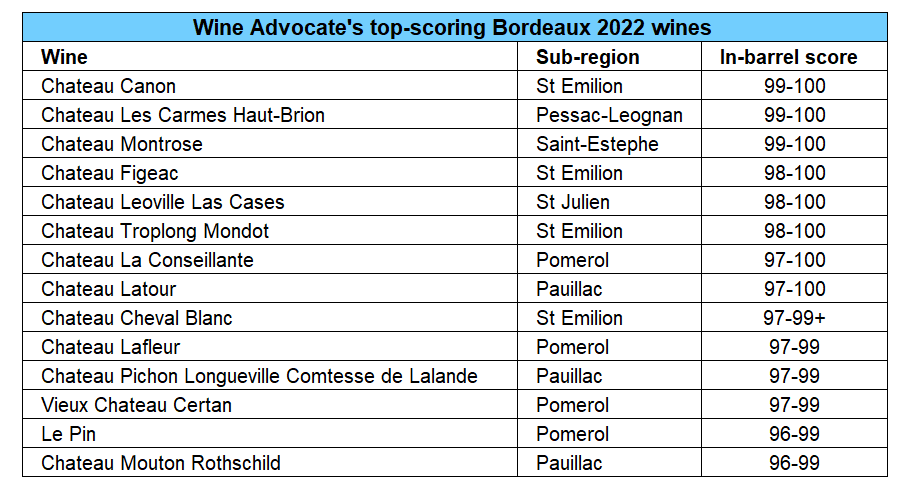

Major critics are yet to release their quality assessments after tasting in Bordeaux this month. Initial harvest reports suggest that 2023 is a good but not great year that may fall behind 2016, 2018, 2019 and 2020, but above 2017 and 2021 in terms of quality.

Gavin Quinney wrote that ‘everything points to what might be called a ‘classic’ Bordeaux vintage, one where the better wines show fruit and finesse over structure, richness and power’. He further noted that 2023 was ‘a year for fraîcheur (freshness) and équilibre (balance), brought about by terroir, gentle extraction, slightly lower alcohol and bright acidity’.

However, the varied impact of climate conditions has led to heterogeneity in grape quality, particularly between those estates that successfully managed mildew and those that did not.

When it comes to volumes, the overall production in 2023 was 384 million litres, below 2022 (411) and slightly above 2021 (377). However, this is considerably lower than the annual average of 487 million litres of the previous decade (2011-2020).

And while yields for the most prestigious appellations were comparatively generous, the volume of wine that may come to the market En Primeur might not be. Liv-ex noted that ‘many estates are reducing the amount of wine offered En Primeur in favour of drip-feeding the market with more mature vintages’. The average stock reduction in the already low-quantity 2021 vintage, for instance, was 30%.

The Bordeaux market and the role of En Primeur

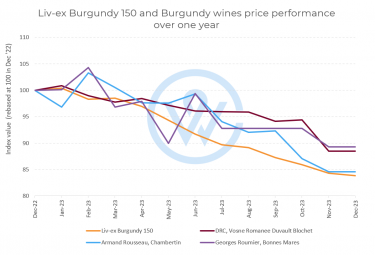

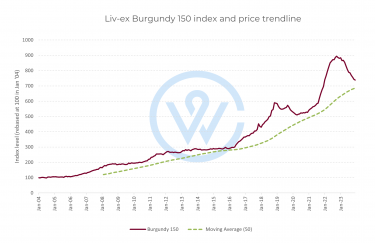

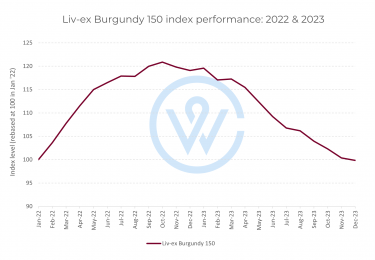

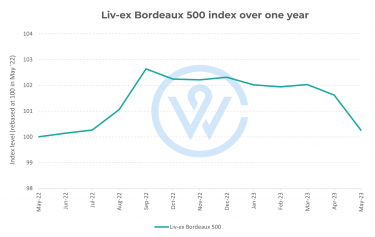

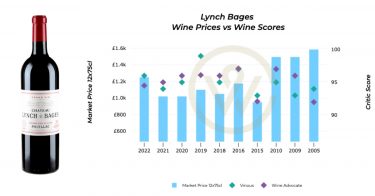

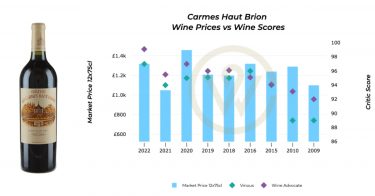

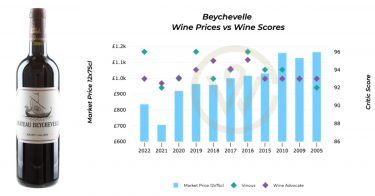

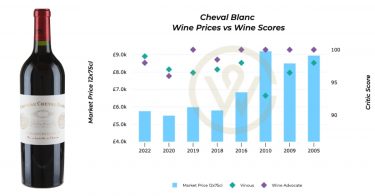

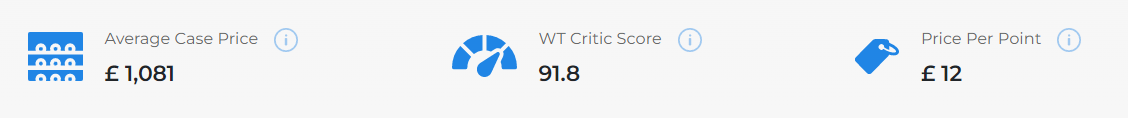

The Bordeaux market has witnessed significant fluctuations over the past few years. The Liv-ex Bordeaux 500 index is down 13.8% in the past year, with many collectible wines seeing even sharper declines.

This trend underscores a shifting landscape where Bordeaux, despite maintaining a large share of the fine wine market, now competes more directly with other prestigious regions like Burgundy and the Napa Valley.

With the unfolding En Primeur tastings, the system itself faces scrutiny. Historically, En Primeur has offered an advantageous opportunity for all involved. While this system has benefited from ensuring early cash flow for producers and allowing buyers to secure potentially valuable wines at favourable prices, recent trends show a misalignment in pricing strategies. Recent back vintages are often available in the market at prices equal to or lower than release, raising questions about the future of the system.

Bordeaux 2023 – pricing and investment potential

Given the backdrop of a declining market and the historical data suggesting that many wines do not immediately appreciate in value post-release, pricing will be a crucial factor for the 2023 vintage. Industry insiders and potential investors will be looking closely at how châteaux price their offerings, seeking a balance between fair value and market dynamics. The hope is that producers will heed the market’s call for more reasonable pricing to reinvigorate interest in En Primeur purchases.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.