- Fine wine can effectively hedge against inflation, often outperforming traditional assets like gold and stocks.

- Investment in fine wine requires consideration of personal ethics, liquidity needs, and a long-term strategy.

- Strategic timing in fine wine investment, such as early purchases, can lead to significant profit taking.

Since 1914, the price of bread has seen inflation of around 11,000%. In the roaring 20s, a loaf cost under a penny. Fast forward to today, the average bread costs around £1.35. This price rise is not due to an increase in the quality of bread but rather a reflection of the decreasing purchasing power of money over time. In the words of the French writer and Burgundy lover, Hugo Voltaire, ‘Paper money eventually returns to its intrinsic value – zero’.

As well as playing havoc with our savings, inflation can be the undoing of fixed-income investment portfolios too. Unless the interest rates outpace the loss of purchasing power, repayments will be worth less and less each year. In these tense economic times, investors may be tempted by hedge funds and hedging assets like derivatives. While these can offer reassurance, they’re also complicated and expensive. So-called ‘safe haven’ assets like gold and property are also effective inflation-hedges. But right now, they are trading at a premium. This article explores an alternative option: fine wine as a hedge against inflation risk.

Assess your inflation exposure in your investment strategy

If you invest in liquid and fixed-income investments like cash or bonds, your wealth is probably exposed to inflation. This tends to be more typical for those closer to retirement, as they may need access to regular funds. Start by identifying these assets in your portfolio. Pay close attention to bonds which last more than five years, as the interest payments (or coupons) could be more at risk of losing value over time.

Once you’ve identified the riskiest assets, refer to your strategy. There may already be a plan for how to deal with periods of high inflation. Most managers will build-in hedging assets from the beginning. But many will also deviate from the strategy tactically from time to time. For example, in high inflation environments, they might sell some bonds and buy stocks – known as going ‘overweight’ or ‘underweight’ from the original allocations. This is what you may need to do if you have too much inflation risk in your portfolio. Depending on your financial needs, fine wine could be a sensible alternative investment for you.

Consider if fine wine is right for you

Fine wine is a truly excellent hedge against inflation. However, it may not be suitable for everyone. If you do not want to invest in fine wine because of religion or personal reasons, you should follow your ethics. Wine is not the only inflation-resistant asset, and you may be better suited to art, luxury watches and collectible cars.

You should also consider your liquidity needs. Fine wine is a long-term asset with intrinsic value. Investors can only collect returns after the bottles have been sold. And for the best results, that could take upwards of five years.

Investors should also be aware that fine wine is traded on the private market. Nowadays, this is much easier than it used to be. Instead of attending physical auctions and joining exclusive clubs, you can find fine wine investment platforms online.

Find a wine to suit your time horizon

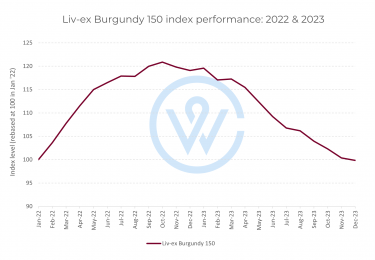

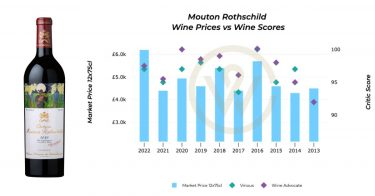

The value of fine wine typically increases with age. Investors often buy fine wine at least five years in advance, with some opting for En Primeur purchases.

In this world, timing is everything. And if you can get it right, you stand to make a handsome profit. Over ten years, Domaine Arnoux-Lachaux Nuits-Saint-Georges Rouge, for example, has delivered returns of 525% and counting.

Before you begin, consider carefully what type of time horizon you are comfortable with. Ideally, you’re looking to plug the inflation gaps in your portfolio, without landing yourself into an illiquidity issue. For example, if you’re concerned about the inflation risk of some five-year bonds, you could look into ‘brands on the move’ that have historically delivered faster returns.

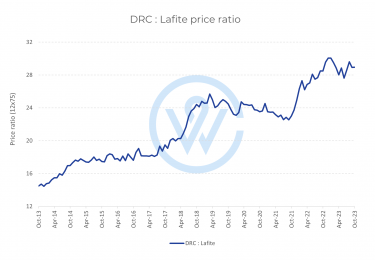

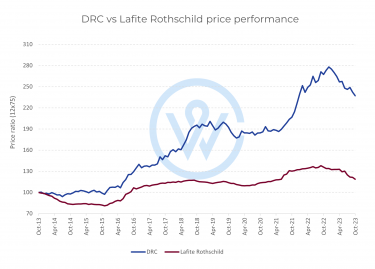

Understand the fine wine market

Fine wine attracts a diverse range of buyers, from enthusiasts to those purchasing for business or personal milestones. Understanding buyer motivations and regional preferences is key to strategic investing. Seasonal trends, like the heightened demand for Champagne towards the end of the year, also play a role in maximising returns.

A precious and depleting asset with intrinsic value

If you’re looking to shield your wealth from the erosive effects of inflation, fine wine could be the answer. It is a precious and depleting asset, with intrinsic value. As one academic paper recently found, ‘fine wine has outperformed almost every other major financial index over the past two decades’. However, to get the best results, you’d probably need to buy, hold and think long-term.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.