WineCap has conducted a series of interviews with key figures at major Bordeaux estates. Today we shed light on their perspectives on the relevance of historic classifications.

- Left and Right Bank producers think the 1855 and 1955 classifications are still important reference for investors.

- Branding influence represents a counter pattern.

- Market forces bring lower-tier Growths to the fore but not trend-setting.

The majority of a tranche of wine producers interviewed by WineCap from both the Left and Right banks are confident that Bordeaux classification systems remain relevant, citing historical framework and terroir as the main factors in determining wine quality and value.

Châteaux also think that the 1855 Classification of Bordeaux and the Saint-Émilion Classification of 1955 will continue to have an impact on wine investor and consumer choices in the decades ahead.

‘This is the classification of terroir,’ said Château Cheval Blanc CEO, Pierre-Oliver Clouet. ‘The (original) classification was very clear and continues to be the same today’.

The classification systems

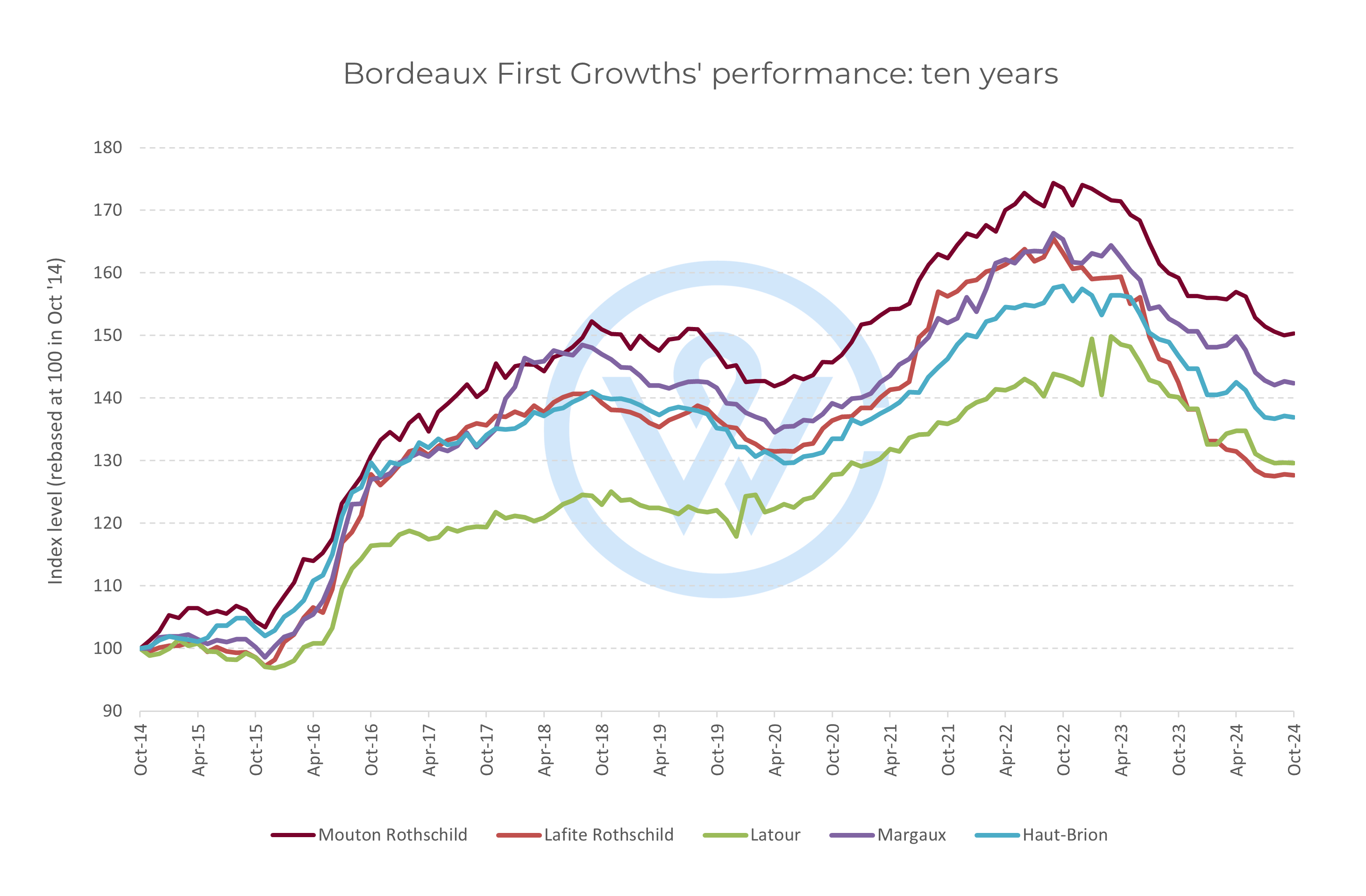

The 1855 Classification of Bordeaux is a ranking of the top wines from the Left Bank’s Médoc region, Graves, Sauternes and Barsac. It was established to coincide with Napoleon III’s Exposition Universelle de Paris, with wines categorised according to reputation and market price from Fifth to the top ranking of First Growth. With the exception of minor changes, it has never been altered. The houses in the highest level are Latour, Lafite Rothschild, Mouton Rothschild, Margaux and Haut Brion.

On the Right Bank, a wine classification hierarchy was founded in 1955 covering Saint-Émilion and Pomerol. Updated every decade with the last review held in 2022, it grades wines into the top tier of Premier Grand Cru Classé A, Premier Grand Cru Classé B, and the broader category of Grand Cru Classé.

Staying power

Philippe Bascaules managing director of First Growth Château Margaux said soil was the defining factor in the 1855 ranking. ‘I think for 90%, it’s still relevant because the quality of the wine is given by the soil, and the soil doesn’t change’.

Philippe Blanc General Manager Château Beychevelle referred to the enduring legacy of the 1855 system. The Saint-Julien house that he oversees is ranked as a Fourth Growth and he does not see this changing in the future.

‘I don’t think any serious people have ever written that first growths didn’t deserve their place,’ he told WineCap. ‘I would say in 30 years’ time, stick to the 1855 classification in Médoc’.

Vincent Millet, General Manager at the Third Growth Château Calon Segur in Saint-Estèphe agrees. ‘The 1855 classification was based not only on the observation of the winegrower through the constitution of his vineyard, but also of his wines,’ he said. ‘For me, it makes no sense to question it, because in a way, it reflects the potential of the different appellations’.

Christian Seely is the managing director of AXA millésimes, the company that owns Second Growth Pichon-Baron in Pauillac. He hints at the foresight of the original ranking framework. ‘I would say that where around 80% of the châteaux were in the classification in 1855 is where they ought to be today. I don’t think another 20 years is going to change that’.

Brand over classification

However, as the global wine landscape shifts and changes, a significant number of Bordeaux winemakers are putting equal weighting in branding and, in some cases, over classification systems.

Julien Barthe, the co-owner and managing director of Premier Grand Cru Classé B, Château Beau-Séjour Becot in Saint-Émilion is of this number. ‘We were very lucky in Beau-Séjour Becot because we were classified as Premier Cru Classé in 1955. Why? Maybe because we are a good winemaker family, but for sure because we have unique and outstanding soil and terroir’.

Despite his acknowledgment of ranked terroir quality, Barthe believes that a house’s brand is gaining traction. ‘Do you know Beau-Séjour Becot or do you not know Beau-Séjour Becot? I really think that the brand will be more important than the classification’. In the last decade, their average wine price has risen 60%, outperforming fellow estates, La Mondotte, Clos Fourtet and Larcis Ducasse.

Calon Segur’s Vincent Millet agrees: ‘What is most interesting today is not so much the classification, but the strength of the brand. For example, you have properties that are ranked fifth in the classification and which have a reputation. A strong brand can be more important than certain Second great classified growths of Margaux, for example. We at Calon Ségur have this strength, this brand that we maintain through the quality of our wines’.

General Manager of Saint-Émilion Grand Cru Classé, Château La Dominique, Gwendoline Lucas said that both Right and Left Bank classifications were becoming irrelevant. ‘Today the consumer doesn’t drink First, Second or Third Growth or Saint-Émilion B or A. They drink a wine they know. They know the style of the wine, so they will drink Château La Dominique rather than Saint-Émilion Grand Cru Classé. So, I would say that the brand, the history and the wine itself, will override classification’.

From an investing perspective, La Dominique has enjoyed a 96% price increase since 2015.

Lower tiers’ achievements

WineCap interviewees recognised the above-average performance of Growths from the lower end of the 1855 classification but were not certain that this constituted a solid trend.

Pichon-Baron’s Seely said: ‘You obviously get exceptional cases of some châteaux outperforming in relation to their classification. You have a Fifth Growth that performs like a Second Growth, and perhaps there are just one or two that perform a little lower than their original ranking. But those cases actually, I think, are the exceptions rather than the norm’.

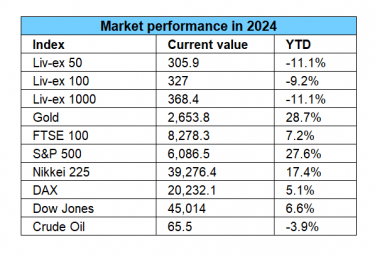

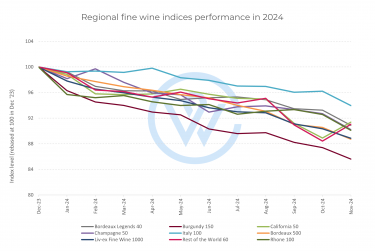

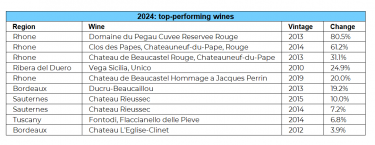

Evolution of Bordeaux’s investment performance

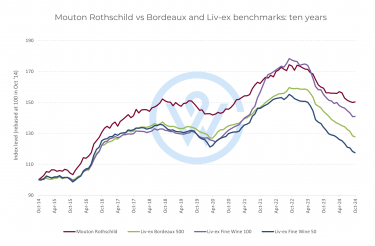

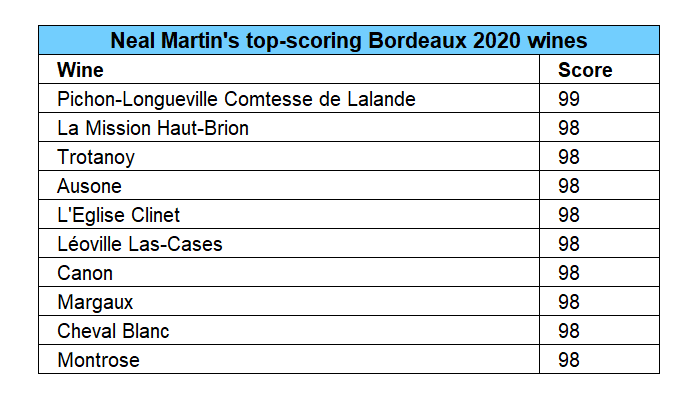

Bordeaux remains the most important wine investment region, accounting for over a third of the fine wine market by value today with a 200% average growth on top labels since 2005. The First Growths, their second wines and “super second” estates are often the cornerstones of investment portfolios.

To find out more about the region, read our Bordeaux Regional Report.