- Even as Bordeaux, Burgundy and Champagne declined in 2025, select wines delivered double-digit gains.

- Value, scarcity and specificity proved decisive as investors became more selective.

- Early signs of market broadening suggest the correction phase may be nearing its end.

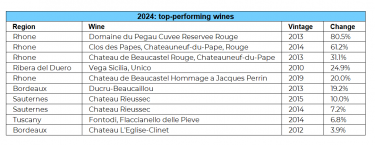

In our annual Fine Wine Report, published last week, we revealed the top-performing wines of 2025 – a diverse group spanning the Rhône, Burgundy, Tuscany and Sauternes. Some of these standout performers posted gains of over 65% in a year defined by prolonged market weakness, subdued sentiment and cautious capital allocation. But beyond these headline risers lies a subtler story.

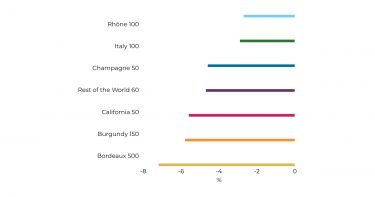

In this final article of the year, we focus on the three most important fine wine regions globally by demand and liquidity: Bordeaux, Burgundy and Champagne. These regions were among the hardest hit during the downturn. Year-to-date, Bordeaux remains down 6.6%, Burgundy – 4.4%, and Champagne – 4.3%.

Yet within each of these regions, distinct pockets of resilience and growth have emerged. Individual wines not only stabilised but delivered meaningful appreciation, offering a clear view into how capital behaves at the tail end of a correction.

What follows is a closer look at the best-performing individual wine indices in Bordeaux, Burgundy and Champagne in 2025, and what they might reveal about the next phase of the fine wine market.

Key points

- Regional averages mask significant dispersion at the individual wine level

- Market downturns tend to reward selectivity rather than broad exposure

- Outliers often signal early shifts in investor behaviour

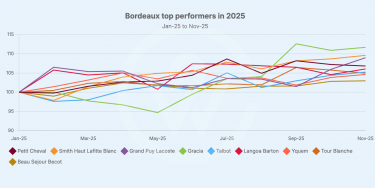

Bordeaux investment: Value at the bottom of the cycle

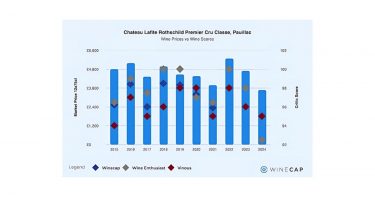

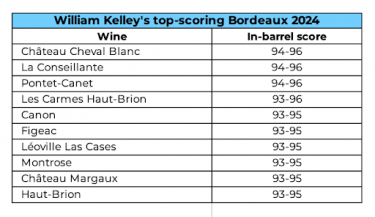

Bordeaux, the most important region in fine wine by traded volume and global recognition, was also among the weakest performers in 2025. A muted En Primeur campaign, coupled with high stock levels and investor fatigue following several years of overpricing, placed sustained downward pressure on prices.

However, Bordeaux’s top performers tell a more nuanced story.

By mid-year, prices across the region appeared to find a floor. As the year progressed, demand selectively returned – first to wines offering clear value relative to quality, and later to brands that had fallen hardest during the correction.

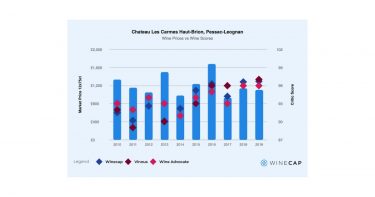

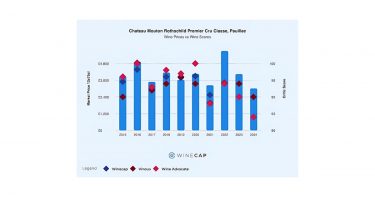

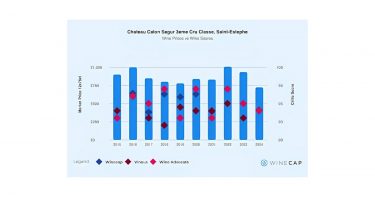

The top performing Bordeaux this year has been Château Gracia, rising 11.7%. The wine has an average price per case of just £881, underscoring the importance of value. The second best performer was Château Smith Haut Lafitte Blanc, up 9.6%. It was followed by Grand Puy Lacoste (9.0%), another relatively undervalued classically styled Pauillac, which saw an uptick in the last quarter. The wine has an average price per case of £589, and has enjoyed a 64% rise in the last decade.

In a market saturated with stock, prices only rise where quality is evident and upside remains. In 2025, investors increasingly favoured estates offering an avenue for growth.

Key points

- Lower entry prices improve downside protection in uncertain markets

- Classic styles and strong track records continue to attract long-term capital

- White Bordeaux is gaining relevance within diversified wine portfolios

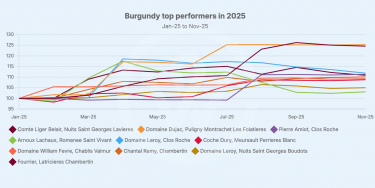

Burgundy’s biggest risers: after the fall

Burgundy remains Bordeaux’s closest rival in market share terms, and one of the most volatile regions of the past decade. After dramatic price appreciation between 2019 and 2022, Burgundy was among the steepest fallers during the downturn, alongside Champagne.

In 2025, Burgundy declined 4.4% on average, but the performance dispersion within the region widened sharply.

Dujac’s Puligny-Montrachet Les Folatières has been the best performing Burgundy this year, up 25.3%, closely followed by Comte Liger Belair, Nuits Saint Georges Lavieres, up 24.6%. The rest of the pack recorded more modest gains in comparison, between 5% and 11%.

After years of capital concentrating narrowly on the most famous Grand Crus, 2025 marked the beginning of a more discriminating phase for Burgundy investment.

Key points

- Burgundy’s volatility reflects its scarcity-driven pricing structureCorrections tend to be sharper after periods of rapid appreciation

- Relative value within elite producer ranges is increasingly important

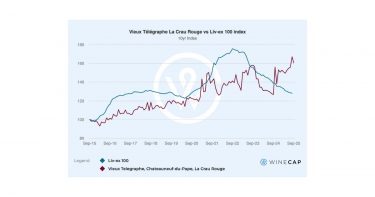

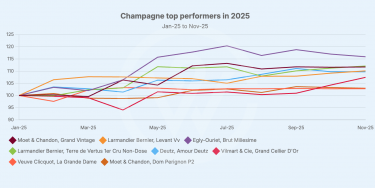

Champagne: From tariff shock to broadening demand

Champagne’s trajectory in 2025 was shaped by external macro forces. The US tariff threat in March hit the region particularly hard, triggering a sharp dip in prices. However, clarity emerged by July, and with it a steady return of demand.

Year-to-date, Champagne has finished down 4.3%, but the region’s top performers tell a story of structural strength and evolving investor preferences.

The top performing wine from the region has been a grower Champagne; Egly-Ouriet has increased 15.9% so far this year. Scarcity, authenticity and critical acclaim have elevated top growers into an investment category once dominated exclusively by Grandes Marques.

Meanwhile, Larmandier-Bernier’s Terre de Vertus in second place, with a 12.0% rise, illustrates the appeal of singular wines: 100% Chardonnay, single terroir, single vintage, and priced well below prestige cuvées. Meanwhile, Moët’s Grand Vintage, up 11.7%, highlights that recognisable brands at accessible price points still command deep global demand.

Collectively, these performers reflect Champagne’s unique strength: a balance of brand familiarity, approachability and increasing diversity.

Key points

- Brand recognition underpins long-term liquidity

- Grower Champagne continues to gain institutional recognition

- Accessible pricing supports both liquidity and diversification

Looking ahead: From narrowing to broadening

One of the defining themes in our annual report – and a key signal for 2026 – is the return of market broadening.

During periods of stress, demand narrows. Capital clusters around the safest names and most mature vintages, while secondary and emerging opportunities are overlooked. The past three years exemplified this dynamic.

The performance patterns seen in Bordeaux, Burgundy and Champagne in 2025 suggest that this phase is beginning to reverse. As volatility subsides and confidence returns, investors are once again willing to look beyond the obvious. The fog is lifting, and with it comes a clearer view of where the next opportunities may lie.

In fine wine, as in all long-term markets, recovery rarely announces itself loudly. It begins quietly – in the outliers.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.