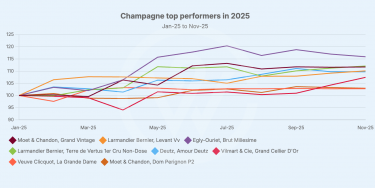

Beyond the glamour of iconic Champagne brands, the category’s power and influence is found in its diversity. Each Champagne style — from cellar-worthy Vintage wines to cult Grower labels — has its own story, profile, and market behaviour. Understanding these distinctions is key for navigating one of the fine wine world’s most resilient segments.

Bullet points

- Champagne is prestigious wine with global enduring appeal

- Four categories of Champagne are Vintage, NV Brut, Rosé, and Grower Champagne

- Each segment has a unique profile and significance for consumers, investors, and collectors

- Luxury, strong brands, scarcity, and terroir expression are features wine lovers appreciate about Champagne

Best Champagne styles

Champagne has long held a unique place in the fine wine world. This can be explained by the fact that it is both a symbol of luxury and an extraordinarily resilient wine category. Over the medium and long-term, Champagne weathers market cycles, global uncertainty, and changing consumer tastes while maintaining robust demand.

Behind the prestigious labels and glamour lies:

- a diverse array of Champagne styles with varying structures

- “cellarability”

- market behaviour

- investment profiles

Developing an understanding of types of Champagne is critical for any wine investment journey. What follows is a breakdown of the four key Champagne categories that are most significant to investors and why. These are: Vintage, Brut (Non-Vintage), Rosé, and Grower Champagne.

We look at what defines these kinds of sparkling wine and why they are important from both a drinking and Champagne investment perspective.

1. Vintage Champagne

What is Vintage Champagne?

Vintage Champagne is a distinguished wine produced solely in exceptional years. This means that a particular Champagne sub-region’s weather conditions have been ideal, yielding fruit of excellent quality and optimal concentration. This enabled the wine to stand alone, showing the unique characteristics of the harvest. This is opposed to the practice of blending wines from across multiple years, as is typical for Non-Vintage (NV) Champagne.

Vintage Champagne requires a minimum of three years of lees ageing. Some houses age vintage cuvées for longer to enhance complexity.

Style

Since it reflects a single, outstanding year, Vintage Champagne tends to be more concentrated, structured, and complex than its NV counterparts. It displays:

- rich textures

- evolved fruit

- nutty, biscuity, brioche, toasty complexity

- good mineral definition

- the capacity to cellar for decades

Champagne houses often regard their vintage wines as emblematic expressions of terroir and brand identity.

Why is Vintage one of the types of Champagne important for investors?

Vintage Champagne is viewed as the most consistent and reliable asset in the sparkling wine investment category. This is for the following reasons:

- limited production: only made in the best years, and usually in much smaller quantities than NV Champagne

- exceptional longevity: finest vintages from great champagne brands such as Krug, Dom Pérignon, Bollinger Champagne, Pol Roger Champagne and Roederer evolve over decades, resulting in steady price appreciation

- historical price performance: Vintage Champagne has displayed some of the most advantageous compound annual growth rates in the fine wine sector, with so-called blue-chip vintages garnering above-average returns

- strong demand globally: Vintage Champagne is consumed widely all around the world, creating pressure on diminishing stocks. This leads to scarcity and increases in Dom Perignon price, for example

From a Champagne investment perspective, Vintage is the category’s backbone. It offers steady long-term growth and less volatility. These features make it an ideal place for beginner investors to start.

2. Brut Non-Vintage (NV)

What is Brut NV Champagne?

Brut NV Champagne is the most common and one of the types of Champagne that wine lovers usually experience first (around 90% of Champagne sold is Brut).

Brut Champagne are made through blending what are called “base wines” from several different vintages. Together, they produce a consistent and recognisable “house style”. Prestige NV cuvées are especially sought-after, demonstrating house blending skill, distinct quality, and complexity with the finest fruit from across vintages.

NV is one of the types of Champagne required to age for at least 15 months prior to release. Many producers go beyond this minimum to enhance a wine’s depth.

Style

A typical Brut NV is:

- dry, fresh, and crisp

- bright and citrusy

- well balanced with delicate brioche or pastry hints

- built for early enjoyment, but some styles lend themselves to ageing

Because NV wines reflect the house’s philosophy, they serve as an essential introduction to each brand.

Why is NV Champagne important for investors?

Usually, Brut NV Champagne is not a key focus for longer-term investment. However, it plays an important role in the broader evaluation of a house’s reputation and offers insights into wider market conditions. Here’s why:

- brand identity/consistency: solid NV releases bolster brand confidence, especially important for great Champagne brands like Bollinger, Pol Roger, Roederer, and Charles Heidsieck

- market demand: Prestige NV cuvées (finest blends) have become collectibles, demonstrating steady performance and rising interest from investors. Examples include Krug Grande Cuvée, Laurent-Perrier Grand Siècle

- portfolio diversification: Prestige NV offers accessibility and can be ideal for shorter-term investment arcs

- gateway for collectors: robust NV sales drive interest in a house’s vintage and Prestige Champagne, influencing their long-term value

Brut NV is not a leading stand-alone Champagne investment category. That said, top prestige NV cuvées demonstrate stability and gradual value appreciation. Investors and collectors are increasingly recognising the value of this segment for building verticals that are brand-oriented.

3. Rosé Champagne

What is Rosé Champagne?

Rosé Champagne emerged as a style in the late 18th century, with Ruinart and Veuve Clicquot the first houses to produce pink sparkling wine. Wine lovers admire it for its fresh, expressive character and delicate red fruit. This Champagne can be produced in two ways:

- blending small quantities of still Pinot Noir or Meunier into Blanc Champagne

- the saignée method, where the pink colour comes from brief red grape skin contact

The majority of Rosé Champagnes are NV, made from a blend of multiple base wines from different harvests for a consistent, identifiable house style. Like Brut NV, this is one of the types of Champagne that is required to age for at least 15 months before release. Many houses go beyond this minimum to develop extra depth and elegance.

Style

A Rosé Champagne bottle features:

- subtle red berry such as strawberry, raspberry, cherry

- full, rounder mouthfeel

- appealing hue that promotes a luxurious image

- food-pairing versatility

For many wine consumers, Rosé Champagne has an indulgent and celebratory profile.

Why is Rosé important for Champagne investment?

Rosé Champagne has seen a rapid rise in popularity around the world, especially among younger, HNW individuals. Its position as one of the industry’s fastest-growing types of Champagne segments is paralleled by its increasing significance in the investment space. This is because of:

- scarcity: this style requires additional production steps, needs more grape selection, and has smaller production amounts than standard Champagne.

- luxury appeal: markets in Asia, the UK, and the US, especially, have elevated rosé to a Champagne status symbol

- strong market performance: prestige rosés like Cristal Rosé, Dom Pérignon Rosé, and Krug Rosé regularly outperform many of their Brut counterparts

- faster appreciation: Rosé Champagne typically appreciates in value more quickly than Brut

- ageing capacity: leading rosé cuvées age elegantly, developing highly-valued, savoury umami depth

For investors looking for high-growth and scarcity, prestige rosé Champagnes display strong performance.

4. Grower Champagne

What is Grower Champagne?

This segment (usually labelled “RM” meaning récoltant-manipulant) is one of the region’s most exciting types of Champagne. The term encompasses producers who cultivate their own fruit and make Champagne from such vineyard holdings. These tend towards small, artisanal, often family affairs that cultivate single villages or specific parcels.

They contrast with big houses (NM, or négociant manipulant) that use multiple growers from across the region to source their grapes.

Style

Grower Champagnes are:

- terroir-driven, expressing a sense of place

- distinctive and full of character

- produced in small quantities

Leading examples of Grower Champagne names include Egly-Ouriet, Selosse, Cédric Bouchard, and Ulysse Collin.

Why is Grower Champagne important for investors?

Grower Champagne has a unique profile, which has led to this sparkling wine’s rise in the fine wine world. By extension, this elevation is influencing its status in the Champagne investment world for the following reasons:

- scarcity: most growers produce minuscule quantities

- cult status: demand for Champagne with precise terroir identity is on the rise

- market recognition: top grower producers are achieving impressive secondary market footprints, with steep year-on-year appreciation

- premiumisation: Grower Champagne resembles Burgundy’s signature approach of single-vineyard, terroir-driven wines

Grower Champagnes brings a boutique, diversifying slant to a portfolio, offering a contrast to the market behaviour of large-volume houses. They’re ideal for investors who appreciate scarcity, craftsmanship, and terroir purity.

Final thoughts: The enduring appeal of different types of Champagne

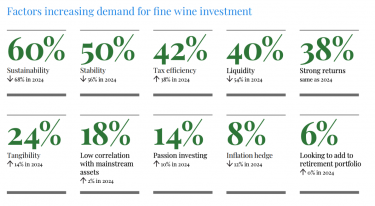

A number of factors position Champagne as a compelling wine investment category. These are:

- reliable global consumption

- strong brands

- strict production regulations for quality guarantee

- ageing capacity

- growing scarcity of older vintages

- luxury demand

Whether building a diversified portfolio or focusing on targeted, high-performing cuvées, an understanding of various types of Champagne is essential for informed investment. This sparkling wine’s styles collectively represent a resilient, robust, and rewarding segment of the fine wine investment space.

FAQs

How should an investor think about the best Vintage Champagnes?

Vintage Champagne from leading houses forms the cornerstone for long-term investment. This category features historically proven returns, consistent ageing trajectories, global liquidity, and relatively low volatility.

How should an investor approach Prestige Rosé?

This Champagne category is a high-growth luxury segment offering excellent price arcs. It is characterised by robust international demand, small production, and impressive long-term appreciation.

What’s the ideal investment strategy for Grower Champagne?

Grower Champagne is a boutique segment with cult followings and an appeal driven by scarcity and a distinct identity. It is gaining traction because of its very limited amounts and how it offers the opportunity for diversification and early positioning for emerging iconic names.

What’s the best way to approach NV Brut Champagne?

Although typically secondary to Vintage or Rosé Champagne for long-term horizons, Brut NV represents a good gauge of house reputation. Prestige NV cuvées can display solid performance for short to medium-term investment.

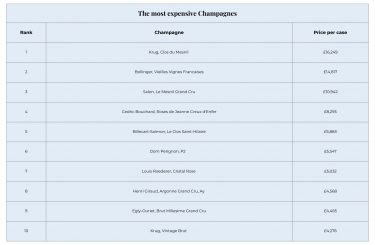

The most expensive Champagne brands

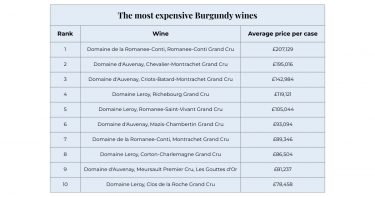

The table below shows the most expensive Champagnes, with prices per case, according to Wine Track data. For more information on performance and scores, please visit Wine Track.

Looking for more? See also WineCap’s Champagne Regional Report.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today