- If interest rates increase or stay the same, there may be golden opportunities for savvy investors to fill their wine cellars for lower-than-average prices.

- If the Bank of England starts to drop interest rates consecutively around May, we would expect the fine wine market to show signs of growth around autumn.

- Rather than focus on short-term economic events, we encourage investors to buy high quality fine wines, and ideally hold them for at least a decade.

Today’s interest rates are 5.25% in the UK. That is a lot higher than most of us are used to. For example, in 2019 they were just 0.75%. But it is reassuring that they have not been cranked up even more over the past months. Consensus among most economists is that the rates will surely come down again in 2024. The question is, by how much?

Unlike the US Federal Reserve, the Bank of England is warning markets not to expect big cuts. As Reuter’s reports, its ‘policy stance assumes a slow fall in interest rates to 4.25% in three years’ time’. However, many economists think that the rates will fall sooner.

Contrary to the central bank, Goldman Sachs predict rates will dip below 4% by the end of the year, marking a drop of more than 1.25%. Experts at Deutsche Bank are almost aligned, anticipating a 1.0% dip in the same timeframe. Andrew Goodwin, chief UK economist at Oxford Economics consultancy, expects the bank to start lowering rates in May. However, other economists suggest that June is more realistic.

In this article, we consider what these different scenarios mean for fine wine investors. When to buy, when to sell and when to hold are all critical questions as we dive into 2024.

If interest rates increase or stay the same

Continued high rates would probably be unwelcome news for most fine wine investors. Dovish policies like this usually led to a stronger pound, making wine more expensive for international buyers if sourcing from the UK market.

Asian and American buyers are a significant part of the fine wine market and cutting them out would probably lead to a dip in prices, as supply outstrips demand.

High interest rates could also temper domestic demand. After all, when the economy shrinks, there is less money for luxury goods. Buyers may opt for better ‘value’ purchases.

The compelling interest rates of savings accounts could also tempt investors away from illiquid assets. Over the short-term, putting cash into a bank account could seem like a safer bet. Even though, of course, over the long-term, the inflation risk is severe.

Ongoing high interest rates would likely create a buyer’s market. For the first few months of the year, until May, we could expect this to continue happening. Around this time, there may be golden opportunities for savvy investors to fill their cellars for lower-than-average prices.

If interest rates decrease by 0.25% – 2%

The most likely scenario is that the Bank of England will gradually reduce rates, starting from late spring or early summer. Most analysts (including Deutsche Bank, Goldman Sachs and Fidelity) seem to be anticipating a drop of at least 1.0%, and the markets have already priced this into products and forecasts. As seen in the news recently, inflation seems to be cooling, creating the right environment for interest rate cuts. For fine wine investors, this makes for reassuring reading.

Shrinking interest rates will make other low-risk investments like gold or savings accounts less compelling. Investors will probably start to feel the pull of more assets with more generous risk premiums. During the second half of the year, if interest goes down, fine wine prices might slowly increase.

A growing economy usually comes with more money to pop Champagne and see the year through in style. We’d expect the fine wine market to perk up in this environment.

Lower interest rates would probably be welcome news for international investors, as this usually signals better exchange rates. In 2021 and 2022, the weak pound and strong dollar stimulated Asian and American markets, boosting fine wine prices.

If the Bank of England starts to drop interest rates consecutively around May, we would expect the fine wine market to show signs of growth by around autumn. Prices would probably begin to creep up and continue rising with each rate cut. This would balance out the market, likely creating more demand and opportunities for sellers.

If interest rates plunge by 2% or more

It seems unlikely that interest rates will ever return to their pre-pandemic lows. Some experts, like those at Fidelity, argue that the previous rates were even kept ‘artificially low’, and overdue a correction. However, as recent years have taught us, unexpected things can happen.

If interest rates nosedive by more than 2% over 2024, it would probably be exceptionally good for fine wine investors. Both global and local demand would likely increase, as we saw in 2021. With the cost of borrowing plunging, we could expect to see more budgets allocated to luxury products like fine wine, creating more of a sellers’ market.

Fine wine investors in 2021 already enjoyed the rewards that come with a weak pound and low interest rates. International buyers leap into the market, creating a surge in demand.

If the interest rates cascade down to 3% or less by the end of the year, we would expect to see demand outstrip supply, leading to a hike in fine wine prices. This would be welcome news for sellers looking to cash-in their returns.

In the long-term, does it matter?

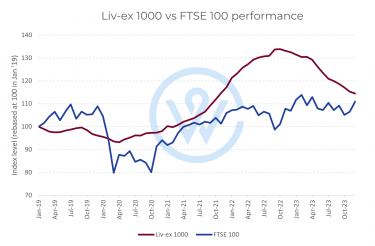

These predictions cover interest rate hikes over the next twelve months. But the real returns of fine wine tend to come in the longer run. As the Liv-ex 1000 index shows, fine wine prices on average have nearly doubled since 2014.

Rather than focus on short-term economic events, we encourage investors to buy high quality fine wines, care for them properly, and ideally hold them for at least a decade. For us, this is the true beauty of wine; its value is mostly intrinsic.

If you’d like to talk to an expert about buying or selling fine wine, we are just a call or an email away.