- To promote the highest standards, Champagne set the 2025 yield limit at the lowest level since the pandemic, though early projections suggest a 10–17% year-on-year increase in the natural crop.

- Comité Champagne introduced “Together for the Champagne Harvest” to align all producers with welfare standards.

- Champagne’s investment market is beginning to show subtle signs of recovery, supported by improving conditions across the region.

Harvest 2025: Notable yield cap upholds high standards

In July, Champagne stakeholders set a yield cap of 9,000 kg/ha for the 2025 harvest, making it the lowest since the 2020 pandemic year. The industry decision-making body, the Comité Champagne called the move “responsible” citing market uncertainty, geopolitical tensions, and volatile consumer behaviour making forecasting more difficult, as the reasons for the limit.

Yield caps since 2020 (kg/ha)

- 2020: 8,000

- 2021: 10,000

- 2022: 12,000

- 2023: 11,400

- 2024: 10,000

The objective of the 2025 reduction is not only to balance production with sales projections: it also aims to support high standards and preserve the exclusivity of Champagne. This investment in quality and new worker welfare measures are positioning the region’s top wines for worthwhile and sustainable investment opportunities.

Champagne key facts

- Located in northeastern France

- Received Champagne AOC in 1936

- 16,000 grape growers & 320 producers

- 300 million bottles yearly

- Annual revenue exceeds €5 billion

- The third most important fine wine investment region after Bordeaux and Burgundy

What is the Comité Champagne?

Established in 1941 and headquartered in Épernay, the Comité Champagne operates as the umbrella organisation for the Champagne industry. This interprofessional organisation promotes cooperation between the Syndicat Général de Vignerons de Champagne (SGV) and the Union des Maisons de Champagne (UMC), two professional groups representing more than 16,000 winegrowers and 350 Champagne houses.

New health, safety, and well-being measures

As the 2025 harvest begins, the Champagne appellation is under observation, with the region determined to counter a tarnished reputation after poor seasonal worker treatment in 2023 recently led to the jailing of three harvest crew contractors. Around 120,000 seasonal harvest workers are arriving across the region to work 34,000 hectares of vines, with their welfare being closely watched.

Following the infamous 2023 season, it’s not only harvest team wellbeing in the spotlight: the protection of the Champagne region’s name and value are also of parallel importance. In line with this two-pronged mission, the Comité Champagne has addressed the challenges with the “Together for the Champagne Harvest” scheme, responding to both the needs of Champagne professionals and the expectations of seasonal workers.

What is the “Together for the Champagne Harvest”?

Following more than a hundred purpose-driven meetings in 2024, when the sector trialled new measures to improve the safety of seasonal workers, “Together for the Champagne Harvest” was born. The initiative takes the form of a series of guides and talks, informing stakeholders of the labor regulations in force. Aimed at making the Champagne harvest more ethical, collaborative, and organised, the scheme brings together four areas of top priority industry focus:

- health and safety during harvest

- collective accommodation for seasonal workers

- service provision

- recruitment

The areas contribute to an emphasis on broader sustainable wine production. All stakeholders were involved in the process: Champagne winegrowers and houses, government departments, inspection services, Mutualité Sociale Agricole, France Travail, prevention and emergency services, employee unions, and service providers.

What are the Moët & Chandon wellbeing measures?

Global Champagne name, Moët & Chandon, has been a leader in harvest crew welfare for years. During the harvest season, Moët & Chandon employs more than 4,000 people, the lion’s share of whom work in the vineyards. With such a huge operation, the focus is constantly on safety, grape harvest crew welfare, and operational efficiency.

Each harvester receives safety training and a full set of protective equipment for all weather conditions, with health and safety officers present in the field to provide stand-by. Additionally, since 2018, Moët & Chandon has also welcomed 18 physiotherapists to their accommodation centers to support physical well-being.

Moët & Chandon continues to invest in modern and comfortable accommodation for directly-contracted workers. The grape pickers employed by external partners enjoy the same high standards, with the house auditing accommodation ahead of the harvest and inspecting sites during picking.

All sites are equipped with dedicated spaces for relaxation and leisure. Last year, the house established a weekly rest day. In the morning, grape pickers can take part in relaxing activities, followed by behind-the-scenes visits to Moët’s pressing centers.

The aim is to allow harvesters to see how their work contributes to the creation of the Champagnes, and to participate in the story of Moët & Chandon.

Moët & Chandon key facts

- Founded in 1743 in Épernay, France, where it’s headquartered

- Part of Wines & Spirits division under Moët Hennessy, which is part of LVMH

- Moët & Chandon tends 1,150 hectares of vines

- Vineyards in Montagne de Reims, Vallée de la Marne, and Côte des Blancs

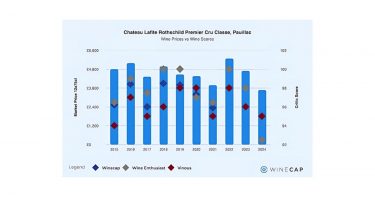

- Their flagship label, Dom Pérignon Vintage, has risen almost 100% in value in the last decade

A quick look at Champagne’s wine investment market

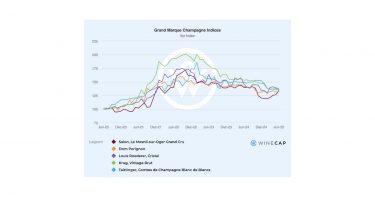

After more than a year of declines, Champagne market trends are pointing to stabilisation.

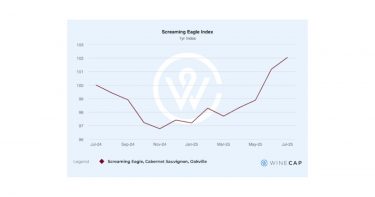

Since 2020, there have been two clear phases in market movement: initially, there was a 93.9% swell from March 2020 to October 2022, then a 34.7% decline that restored prices to 2021 levels. Although modest, June saw the first price uptick, paired with consolidation among top brands, indicating that the bearish market might soon be over.

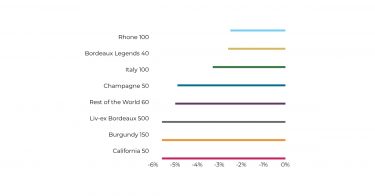

Fundamentals such as scarcity, ageing potential, sustainability, and global demand are intact, with more attractive entry points increasing the appeal of Champagne investment. The region is well positioned to be the first fine wine area to re-enter growth, making wine portfolio diversification opportunities difficult to ignore.

For more, read our Champagne Regional Report.