- Several fine wine regions made gains over the last month, including Burgundy, California, and the Rhône.

- ‘Off’ vintage Bordeaux wines have delivered the best returns so far in 2025.

- The spread between the top-performing fine wines (+18% on average) and the Liv-ex 1000’s broad decline (around -4.7%) highlights why selection is key.

The fine wine market remains subdued in 2025, continuing the recalibration that began in late 2022. Yet even in a broadly negative environment, certain wines have surged ahead (see H1 winners), delivering double-digit gains and reaffirming that in fine wine investment, selectivity defines success.

Signs of stability emerge across key fine wine regions

After more than two years of correction, there are tentative signs of stabilisation. Several regional indices posted positive month-on-month (MoM) movements in September, hinting that momentum could be shifting beneath the surface.

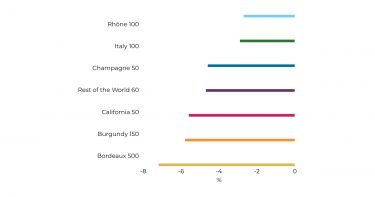

The Liv-ex Burgundy 150, California 50, Rhône 100 and Rest of the World 60 indices each rose 0.6–0.7% month-on-month. These modest upticks may not yet signal a broad recovery, but they do suggest that the worst of the selling pressure may be easing.

Still, the year-to-date picture remains negative across the board:

Even as indices remain in the red, the range of outcomes within them has widened, revealing a growing divergence between outperformers and laggards. A select few wines have posted strong gains – a reminder that even in downturns, opportunities persist.

The top-performing wines so far this year

‘Off’ vintage Bordeaux leads the way

Despite the Bordeaux 500 Index falling 7.2% year-to-date, four of the ten best-performing wines come from the region, proving that careful vintage and producer selection remain key.

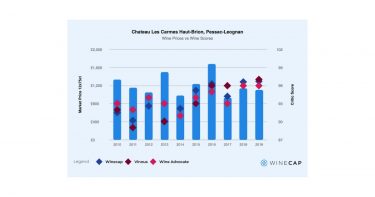

Château Les Carmes Haut-Brion 2013 stands out as the year’s star, up 38.2%. The 2013 vintage, long dismissed due to challenging weather conditions, has found new appreciation as enthusiasts and investors rediscover its finesse.

Over the past decade, prices for the brand have risen 148%. The 2014 and 2017 vintages are other attractive ‘off’ vintage alternatives.

Château Beychevelle 2013 follows a similar line. Once overlooked, its reputation in Asian markets and steady critic support have lifted prices 22.2% year-to-date. Likewise, Château Canon 2014 and Château Smith Haut Lafitte 2014 each gained over 13%, highlighting a broader off-vintage resurgence in the region.

These gains suggest that Bordeaux’s correction phase may be creating attractive entry points for investors willing to look beyond the obvious trophy years.

The Rhône: The value region continues to deliver

The Rhône 100 remains the best-performing regional index of 2025, down just 2.7% year-to-date, with a recent 0.6% month-on-month gain adding to its reputation as a steady performer.

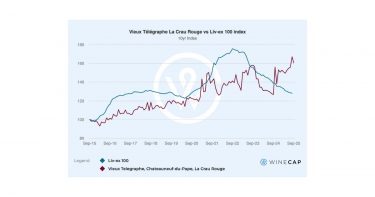

The standout is Vieux Télégraphe La Crau Rouge, appearing twice in the top five for its 2020 (26.1%) and 2021 (18.3%) vintages. The wine’s longevity, critical consistency, and relative affordability have made it a favourite among both collectors and long-term investors.

Meanwhile, Paul Jaboulet Aîné’s Hermitage La Chapelle 2014 climbed 15.3%, underscoring the growing investor appetite for Rhône’s great single-vineyard wines. With smaller yields and limited back-vintage supply, demand has begun to outpace availability – a sign that the Rhône’s ‘quiet outperformance’ may continue into 2026.

Burgundy and Sauternes: Scarcity reigns supreme

Though the Burgundy 150 Index remains 5.8% down so far this year, its top producers continue to enjoy demand driven by scarcity.

Domaine de la Romanée-Conti (DRC) Grands Échezeaux Grand Cru 2021 rose 13.3%, proving once again that rarity trumps sentiment. Over the last decade, prices for the wine have risen on average 300%.

Sauternes has also enjoyed a quiet renaissance so far this year, with Château Suduiraut 2016 making it into the top ten, with a 13% rise in value. With prices still well below their historical highs, the sweet wines segment could offer contrarian upside heading into 2026.

California: Cult wines stay strong

Although the California 50 index is down 5.6% year-to-date, the 0.7% rise last month hints at price recovery. This year, despite softer global sentiment, high-end Napa continues to attract attention domestically and abroad (from Asia in particular).

The region’s top label, Screaming Eagle Cabernet Sauvignon 2012, has advanced 12.4% year-to-date.

As previously noted, Screaming Eagle remains the top traded US wine by value. With six perfect 100-point scores in just 13 vintages, it sits in a league of its own among American wines. Prices for the brand have risen more than 200% in the last 20 years, making it one of the most lucrative long-term holds in the fine wine market.

Divergence defines 2025

The spread between the top-performing wines (+18% on average) and the Liv-ex 1000’s broad decline (around -4.7%) reveals just how uneven performance has become.

Wines that combine scarcity, maturity, and reputation have emerged as the safest harbours, while those driven by hype or youth have seen steeper declines. Investors who focused on undervalued vintages (2013, 2014), critically reliable producers and globally recognised names (DRC, Screaming Eagle) have fared significantly better than the market at large.

Looking ahead: A market finding its floor

With multiple indices turning slightly positive month-on-month, the fine wine market may be approaching an inflexion point. The next phase of the cycle could favour those already positioned in high-quality, limited-production wines that have held steady during the downturn.

As 2025 enters its final stretch, it has become even clearer that scarcity, selectivity, and substance continue to outperform broader market sentiment.

For more on the fine wine market, read our Q3 2025 Fine Wine Report.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.