The fine wine market continued its downward trend throughout Q3 2024, but there are reasons for cautious optimism. Our Q3 2024 Fine Wine Report highlights the main themes that shaped the market, from regional performance to specific brand successes, and provides an outlook for the remainder of the year.

Executive summary

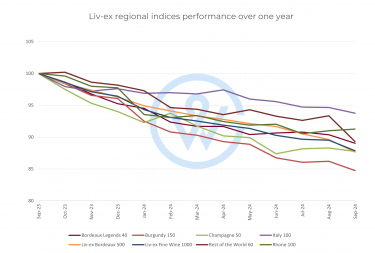

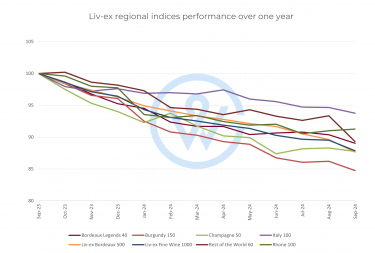

- Since October 2022, fine wine prices have been in consistent decline, with a 4% drop on average in Q3 2024.

- Bordeaux experienced the steepest fall at 4.4%, while Champagne defied the trend with a modest 0.4% increase last quarter.

- Steady demand for fine wine continues to suggest a price recovery on the horizon.

- Certain brands have outperformed the market, including Ruinart, Taittinger, and Château de Beaucastel.

- Krug Vintage Brut 2004 has been the best-performing wine year-to-date, up 21.6%.

- This year has already seen several broken auction records, including for high-profile Burgundy, which points to continued interest in fine wine.

- Nine wines received perfect 100-point scores by Jane Anson in her recent Bordeaux 2009 and 2010 vintage retrospective.

- France’s 2024 harvest is projected to be down 22% compared to last year, and 15% below the five-year average.

- Looking ahead to Q4 2024, the market continues to present attractive buying opportunities, especially for investors with a long-term vision.

The trends that shaped the fine wine market

Global market recovery driven by rate cuts

In Q3 2024, global markets showed signs of recovery, bolstered by central banks pivoting towards interest rate cuts as inflation began to ease. Following turbulence in early August, stock markets rebounded, setting new records by the end of the quarter. Central banks, including the US Federal Reserve, the European Central Bank (ECB), and the Bank of England, all shifted their focus from inflation control to stimulating economic growth. The Fed’s September rate cut – the first since 2020 – catalysed a surge in US stocks, and similar moves from other central banks supported this global rebound. Despite lingering concerns about a potential US recession and Japanese market volatility, the overall global outlook improved, with lower rates and better economic conditions presenting growth opportunities.

Fine wine prices fall 4% in Q3

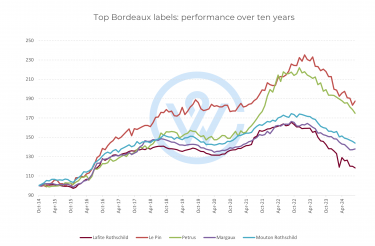

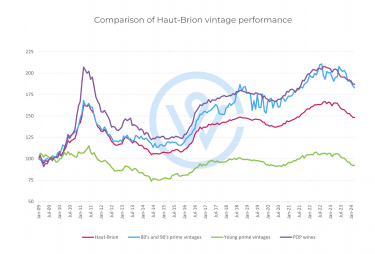

In contrast to the broader economic recovery, the fine wine market remained bearish, with a 4% average drop in prices in Q3. The Liv-ex 100 index saw its steepest fall of the year, down 1.7% in October. Bordeaux led the decline, with a 4.4% drop, although there was a slight uptick in Sauternes prices. Champagne offered a bright spot, rising 0.4% last quarter, with brands like Dom Ruinart Blanc de Blancs and Taittinger posting strong returns (over 30% in the last six months). This mixed performance underscores the complexity of the fine wine market, where price movements can vary widely by region and brand.

New fine wine releases beyond Bordeaux

As always, autumn brought the highly anticipated La Place de Bordeaux campaign, with major New World brands such as Almaviva, Seña, and Penfolds Grange releasing their latest vintages. However, this year’s campaign fell flat, with many new releases priced similarly to last year, despite older vintages showing better value and investment potential due to price corrections. Investors may find more favourable opportunities in back vintages that boast higher critic scores at lower prices.

Regional fine wine performance in Q3

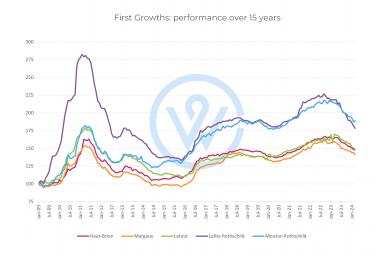

The fine wine market has now returned to its 2021 levels, with prices declining across most regions in Q3 2024, except for Champagne, which recorded a modest 0.4% increase.

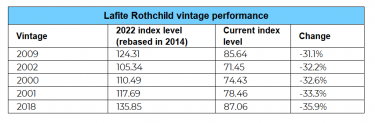

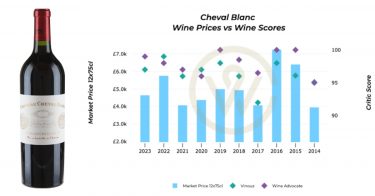

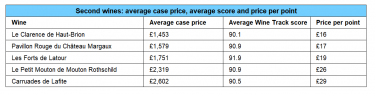

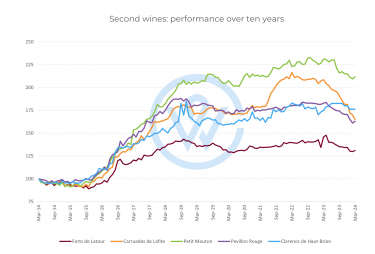

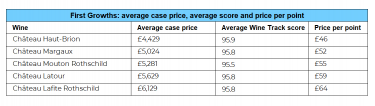

Bordeaux experienced the most significant drop, falling 4.4%, driven down primarily by the Second Wine 50 index, which plunged 6.6%, and the Right Bank 50 index, down 4.6%. Many wines from the 2019 vintage, which had previously appreciated in value, have now returned to their original release prices.

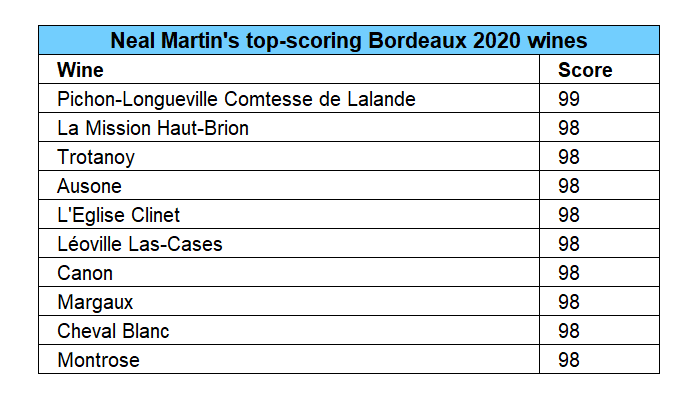

Despite this trend, Bordeaux is enjoying steady market demand, taking over a third of the market by value. Moreover, Jane Anson recently revisited the 2009 and 2010 vintages, awarding nine wines 100 points – a move likely to stimulate demand and prices.

When it comes to other regions, Italy and Burgundy also saw a 2% drop in Q3. The Rhône was somewhat more resilient, experiencing a smaller decrease of 0.8%.

The best-performing wines

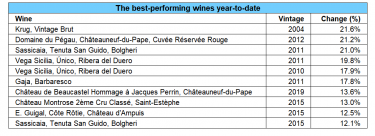

While the broader market continues to face challenges, certain wines buck the trend, reinforcing the importance of strategic, brand-specific investment decisions.

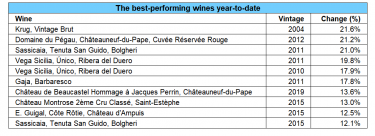

In Q3 2024, some brands have delivered exceptional returns. The table below showcases the best-performing wines year-to-date, with regions like Tuscany and the Rhône dominating the list.

Leading the pack is Krug 2004, which saw an impressive rise of 21.6%, reflecting the continued strength of Champagne in the investment market. Earlier this year, Antonio Galloni (Vinous) rescored the wine, giving it 98 points. He described it as a ‘gorgeous Champagne that is just beginning to enter its first plateau of maturity’.

Close behind is Domaine du Pégau’s Châteauneuf-du-Pape Cuvée Réservée 2012, which appreciated by 21.2%. Sassicaia 2011 follows with a 21% increase, while its 2015 vintage takes the tenth spot, with a 12.1% rise.

Vega Sicilia Único also features twice with its 2010 and 2011 vintages, demonstrating the increased demand for Spanish wines.

Wines from Bordeaux and the Rhône also make the list, showcasing the diversity of the wine investment market.

The most expensive wines in 2024

The world’s most expensive wines in 2024 are overwhelmingly dominated by Burgundy. At the top of the list is Domaine de la Romanée-Conti’s Romanée-Conti Grand Cru, with an average price of £221,233 per case. Following closely is Domaine d’Auvenay Chevalier-Montrachet Grand Cru, priced at £204,328.

Other notable entries include:

- Domaine d’Auvenay, Criots-Bâtard-Montrachet Grand Cru at £141,979.

- Liber Pater, from Bordeaux, priced at £140,009, stands out as the only non-Burgundy wine in the list.

- Domaine Leroy, Richebourg Grand Cru, valued at £120,007, further establishes Burgundy’s dominance as a highly collectible wine region.

Burgundy producers such as Domaine Leroy and Domaine d’Auvenay appear multiple times on the list. The trend reflects how scarcity, reputation, and critical acclaim are key drivers of value, especially as the market for fine wine becomes increasingly selective in uncertain economic times.

Further entries include:

- Domaine Leroy, Romanée-Saint-Vivant Grand Cru at £103,844.

- Domaine d’Auvenay, Mazis-Chambertin Grand Cru at £93,818.

- Domaine de la Romanée-Conti, Montrachet Grand Cru at £89,529.

- Domaine Leroy, Corton-Charlemagne Grand Cru at £81,827.

- Domaine d’Auvenay, Meursault Premier Cru, Les Gouttes d’Or at £80,715.

This dominance by Burgundy reflects its unmatched status in the global wine market, where scarcity and consistent quality continue to command premium prices.

For more information, visit Wine Track.

Fine wine news

The autumn La Place de Bordeaux release campaign

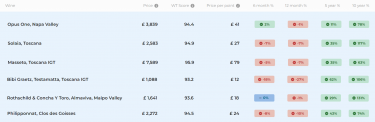

The 2024 La Place de Bordeaux campaign saw the latest releases from Masseto, Solaia, Seña, Penfolds Grange and many more. However, many of these new vintages were released at the same or slightly higher price levels as last year, despite a general market decline, making them less attractive from an investment perspective.

For instance, Masseto 2021 received a perfect 100-point score from Antonio Galloni but was priced at the same level as last year, with back vintages such as 2017, 2018 and 2019 offering better value. Meanwhile, the 100-point Solaia 2021 was released at a 15.7% premium on the 2020 vintage.

From Chile, the 2022 Seña and Viñedo Chadwick were offered at last year’s prices, but older, higher-scoring vintages such as Seña 2019 and Viñedo Chadwick 2021 remain more affordable. Penfolds Grange 2020 saw a small price increase, yet back vintages like the 100-point 2013 offer greater investment potential. Overall, back vintages, with comparable or higher critic scores, often provide better value for investors looking to capitalise on the current market dip.

Historically low yields in France

The 2024 French wine harvest is projected to be one of the smallest in recent history, with regions like Burgundy and Bordeaux experiencing significant declines due to adverse weather conditions.

Burgundy’s output is projected to be down by 25% compared to 2023, while Bordeaux is facing a 10% drop, resulting in the region’s lowest production volume since 2017.

Historically, such scarcity in Burgundy has driven secondary market price increases, as collectors rush to secure rare wines. However, the economic downturn may temper this trend, making selectivity key for investors. In Bordeaux, while smaller harvests often support price stability for premium wines, the broader market conditions may limit price recoveries, especially for mid-tier labels.

Q4 2024 market outlook

The consistent decline in fine wine prices leaves many wondering when the market will stabilise. Despite this downward trend, several factors point toward potential recovery and attractive buying opportunities in Q4.

Firstly, strong demand for select wines persists, particularly for brands that continue to outperform the market. This year has already seen several broken auction records, including for high-profile Burgundy, which points to continued interest in fine wine.

While the market as a whole is facing challenges, strategic investment in the right wines can still yield impressive returns. Investors looking to capitalise on market lows should consider brands which have consistently shown growth despite broader regional declines.

The global economic backdrop also provides reasons for optimism. Central banks, led by the US Federal Reserve, have shifted towards interest rate cuts which could stimulate further investment in alternative assets like fine wine.

In terms of regional performance, the ongoing declines in key regions may start to stabilise, as already seen in Champagne. Despite a 4.4% drop in Q3, Bordeaux remains a dominant player with one-third of the market share by value. With critics such as Jane Anson awarding nine perfect 100-point scores to Bordeaux wines from the 2009 and 2010 vintages, we may see renewed interest in classic vintages.

In summary, Q4 2024 offers a unique window of opportunity for long-term investors. With the current decline, strategic investments in high-performing brands and undervalued vintages could offer substantial returns on the road to recovery.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.