- The 2022 Mouton Rothschild label has been revealed.

- Mouton Rothschild is the best performing First Growth over the last decade.

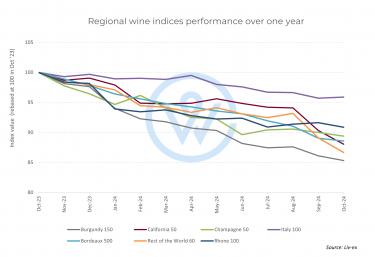

- The wine has also outperformed the Liv-ex 100 and Bordeaux 500 indices.

Unveiling the 2022 label

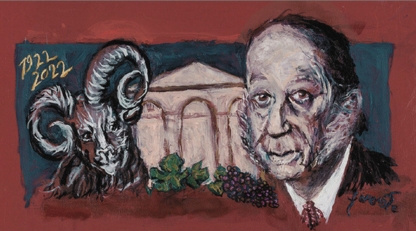

Bordeaux First Growth Château Mouton Rothschild revealed its 2022 label design on December 1st. Created by French artist Gérard Garouste, the original artwork commemorates the 100th anniversary of Baron Philippe de Rothschild’s leadership at the family estate.

The label showcases the château’s iconic front wall and a grapevine, elegantly framed by a portrait of Philippe de Rothschild and a ram, his signature emblem.

The tradition of artist-designed labels began in 1945, when Baron Philippe de Rothschild marked the end of World War II with a special artwork featuring a ‘V’ for victory, designed by Philippe Jullian.

As previously explored, this practice has significantly enhanced Mouton Rothschild’s collectability, and the wine’s value has typically risen in the month following the label reveal.

Mouton Rothschild: ahead of the pack

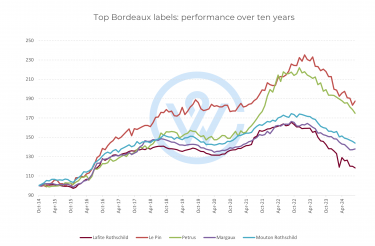

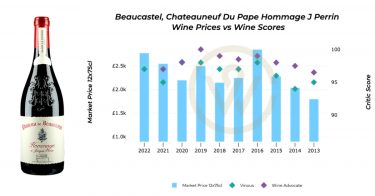

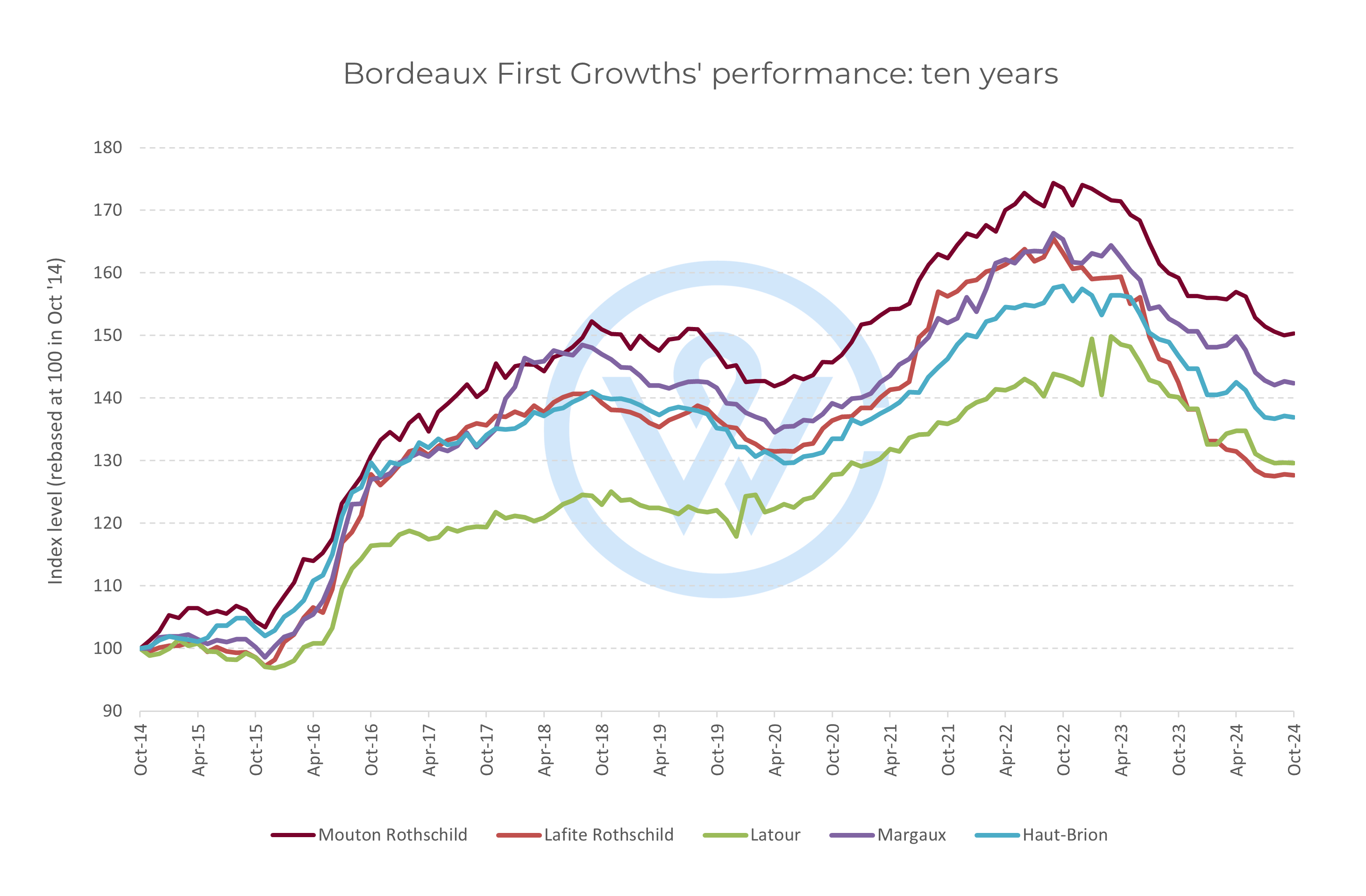

While the artist designed labels alone are not the key drivers of Mouton Rothschild’s investment performance, the wine does lead the way among its peers. It is the best performing First Growth over the last decade.

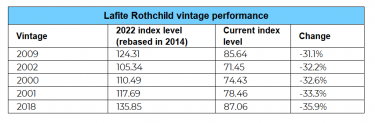

Mouton Rothschild prices have risen 50.3%, compared to 42.3% for Margaux and 36.9% for Haut-Brion. Both Lafite Rothschild and Latour have increased by close to 30% over the same period.

From the market’s low in June 2014 to its peak in September 2022, Mouton Rothschild recorded a 76% increase. It was the first First Growth to recover from the correction following the China-driven wine boom.

During the recent market downturn, Mouton Rothschild has exhibited relative resilience. Prices have fallen 13.8% since its peak. Only Haut-Brion has seen a smaller decline of 13.1%. The biggest faller has been Lafite Rothschild, down 22.8% since September 2022.

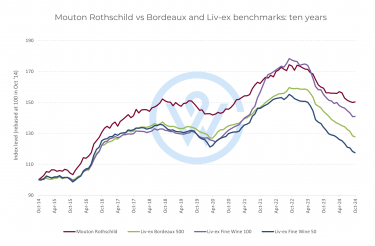

Mouton Rothschild and the broader market

Mouton Rothschild is also nicely positioned in the broader wine investment market. It has outperformed the industry benchmark, the Liv-ex 100 index, which is up 40.9% over ten years. It has also fared better than the Liv-ex 50 (17.5%), which tracks the price movements of the First Growths, and the broader Bordeaux 500 index (27.8%).

Mouton Rothschild has demonstrated consistent strength in the fine wine market, supported by its established history and strategic positioning. The estate’s practice of commissioning artist-designed labels has enhanced its collectability, strengthened by its reputation for quality.

The release of the 2022 label marks another milestone in the estate’s history. Mouton Rothschild’s performance, both in terms of relative resilience during market downturns and long-term growth, highlights its role as a reliable component in a well-diversified wine investment portfolio.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.