Wine has captivated collectors for centuries – not just for its flavour and artistry, but for its ability to increase in quality and value over time. For many enthusiasts, this has made fine wine one of the world’s most compelling collectible assets.

In recent years, the most expensive bottles of fine wine have evolved into global luxury assets in their own right. Record-breaking sales at Sotheby’s and Christie’s, particularly from Burgundy and Bordeaux, have drawn the attention of collectors across Europe, the United States, and Asia. The fine wine market has proven remarkably resilient, often outperforming traditional investment sectors during periods of volatility. As more investors and collectors explore alternative assets, interest in understanding what drives the value of the world’s rarest bottles has grown rapidly.

But what is the most expensive wine on earth? And why are some bottles worth more than luxury cars – or even homes? In this guide, we explore the top 10 most expensive wines in the world, breaking down their prices, regions, rarity, and what makes a single bottle so valuable.

Ten of the world’s most expensive wines

The wines featured below have achieved legendary status in the world of fine wine – not only because of their craftsmanship, but also due to the unique stories and circumstances that have shaped their value. From minuscule production levels to historic vintages and iconic vineyard sites, each bottle reflects centuries of winemaking heritage and a global appetite for rarity.

Domaine Georges & Christophe Roumier, Musigny Grand Cru

Producer: Domaine Georges & Christophe Roumier

Average price: £13,595

Wine type: Red

Grape: Pinot Noir

Region: Burgundy, France

Domaine Roumier is one of Burgundy’s most revered producers, responsible for some of the region’s most expensive wines. Its Musigny Grand Cru – grown on exceptional limestone soils in the Côte de Nuits – offers remarkable finesse and longevity. As a Grand Cru, Burgundy’s highest classification, this wine is treasured for its age-worthiness, rarity, and ability to command high auction prices.

Production levels from Musigny are extremely limited, and the vineyard’s old vines contribute to the wine’s intensity and depth. Collectors value Roumier for its consistency across vintages and its meticulous approach to viticulture, both of which drive sustained demand and premium pricing.

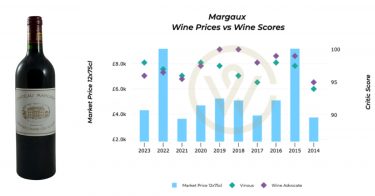

Château Margaux

Producer: Château Margaux

Price: $225,000 (gained by insurance reimbursement in America)

Wine type: Red

Grape: Bordeaux blend

Region: Bordeaux, France

A bottle of this wine, created in 1787, was said to be a part of Thomas Jefferson’s personal collection.

A wine trader called William Sokolin later acquired it and took it to a dinner in Bordeaux, where the waiter knocked it off the table and smashed the bottle. Sokolin was later reimbursed with $225,000 by his insurance company, but the bottle was originally thought to be worth $500,000. Château Margaux is also a consistent producer of top-performing Cabernet Sauvignon-led blends, reinforcing its status as a pillar of fine wine investment.

Classified as a First Growth in the historic 1855 Classification, Château Margaux’s reputation spans centuries. Pre-phylloxera bottles such as the 1787 are exceptionally rare, making them prized artefacts of wine history. Provenance plays a major role in the value of such wines, and Jefferson-linked bottles remain some of the most sought-after in the world.

Domaine Leroy, Musigny Grand Cru

Producer: Domaine Leroy

Average price: £31,691

Wine type: Red

Grape: Pinot Noir

Region: Burgundy, France

Founded in 1868 by wine merchant François Leroy, the Domaine (vineyard) is now owned by Lalou Bize-Leroy, who also owns Domaine d’Auvenay.

This dry red wine is produced from Pinot Noir grapes and is farmed biodynamically. This ethical approach to farming provides nutrients to the plants by using their own composting measures, as opposed to using chemical fertilisers. Although more labour-intensive, this approach produces high-quality fruit and is better for the environment.

Domaine Leroy’s wines are often considered on par with, or even superior to, those of Domaine de la Romanée-Conti, both making wines from prestigious communes such as Vosne-Romanée. Micro-production levels mean only a few barrels are produced each year, resulting in extremely limited global availability. This scarcity, combined with critical acclaim, contributes significantly to its exceptionally high market value.

Krug Vintage Brut Champagne

Producer: Krug

Price: Sold for £14,800

Wine type: Sparking wine

Grape: Champagne

Region: Champagne, France

Krug is one of Champagne’s most renowned houses, producing some of the region’s most sought-after and expensive wines.

At a Hong Kong wine auction in 2009, the 1928 Krug Vintage Brut set a record as the most expensive Champagne ever sold at the time. Its combination of rarity, craftsmanship, and historical prestige make it a pinnacle of sparkling wine collecting.

Older Champagne vintages like 1928 are incredibly rare because sparkling wine is typically consumed young. Bottles that survive nearly a century in pristine condition gain immense value. Krug’s long ageing process on lees, combined with its dedication to complexity and structure, makes its older vintages particularly collectible.

Screaming Eagle Sauvignon Blanc

Producer: Screaming Eagle

Average price: £4,610

Wine type: White

Grape: Sauvignon Blanc

Region: Oakville, USA

Although not the most expensive wine on the list, this is one of the most expensive white wines from the North Coast of the United States.

As one of Napa Valley’s original “cult wines,” Screaming Eagle produces extremely limited quantities, often fewer than 1,000 cases per year. While known primarily for its Cabernet Sauvignon, its Sauvignon Blanc has become one of the most expensive white wines in the world, driven by rarity and intense demand.

Screaming Eagle’s allocation list is famously difficult to join, with waiting lists spanning years. This exclusivity fuels secondary-market prices, as collectors compete for the winery’s rarest bottles. Napa Valley’s rise as a luxury wine region has further elevated Screaming Eagle’s iconic status.

Domaine Leflaive, Montrachet Grand Cru

Producer: Domaine Leflaive

Average price: £12,430

Wine type: White

Grape: Chardonnay

Region: Burgundy, France

Montrachet is considered the best white wine vineyard in the world, with bottles often dominating top 10 most expensive wine lists. Domaine Leflaive’s Grand Cru Chardonnay – barrel-fermented and known for citrus, hazelnut, and buttery richness – remains a benchmark of Burgundy craftsmanship.

Leflaive’s plots in Montrachet sit on prime limestone-rich soils, offering exceptional drainage and mineral expression. With only a very small portion of the already tiny Montrachet vineyard under its control, Leflaive produces minuscule quantities of this wine each year, contributing significantly to its rarity.

Liber Pater

Producer: Liber Pater

Average price: The 2015 variety had an average price of £27,500

Wine type: Red

Grape: Bordeaux blend

Region: Bordeaux, France

Liber Pater produces some of the most expensive wines in the world. This vintage wine was created in 2015, and due to its very low production numbers and the use of grapes from ungrafted vines, it has become a true collector’s item.

Liber Pater aims to recreate the taste of pre-phylloxera Bordeaux by using nearly extinct grape varieties and traditional winemaking techniques. The estate produced just 550 bottles in 2015, making it one of the lowest-production wines in Europe. Its experimental approach attracts collectors seeking something truly singular.

Château d’Yquem

Producer: Château d’Yquem

Price: Sold for £75,000

Wine type: Dessert

Grape: Semillon & Sauvignon Blanc

Region: Sauternes, France

As the only Premier Cru Supérieur in the 1855 Classification, Château d’Yquem has no rivals in the world of sweet wine. The 1811 vintage – one of its most celebrated – sold for £75,000 and was recognised by Guinness World Records as the most expensive standard bottle of white wine ever sold at auction. The wine bottle is said to be on display in Mr Vanneque’s restaurant in Bali, protected by bulletproof glass.

Château d’Yquem benefits from a unique microclimate that encourages the development of noble rot, allowing the estate to produce extraordinarily concentrated and long-lived wines. Many vintages of Yquem can age for over a century, which further enhances its allure among collectors.

Domaine Leroy, d’Auvenay Chevalier-Montrachet Grand Cru

Producer: Domaine d’Auvenay (part of Domaine Leroy)

Average Price: £23,439

Wine Type: White

Grape: Chardonnay

Region: Burgundy, France

Another masterpiece from Lalou Bize-Leroy, this ultra-rare Grand Cru comes from a tiny four-acre estate. Minuscule yields and perfect craftsmanship make it one of the top 10 most expensive wines in the world.

In certain vintages, only one or two barrels of this wine are produced, placing it among the most limited-production white wines in existence. The combination of terroir precision, strict biodynamic principles, and extremely low output fuels exceptionally high prices.

Egon Müller, Scharzhofberger Riesling Trockenbeerenauslese

Producer: Egon Müller

Average Price: £12,147

Wine Type: Dessert

Grape: Riesling

Region: Mosel, Germany

Egon Müller is synonymous with world-class Riesling. Their Trockenbeerenauslese – made from individually selected botrytised berries – is among the most expensive dessert wines globally, often achieving record prices at international wine auctions.

TBAs are among the rarest and most labour-intensive wines to produce, requiring hand-picking berry by berry. Egon Müller consistently commands the highest Riesling prices in the world, with some vintages selling for tens of thousands of pounds on release.

What makes wine so expensive?

When examining the world’s most expensive wines, several factors consistently influence rarity and price:

1. Reputation and provenance

Producers like Domaine de la Romanée-Conti, Lafite Rothschild, and Krug have global reputations for exceptional quality. Strong brand prestige pushes demand upward – especially when paired with historical significance.

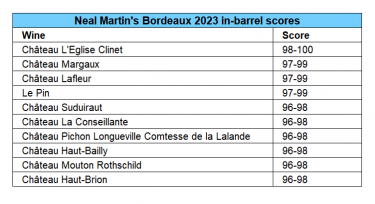

2. Critical acclaim

Fine wine critics such as Robert Parker and major publications like Wine Spectator influence global pricing. High scores often trigger strong interest at wine auctions, driving prices even higher.

3. Ageing potential

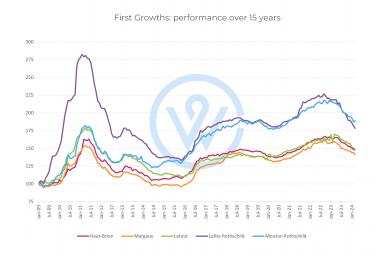

Investment-grade wines improve dramatically with age. A wine built for long-term cellaring – such as Bordeaux blends or Grand Cru Burgundy – will usually appreciate in value.

4. Scarcity

Rarity is the backbone of luxury pricing. Limited-production wines, low-yield vineyards, or single-parcel bottlings make wines more exclusive. When only a single bottle or a few hundred bottles exist, demand can skyrocket.

5. Historical or cultural importance

Bottles owned by notable figures (e.g., Thomas Jefferson) or from legendary vintages often become priceless artifacts.

Valuation is also influenced by condition and storage history. Wines stored in professional, temperature-controlled cellars command higher prices, while bottles with damaged labels, signs of leakage, or poor provenance may lose significant value. Auction houses play a major role in establishing price benchmarks, and the presence of original wooden cases, wax seals, or château documentation can increase a bottle’s desirability.

Why invest in fine wine?

Fine wine is a powerful alternative investment because:

-

it has low correlation with global stock markets

-

values tend to rise steadily over time

-

supply naturally decreases as bottles are consumed

-

the category has historically remained more stable than gold or real estate

-

prestige wines retain global demand regardless of economic cycles

Fine wine is also considered tax-efficient in several regions, further increasing its appeal for investors seeking long-term growth without excessive tax burdens. Its global nature – traded actively in London, New York, Hong Kong, and Singapore –provides a diverse base of demand. Historically, fine wine has demonstrated resilience during economic downturns, making it an attractive hedge against inflation and uncertainty.

For collectors, investing also provides the joy of building a cellar filled with some of the most extraordinary wines ever created.

Your wine investment journey starts here

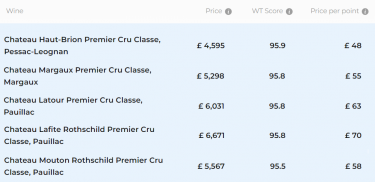

WineCap gives you access to some of the world’s most investible wine allocations. Once your preferences are understood, you gain access to a broad portfolio of investment-grade wines, stored in secure government-bonded facilities.

We don’t charge a management fee and our brokerage charges are very low, so you have access to rare wines at a fair price.

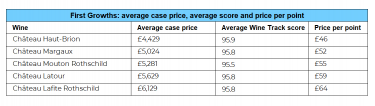

Whether you are looking to begin your portfolio with classic investment wines like First Growth Bordeaux or are exploring ultra-rare bottles such as Domaine Leroy, WineCap provides expert guidance at every stage. Our team can help ensure proper storage, verify provenance, and identify the strongest long-term performers in the market, giving you confidence as you build your wine investment portfolio.

To start your wine investment journey, schedule a consultation with one of our experts.