- Wealth managers in both the UK and US anticipated increased demand for equities, real assets, and alternatives amid shifting trade policy landscapes.

- US respondents showed stronger confidence in alternative assets, while UK managers leaned more toward traditional equities and property.

- Fine wine was viewed in both markets as a resilient, inflation-resistant asset with long-term appeal, especially in portfolios seeking diversification.

With President Donald Trump back in the White House, global markets have once again entered a period of trade policy uncertainty. In late May 2025, the administration proposed sweeping 50% tariffs on European Union imports, initially planned for June 1 but now delayed until July 9 following negotiations with European Commission President Ursula von der Leyen. The move echoes earlier policy cycles that disrupted cross-border commerce, and while implementation remains uncertain, it has revived conversations about portfolio resilience and asset class performance under changing geopolitical conditions.

In our Wealth Management survey earlier this year, investors across both sides of the Atlantic were asked to consider how a renewed focus on domestic trade policy and market protectionism might shift capital allocation preferences. Their responses revealed an appetite for assets considered resilient, global, and responsive to consumer growth.

A recalibration of confidence across core and alternative assets

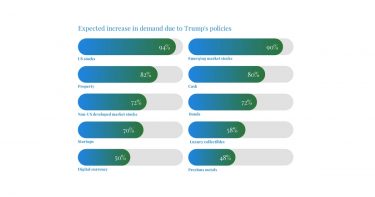

Across both markets, wealth managers projected increased demand for a wide range of asset classes, albeit with slightly different emphases. In the United Kingdom, demand was strongest for traditional equity exposures, particularly US stocks (94%) and emerging markets (90%), reflecting a continued belief in global growth opportunities despite the shifting trade backdrop. Property and non-US developed stocks also garnered attention, as did cash and bonds – indicating a balanced appetite for both growth and defensive positions.

*UK

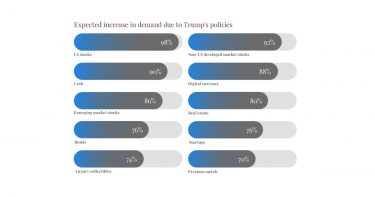

In the US, the tone was more expansive and optimistic. US stocks topped the list at 98%, with similarly high sentiment for non-US developed markets (92%), cash (90%), and emerging market equities (86%). However, American wealth managers also showed a greater inclination toward alternatives – digital currency (88%), real estate (80%), startups (76%), and luxury collectibles (74%) all ranked notably high. This suggests that, even in the face of policy shifts, US investors were inclined to look for opportunity amid change, particularly in sectors with strong long-term narratives or tangible value.

*US

A nuanced position for fine wine and luxury assets

Fine wine and other luxury collectibles were not among the top-tier asset classes in the survey but nevertheless held their own as part of a well-rounded diversification strategy.

While only 58% of UK respondents expected an increase in demand for luxury collectibles compared to 74% in the US, both figures reflect a belief in the long-term value of tangible, non-correlated assets – especially during periods of policy uncertainty.

Historically, fine wine has performed well in such climates. Its low correlation with traditional financial markets, combined with intrinsic scarcity and global appeal, positions it as an attractive option for wealth preservation.

US respondents in particular noted that if Trump’s policies were to echo those from his previous term – most notably tax cuts that increased disposable income among high-net-worth individuals – then demand for luxury goods, including fine wine, could grow in tandem with consumer confidence.

Inflation resistance and tangibility remain key themes

Another through-line in both markets is the recognition that tangible, inflation-resistant assets may offer stability when macroeconomic or policy environments shift. While digital assets and equities continue to dominate discussions, the inclusion of fine wine and real estate in both countries’ top ten expected demand growth areas suggests a common view: that real, finite goods still hold a trusted place in long-term strategies.

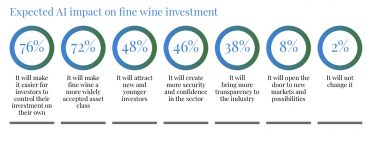

This sentiment aligns with broader investment trends of the past five years, during which fine wine has steadily gained credibility as an alternative asset. From a performance standpoint, it has demonstrated resilience through downturns and delivered attractive risk-adjusted returns over the long term. And as more platforms offer increased liquidity and data transparency, fine wine is becoming more accessible to wealth managers seeking both diversification and durability.

Looking ahead

While our survey preceded the most recent tariff developments, the views it captured reflect a broader mindset already taking shape among global investors. As the July 9 tariff deadline approaches, and with the potential for further policy changes, these pre-existing preferences offer a lens into how wealth managers may continue to allocate in an evolving geopolitical environment.

For fine wine in particular, its dual role as both a passion asset and a portfolio stabiliser could prove increasingly valuable. Whether driven by renewed domestic consumption or a search for global, inflation-resistant stores of value, fine wine appears poised to remain a quiet but meaningful part of the wealth management conversation on both sides of the Atlantic.

Looking for more? See also:

*UK

*UK *US

*US *UK

*UK *US

*US