- Demand for Spanish wines has surged, with the region’s trade by volume outpacing the USA.

- More Spanish wines are now offered on La Place since after Telmo Rodríguez’s ‘YJAR’ paved the way in 2021.

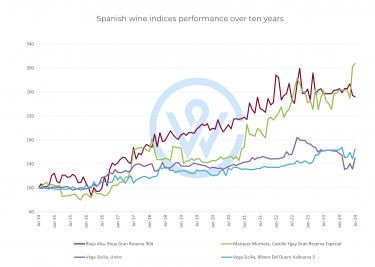

- Marqués de Murrieta’s Castillo Ygay Gran Reserva is Spain’s top performer in the last decade.

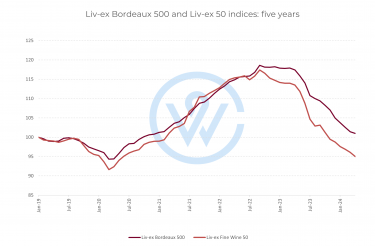

Spanish wines are increasingly gaining recognition in the fine wine investment landscape. Liv-ex recently reported that Spain’s year-to-date trade share by value has more than doubled compared to the same period in 2023 (2.2% vs 0.9%). In volume terms, the country has traded 20.5% more than the US – but at lower average trade prices.

As we wrote in a recent member-only offer, Spanish wine represents some of the best value in the fine wine market and remains an underexploited sector by investors.

The surging demand for Spanish wines

Spain has a long and diverse history on the wine investment market, masked under a low trade share. Given the current buyer’s market, however, with investors looking for value, Spain is keenly poised for growth.

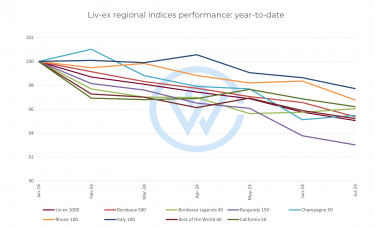

Earlier this month, its trade share by value overtook the Rhône, which prompted Liv-ex to monitor its performance separately from the Rest of the World category, in which it previously belonged.

In terms of regional distribution, Ribera del Duero and Rioja dominate the investment market for Spanish wines, being home to some of the most successful wine brands.

More Spanish wines are now also offered through La Place de Bordeaux, after Telmo Rodríguez’s ‘YJAR’ paved the way in 2021, such as De La Riva, Algueira and Matallana.

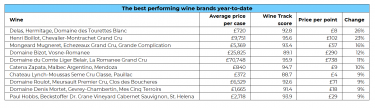

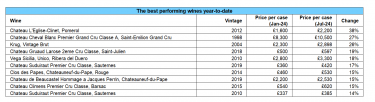

Spain’s top wine labels for investment

Spain’s most established wines for investment are Vega-Sicilia Unico, Valbuena and Alion, Pingus and Flor de Pingus, Marqués de Murrieta Castillo Ygay Gran Reserva, La Rioja Alta Gran Reserva 904 and 890, and López de Heredia Viña Tondonia.

When it comes to price performance, Ygay Gran Reserva leads the way, with a 207.7% rise over the past decade. One of the region’s brightest stars, the brand benefitted from Wine Spectator’s recognition as ‘Wine of the Year’ in 2020. Since then, prices have risen sharply.

The second-best performer has been La Rioja Alta Gran Reserva 904, up 151.8%. Meanwhile, Vega-Sicilia’s wines have been slower and steadier, increasing between 50%-65% over the last ten years. They offer some of the best value from Spain today.

As the fine wine market continues to expand and diversify, Spain has all the fundamentals for future success.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.