- Orange wine is trending globally, but remains a niche category in the fine wine market.

- Demand is driven by drinkers, not collectors, limiting investment relevance.

- Ancient in origin, modern in branding, orange wine sits outside blue-chip benchmarks.

Orange wine has become one of the most visible wine trends of the past decade – a style that dominates progressive restaurant lists, natural wine shelves, and social media feeds. Its amber hue and unconventional structure make it instantly distinctive.

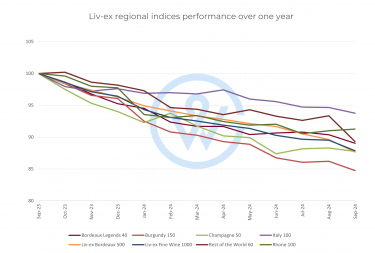

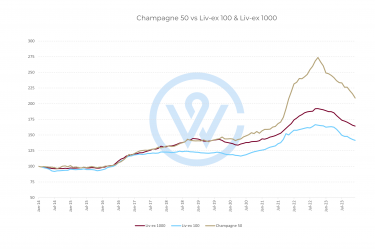

However, from an investment standpoint, orange wine occupies a very different space from the blue-chip categories that define the fine wine market. While Champagne, Burgundy and top Bordeaux continue to attract global collector demand and measurable secondary-market liquidity, orange wine remains largely consumption-driven – fascinating to drink, but rarely traded, benchmarked, or treated as an asset.

That is not because orange wine lacks history. In fact, the techniques behind it may be among the oldest in the world. Instead, it reflects a category where cultural momentum has not translated into investment fundamentals.

Below, we explore what orange wine is, where it comes from, why it has risen in popularity and why it remains, for now, a wine trend rather than a collectible market.

We clarify why its investment potential is limited, highlighting how it compares to portfolio-grade wine segments.

What is orange wine?

Orange wine is best understood as white wine made using red wine production methods.

Instead of pressing white grapes immediately and fermenting only the juice, orange wine is fermented with the grape skins – and sometimes stems – for an extended period. This process, known as skin contact, extracts colour, tannins, texture, and phenolic complexity, producing wines that range from golden amber to deep orange in appearance.

Despite the name, orange wine has nothing to do with oranges or citrus fruit. The colour comes entirely from the grape skins.

Orange wine is also commonly referred to as:

- Skin-contact white wine

- Amber wine (particularly in Georgian traditions)

This simple shift in technique creates a style that sits between categories: structurally closer to red wine, yet aromatically rooted in white grapes.

How is orange wine made?

The defining feature of orange wine is maceration: the extended contact between grape juice and skins.

Most conventional white wines are pressed off skins quickly to preserve freshness and minimise tannin. Orange wine does the opposite: it embraces skin contact to build depth and structure.

Key variables include:

Length of skin contact

This can range from a few days to several months. Longer maceration generally increases tannin, grip, and savoury complexity.

Fermentation vessels

Orange wines can be made in:

- Stainless steel (cleaner, fruit-driven styles)

- Oak barrels (more oxidative, structured examples)

- Amphora or clay vessels (traditional, earthy styles)

- Georgian qvevri (buried clay pots used for millennia)

Winemaking philosophy

Orange wine overlaps heavily with the natural wine movement, though not all orange wines are “natural.” The technique is separate from the ideology. The result is one of the wine world’s most diverse categories – exciting, but also highly variable.

Where did orange wine originate?

Orange wine may feel modern, but its origins are ancient.

The most frequently cited historical anchor is Georgia, where winemakers have produced skin-contact wines for thousands of years using traditional clay vessels called qvevri. This method is so culturally significant that UNESCO has recognised the ancient Georgian qvevri winemaking tradition as part of humanity’s intangible heritage.

What is new is not the practice, but the label. The term “orange wine” itself was coined in 2004 by British importer David A. Harvey as a way to describe this hard-to-classify style in accessible language. The name stuck, helping transform an old technique into a modern global category.

Orange wine vs white wine: what’s the difference?

One of the most common questions is how orange wine differs from traditional white wine.

Orange wine occupies a middle ground: it can drink like a white, but behave like a red at the table.

Why has orange wine become so popular?

Orange wine’s rise is best understood as the overlap of three powerful trends.

1. The natural wine movement

Orange wine fits neatly into the minimal-intervention narrative: ancient techniques, lower additives, small producers, authenticity. It became a signature style within the broader natural wine boom.

2. On-trade influence

Sommeliers embraced orange wine because it fills a useful gap. It pairs widely, offers guests something new, and provides a “third lane” between red and white.

3. Social media visibility

Orange wine is visually distinctive. Its colour, story, and identity are easy to communicate in a single image or short video, making it one of the most shareable wine categories of the last decade.

Like many trends, however, enthusiasm can be cyclical. Some markets have already seen drinkers shift toward adjacent styles, such as chilled reds, after peak orange wine experimentation.

Orange wine: Flavour profile

Orange wine reveals a spectrum of flavours. Common tasting characteristics include:

- Dried apricot and orange peel

- Herbal tea and chamomile

- Nuts, spice, and savoury tones

- Oxidative notes in some traditional styles

- A firm, tannic grip uncommon in white wine

For adventurous drinkers, this is precisely the appeal. But for investors, it highlights the category’s stylistic inconsistency.

Best orange wine regions to know

Orange wine is now global, but several regions remain reference points:

- Georgia – the historic home of qvevri wines

- Friuli-Venezia Giulia (Italy) – a modern epicentre for serious skin-contact whites

- Slovenia (Brda/Goriška) – cult producers and structured examples

- Austria and Alsace – aromatic varieties well suited to maceration

These regions help reinforce orange wine’s credibility; however, this growing reputation for quality does not always translate into collectability.

Why orange wine is interesting for drinking

If your goal is pleasure per pound (rather than return per annum), orange wine can be genuinely compelling:

It’s food-friendly in a way most whites aren’t

Tannin and savoury texture means orange wine can handle:

- Spice and aromatics (think Middle Eastern, North African, Thai-inspired dishes)

- Umami-heavy plates

- Rich vegetables and fermented flavours

It offers a “third lane” between white and red

For drinkers interested in exploring styles beyond the obvious categories, orange wine is a legitimate alternative, especially when served slightly cool, like a light red.

It rewards curiosity

Because methods differ wildly, orange wine invites exploration: maceration length, vessel choice, grape variety, oxidative handling, and winemaker intent all show up clearly.

Why isn’t orange wine “investment-grade” in most cases?

Popularity doesn’t automatically create an investment market. Fine wine investment tends to concentrate where the market has deep liquidity, transparent pricing, repeatable demand, and established benchmarks.

1. Liquidity: there isn’t a thick secondary market

Most orange wine is produced in small volumes by small producers and bought to drink, not trade. That typically means:

- Fewer repeat transactions

- Wider bid:offer spreads

- Less reliable exit options

2. Benchmarking: pricing is fragmented

Investment-grade wine categories like Bordeaux, Burgundy, and Champagne benefit from comparable “reference labels” across vintages and formats. Orange wine is too stylistically diverse – and too producer-fragmented – to form a stable, broadly recognised benchmark set in the way Bordeaux’s Growths or top Burgundy domains do.

3. Consistency and quality control can be uneven

Orange wine overlaps heavily with minimal-intervention winemaking. When it’s great, it’s distinctive; when it’s flawed, it’s obvious. Some on-trade commentary has highlighted consumer fatigue with more extreme or inconsistent examples in certain markets. From an investment lens, variability increases risk and reduces broad-based demand on resale.

4. Cultural prestige hasn’t translated into “blue-chip” status

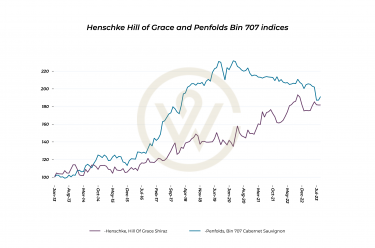

While range wine has history (Georgia) and cult producers (Friuli/Slovenia), the category lacks the long-established global collector infrastructure that underpins investment-grade segments – the kind of ecosystem visible in widely tracked fine wine indices and luxury-asset reporting.

Can any orange wines be collectible?

Some orange wines may show collectible traits if they combine:

- Producer cult status and long-term critical attention

- Provenance-friendly packaging and consistent release patterns

- Demonstrated longevity (some serious skin-contact whites can age)

- Repeat demand from a niche but wealthy collector base

Even then, “collectible” is not the same as “investment-grade”.Without a robust resale venue and repeated market clearing prices, the potential remains very low at present.

WineCap view: orange wine is a trend, not an allocation

Orange wine is one of the most interesting modern wine stories because it flips expectations: it looks new, but its roots are ancient; it is fashionable, yet rarely traded; and it is driven more by experience than asset behaviour.

For most collectors, orange wine is best treated as:

- A consumption-led category (buy to drink, not to flip)

- A cultural trend worth understanding

Orange wine and blue chip investment summary

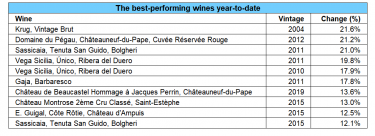

For investors seeking long-term appreciation, the market continues to favour regions with established liquidity and repeatable demand, including:

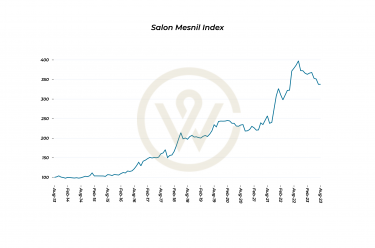

- Top Champagne (Dom Pérignon, Krug, Salon)

- Burgundy domaines with constrained supply

- Classified Bordeaux with global recognition

- Italian blue chips (Sassicaia, Giacomo Conterno)

Orange wine may be one of the most exciting categories to explore as a drinker but investment-grade wine remains defined by structure, scarcity, and market depth.

FAQ: Orange wine

What is orange wine?

Orange wine is white wine fermented with grape skins, creating an amber colour and tannic structure.

Why is orange wine orange?

Because extended skin contact extracts colour and phenolics from white grape skins.

How is orange wine different from white wine?

Orange wine has more tannin, texture, and savoury complexity due to skin fermentation.

Is orange wine natural wine?

Not necessarily. Orange wine refers to technique, while natural wine refers to philosophy.

Does orange wine age well?

Some structured examples can age, but the category is too broad to generalise.

Is orange wine a good investment?

In most cases, no. Orange wine lacks the liquidity, benchmarking, and collector infrastructure required for investment-grade status.