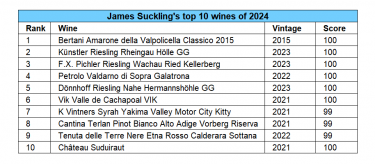

- James Suckling’s top 100 wines of 2024 list has been released.

- His wine of the year is Bertani Amarone della Valpolicella Classico 2015.

- Italy dominates the rankings followed by France and the US.

American critic James Suckling has released his top 100 wines of 2024 list, along with his wine of the year. Based on tens of thousands of bottles tasted and rated over the year, the list highlights wines that combine exceptional quality, character, and accessibility.

For 2024, Suckling’s Wine of the Year is Bertani Amarone della Valpolicella Classico 2015, awarded a perfect 100-point score. Italy dominates the rankings overall, followed by France and the United States, reflecting both traditional strongholds and evolving global demand.

This article breaks down the James Suckling Top 100, explains how the list is compiled, explores regional performance, and highlights what collectors and investors can learn from the 2024 results.

How the James Suckling Top 100 is compiled

James Suckling’s rankings are underpinned by scale and consistency. Over the past year, Suckling and his international tasting team reviewed more than 40,000 wines, producing detailed tasting reports, vintage analyses, and regional breakdowns.

Unlike many critics, Suckling’s approach is deliberately broad. The bottles tasted and rated span:

-

Everyday wines priced below $20

-

Estate wines from leading regions such as Bordeaux, Burgundy, and Napa Valley

-

Limited-production cuvées from small, high-quality producers

The Top 100 list is then selected from this vast dataset, based on more than just numerical scores.

Criteria for inclusion in the Top 100

To qualify for the James Suckling Top 100, wines must meet several key criteria:

-

Minimum production of approximately 5,000 bottles

-

Median release price below $500 (£385)

-

A score typically between 97 and 100 points

-

What Suckling describes as a “wow factor” – an emotional impact that elevates a wine beyond technical excellence

This ensures the final list balances prestige with real-world availability, creating a list of wines that is both aspirational and practical for collectors.

A record year of tasting: More than 40,000 wines reviewed

The scale of Suckling’s tasting operation is unmatched. In 2024 alone:

-

More than 40,000 bottles tasted and rated

-

Hundreds of tasting reports published

-

Wines assessed across all major regions and styles

Each wine is evaluated blind where possible, with scores reflecting overall quality, balance, structure, and ageing potential. These tasting notes form the backbone of the final Top 100 ranking.

Regional overview: Italy leads the James Suckling top 100

Italy once again emerged as the strongest-performing country in the 2024 rankings.

Total wines reviewed in 2024

The countries with the largest representation included:

-

Italy – 9,100 wines

-

France – 9,000 wines

-

United States – 6,800 wines

-

Spain – 3,800 wines

-

Argentina – 2,300 wines

-

Germany – 2,000 wines

-

Australia – 1,700 wines

-

Chile – 1,550 wines

Additional tastings included wines from Greece, Hungary, Canada, Uruguay, and China, highlighting the increasingly global scope of Suckling’s work.

Countries featured in the James Suckling Top 100

Despite intense competition, Italy secured 26 places in the Top 100 – more than any other country. These wines span a wide range of styles and regions, including:

-

Amarone della Valpolicella

-

Barolo

-

Brunello di Montalcino

-

Alto Adige whites

-

Super Tuscan blends

France followed with 18 wines, led by Bordeaux, Champagne, and the Rhône Valley. Burgundy Grand Crus and structured Rhône reds continue to perform strongly, reinforcing France’s long-standing reputation for producing great wine.

The United States placed 15 wines on the list, driven largely by Napa Valley Cabernet Sauvignon and Oregon Pinot Noir. This confirms the continued global appeal of top-tier American producers.

Germany delivered 12 wines, a standout performance that underscores the growing recognition of dry Riesling as one of the world’s most precise and age-worthy styles.

Chile, Australia, Argentina, and Spain also featured, while China made a notable appearance with Ao Yun Shangri-La 2020, reflecting its rising status in the fine wine market.

Wine of the Year 2024: Bertani Amarone della Valpolicella Classico 2015

At the top of the ranking is Bertani Amarone della Valpolicella Classico 2015, which received a perfect 100-point score.

James Suckling describes the wine as a benchmark expression of Amarone, praising its balance between power and elegance. His tasting notes highlight:

-

Full-bodied structure

-

Filigree, refined tannins

-

Bright, persistent acidity

-

A long, savoury, and complex finish

Suckling calls it a wine that expresses “the greatness of time and place”, emphasising its ability to age gracefully while remaining compelling today.

The selection of an Amarone as Wine of the Year is particularly significant. It reflects growing international appreciation for Italy’s traditional red wines beyond the established icons of Barolo and Brunello.

Value and accessibility: a defining theme of 2024

One of the most striking aspects of the James Suckling Top 100 Wines of 2024 is its focus on accessibility.

According to Suckling:

-

Nine wines in the Top 100 are priced between $30 and $60

-

Many highly rated white wines remain attractively priced

-

The second-ranked wine on the list retails for around $65 (£50)

This emphasis on value reflects changing market dynamics, where consumers and collectors alike are seeking great wine without excessive price inflation.

Notable regional highlights

Germany’s breakthrough year

Germany’s strong showing confirms the exceptional quality of recent vintages, particularly for dry Riesling. Wines such as Künstler Riesling Rheingau Hölle GG 2023 demonstrate precision, minerality, and ageing potential.

Austria’s continued rise

Austria continues to build momentum, especially with wines from Wachau. These bottlings offer clarity of terroir and consistency across vintages.

China’s growing presence

The inclusion of Ao Yun Shangri-La 2020 marks a milestone for Chinese wine. Produced at high altitude in the Himalayan foothills, it showcases craftsmanship, innovation, and a distinct regional identity.

What collectors can learn from the James Suckling Top 100

The Top 100 is a snapshot of the global fine wine landscape.

For collectors and investors, it highlights:

-

Shifting stylistic preferences

-

Regions delivering strong value

-

Wines with long-term ageing potential

-

Emerging regions beyond traditional powerhouses

Whether searching alphabetically by winery, sorting by vintage score, or exploring tasting reports, the list offers a curated starting point for building a diverse and forward-looking cellar.

Final thoughts

The James Suckling Top 100 Wines of 2024 reflects a wine world in transition which values authenticity, balance, and accessibility alongside technical excellence.

From Amarone in Veneto to Riesling in Germany and Cabernet Sauvignon in Napa Valley, the list captures the diversity and excitement of today’s fine wine market. For collectors, it provides a reliable guide to wines that deliver both immediate pleasure and long-term promise.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.