- India remains one of the smallest wine markets globally, but consumption is growing rapidly from a very low base.

- The latest EU-India trade deal marks the first meaningful step toward tariff liberalisation, improving long-term access for European wine.

- History shows that when large markets open gradually – as China did in the early 2000s – collector demand and investment interest can follow.

India and the European Union announced a major step forward in trade relations last week, with Brussels hailing the agreement in principle as one of the most significant developments in modern EU trade policy. Among the headline areas under discussion: India is expected to begin easing tariffs on European wine, alongside beer and olive oil, as part of a broader push toward gradual market liberalisation.

At first glance, wine may seem like a footnote in a deal dominated by cars, textiles, pharmaceuticals, and geopolitics. But for the fine wine world – and particularly for the long-term evolution of wine investment demand – India’s gradual market opening could prove far more consequential than current consumption figures suggest.

India’s wine market growth: Small base, rapid expansion

India remains one of the least developed wine markets in the world relative to its population.

Wine represents well below 1% of the country’s total alcohol consumption, and India accounts for only a tiny fraction of global wine imports. Total annual consumption is still modest, with domestic producers supplying the majority of the market.

On a per-capita basis, the numbers are striking: India consumes approximately 0.02 litres per adult per year – the equivalent of a single tasting measure per person annually.

To put that in context:

- Australia consumes over 20 litres per capita

- France and Italy sit above 40 litres

- Portugal leads the world at more than 60 litres

India may be the world’s most populous country, but wine remains a marginal category.

And yet the trajectory is clear: India’s wine market has been expanding at double-digit rates, making it one of the fastest-growing alcoholic beverage segments in the country.

Market researchers project India’s wine market could reach around $520 million by 2028, and potentially approach $1 billion by 2034 – still small globally, but significant given today’s base.

Wine consumption in India: A premium lifestyle category

India’s alcohol market remains overwhelmingly dominated by spirits and beer:

- Spirits: ~53%

- Beer: ~46%

- Wine: less than 1%

In high-income economies, wine often represents around 27% of alcohol consumption, and the European region sits closer to 31%. India’s wine market is therefore not simply small; it is structurally underdeveloped. But this is also why the upside is so significant.

Wine is increasingly positioned not as mass alcohol consumption, but as a lifestyle and premium category, particularly in major urban centres. It is also uniquely aligned with the growth of India’s middle class, which comprised 31% of the population in 2023 and is projected to reach 60% by 2047.

Indian wine imports are rising in urban premium markets

Imported wine remains a small segment in absolute terms, but it is gaining visibility in affluent metropolitan markets such as Mumbai, Delhi, and Bengaluru.

European exporters have reported steady growth, and producers are increasingly investing in distribution networks, brand-building, and consumer education.

Crucially, wine markets almost always develop first in wealthy cities before broadening nationally – and India’s trajectory so far fits that pattern.

India’s wine import tariffs: The key barrier to European wine

For decades, India’s wine market has been constrained less by demand than by access.

India’s 150% wine import duty has historically restricted European wine exports, making imported bottles prohibitively expensive. On top of federal tariffs, each Indian state layers its own excise regime, often inflating shelf prices dramatically.

In practice, imported bottles can end up three to five times more expensive than comparable wines in other major markets once all taxes and fees are applied.

Any reduction in national duties would therefore be meaningful since it will start to unwind the single largest structural barrier at the federal level.

True liberalisation, however, would still require significant state-level reform.

India alcohol taxes: State-by-state barriers remain

India’s wine market is extremely fragmented. States fall into four distinct regulatory environments:

- Private distribution markets – Maharashtra, Goa, Haryana

- Government monopoly models – Tamil Nadu, Kerala, Delhi

- Auction and lottery markets – Punjab, Chandigarh

- Dry states – Bihar, Gujarat, Nagaland, Mizoram

Even where excise rates are manageable, barriers remain high through label registration fees and entry costs. Delhi, for example, charges a Rs. 2 lakh brand fee, while other states impose steep registration hurdles.

Northern states have even introduced “cow cess” levies — welfare fees on every bottle of wine to fund cattle shelters.

This complexity means that India’s market opening will be uneven, gradual, and city-led.

Wine education on the rise

Fine wine markets do not develop through income alone. They require education.

The rise of figures such as Sonal Holland MW, India’s first and only Master of Wine (since 2016), reflects the growing sophistication of India’s wine ecosystem. Her academy and the India Wine Awards are helping to build a professionalised culture of tasting, curation, and consumer knowledge.

This shift matters enormously: investment demand does not emerge without informed appreciation of provenance, scarcity, and value.

EU–India trade deal arrives in a fragmented global trade world

It is impossible to separate this agreement from the wider context in which it has arrived.

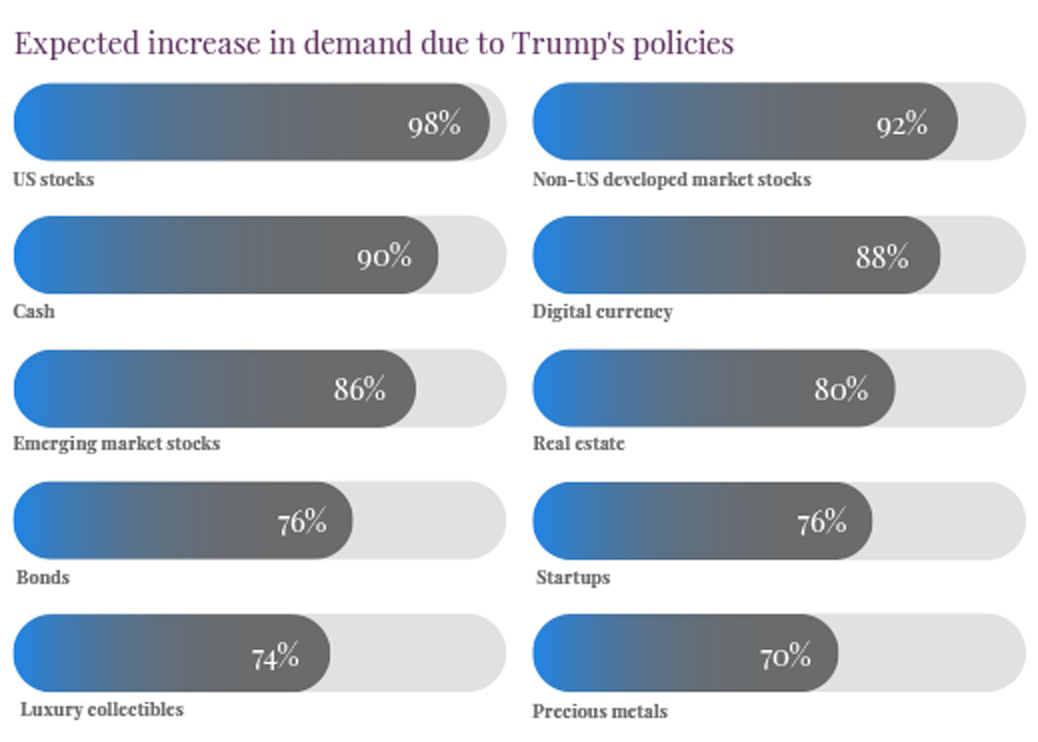

Global trade is becoming more fragmented. Tariff regimes are increasingly politicised, supply chains are being re-evaluated, and cross-border flows of goods are being reshaped by geopolitics as much as economics.

The wine market is not immune. Over the past year, the fine wine industry has been watching renewed trade tensions between the US and key partners, alongside uncertainty around tariffs, shipping, and market access. In that environment, any meaningful liberalisation elsewhere carries outsized importance.

India’s decision to begin lowering duties on European wine therefore signals a gradual shift toward integration, and it is coming at a moment when much of the global trade landscape is moving in the opposite direction.

For fine wine, where demand is global but supply is finite, the emergence of new consumer markets has always been one of the most powerful long-term drivers of price appreciation.

China’s wine boom shows what happens when large markets open

The closest modern parallel to the opening of the Indian wine market is China.

In the early 2000s, China’s wine market was similarly underdeveloped. But gradual reductions in trade barriers, expanding distribution, and the emergence of gifting culture created one of the most dramatic demand transformations the wine world has ever seen.

By the late 2000s and early 2010s:

- Bordeaux became a symbol of luxury

- Auction activity surged across Asia

- Global pricing dynamics shifted

India today is not China in 2010. Its regulatory structure is more fragmented, its per-capita consumption far lower, and cultural constraints are more pronounced.

But the structural similarities remain notable:

- A vast population starting from a low base

- Rapid urban wealth concentration

- Wine positioned as aspirational luxury

- Increasing education and professionalisation

- Early steps toward reduced import barriers

In markets of this scale, even modest shifts in penetration can carry long-term implications.

What this could mean for fine wine investment

For investors, the key takeaway is not that India will suddenly become a dominant importer of blue-chip Burgundy or Champagne.

The market is still highly taxed, highly regulated, and structurally complex. State-level excise regimes, distribution monopolies, and steep registration costs remain major constraints. True liberalisation will take years.

However, fine wine investment is not driven by today’s consumption alone – it is driven by expectations of future demand.

Opening markets matter because they create:

- Greater accessibility

- More transparent pricing

- Broader consumer participation

- And, crucially, the early foundations of collector culture

India is not there yet but may now be entering the first stage of a familiar cycle: from niche consumption, to aspirational luxury, to informed collecting, and eventually, to investment-grade demand.

A wine market to watch

In a world where global trade is becoming more fragmented, even the gradual opening of a market of 1.4 billion people is one of the most important long-term developments the fine wine industry can watch.

The industry has speculated for decades about what India could become for fine wine. Now, for the first time, the market may be beginning to find out.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today