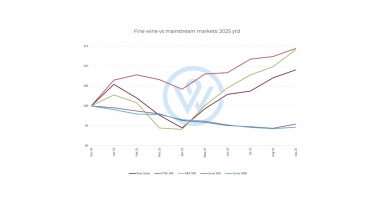

- The fine wine market has closed 2025 on a positive note, with prices rising for four consecutive months.

- Despite improving momentum, fine wine prices remain close to five-year lows, creating buying opportunities.

- Market broadening is a defining feature of rising markets, and 2026 is likely to mark the early stages of this transition.

After three years defined by correction, caution and recalibration, the fine wine market enters 2026 in a notably stronger position. Prices have stabilised, liquidity has improved, and demand is beginning to broaden – all signs that the market has moved beyond its most challenging phase and is laying the foundations for a sustainable recovery.

While it would be premature to describe the current environment as a full rebound, the early months of 2026 mark the firmest starting point the fine wine market has seen since 2022. For investors with a medium- to long-term horizon, this combination of stabilising prices and still-attractive valuations presents one of the most compelling opportunity windows in several years.

A firmer start to the year than at any point in the past three years

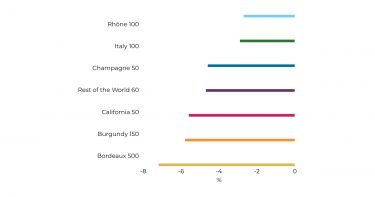

In our final article of 2025, we examined the performance of Bordeaux, Burgundy and Champagne – the three most important fine wine regions for investors – and highlighted pockets of growth across each. Crucially, that momentum has not faded with the turn of the calendar year.

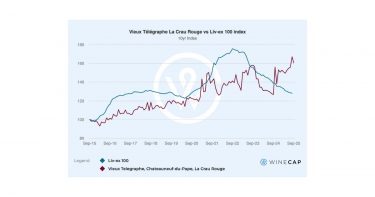

Fine wine prices have now risen for four consecutive months, closing 2025 on a positive note and carrying that strength into early 2026. This sustained improvement matters. Rather than a short-term technical bounce, it signals a market that is beginning to find equilibrium after a prolonged period of repricing.

Key indicators suggest the market is now operating on firmer footing:

- Prices have stabilised after reaching five-year lows

- Liquidity has improved across leading regions and producers

- Buyers are returning with greater confidence and selectivity

- Multiple regions are now participating in early recovery trends

Taken together, these developments point to a healthier, more balanced fine wine market entering the new year.

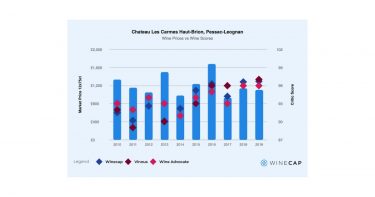

Buying opportunities remain as prices hover near five-year lows

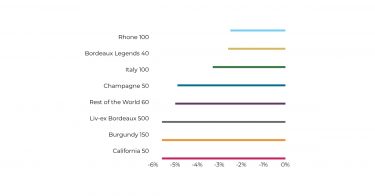

Despite improving momentum, fine wine prices remain close to five-year lows across many regions and vintages. Historically, this late-stage downturn phase – when prices stabilise before rising meaningfully – has offered some of the most attractive entry points for long-term investors.

Importantly, recovery does not begin with uniformly rising prices. Instead, it starts with price consolidation, followed by gradual gains concentrated in the most liquid and well-recognised segments of the market. That is precisely the pattern emerging today.

For investors, this creates a rare alignment of conditions:

- Valuations remain compelling

- Downside risk has diminished compared to previous years

- Demand is rising without speculative excess

- Portfolio construction can prioritise quality and value

Rather than signalling missed opportunity, the current environment suggests that disciplined, data-driven allocation remains well-timed.

Demand is rising and signs of recovery are becoming clearer

Demand has strengthened steadily since the second half of 2025, with improving sentiment evident across both private collectors and wealth managers. While activity remains selective, confidence has clearly returned.

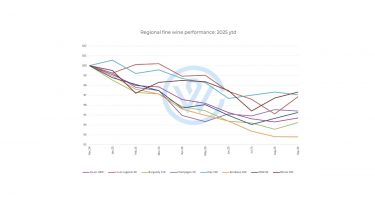

Several regions have already begun to turn:

- Champagne has benefited from strong global recognition, accessible entry points and consistent liquidity

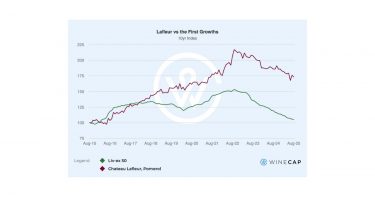

- Bordeaux has stabilised, particularly in older vintages and First and Second Growths

- Burgundy continues to demonstrate resilience driven by scarcity and long-term demand

- Tuscany and the Rhône have seen renewed interest as investors look beyond the most concentrated names

This multi-regional participation is an important signal. Recoveries that are confined to a single region tend to be fragile; recoveries that broaden tend to endure.

Momentum from late 2025 has been sustained

One of the most encouraging developments is the continuity of momentum. This matters for two reasons. First, it suggests that buyers are responding to fundamentals rather than short-term catalysts. Second, it indicates that confidence is building gradually, allowing the market to recover in a measured, sustainable way.

Sustained momentum also reinforces the importance of patience. Fine wine recoveries rarely follow sharp, V-shaped trajectories. Instead, they evolve through phases of stabilisation, selective appreciation and eventual broadening.

The case for market broadening in 2026

Market broadening is a defining feature of rising markets, and 2026 is likely to mark the early stages of this transition.

During periods of falling or uncertain prices, demand tends to narrow. Investors concentrate on the most established names, mature vintages and highest-liquidity wines. This was a defining theme throughout much of 2024 and 2025 global wine investment trends.

As confidence improves, the opposite dynamic emerges:

- Buyers begin to search for relative value

- Secondary regions and vintages re-enter consideration

- Portfolios become more diversified

- Opportunity expands beyond a small group of blue-chip wines

In 2026, this process is likely to unfold gradually, with selective broadening, supported by brand strength and the search for value.

Tariffs and the macro backdrop: a potential catalyst

Another factor shaping early 2026 sentiment is the evolving global trade environment. Tariffs remain under review by the US Supreme Court after lower courts deemed them illegal. While outcomes remain uncertain, the broader implications extend well beyond fine wine.

Should tariff pressures ease, the effects could ripple across global markets:

- Improved trade clarity

- Increased capital availability

- Stronger investor confidence

- Renewed appetite for alternative assets

In periods when liquidity improves and uncertainty recedes, portfolio diversification tends to increase. As a top-performing collectible and passion investment, historically, fine wine has benefited from such shifts.

Fine wine remains the most in-demand collectible

According to the WineCap 2025 Wealth Reports, fine wine is the most in-demand collectible asset among wealth managers and financial advisers, outperforming art, watches, whisky and luxury handbags.

Several factors continue to underpin this appeal:

- Proven long-term performance

- Increasing market transparency

- Global liquidity and established secondary markets

- Growing acceptance within diversified portfolios

Fine wine’s evolution from passion asset to mainstream alternative investment has been gradual, but it is now firmly established.

Looking ahead: The 2026 Wealth Report

As the market enters this next phase, attention will increasingly turn to how wealth managers and financial advisers are adapting their allocation strategies. WineCap’s upcoming 2026 Wealth Report will examine these shifts in detail, exploring how fine wine is being integrated into portfolios amid changing economic conditions.

Early indications suggest that fine wine’s role as a diversification tool is strengthening, supported by improved data access, transparency and liquidity.

A healthier starting point for 2026

The fine wine market enters 2026 at a point where prices have stabilised, demand is rising, and opportunity is broadening. For investors, this marks a healthier phase of the cycle. After three challenging years, the market is finally positioned to move forward on firmer footing – and for those willing to act selectively, the early stages of recovery often prove the most rewarding.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.

*UK

*UK *US

*US *UK

*UK *US

*US